The following is a guest post by Charley Mendoza, a freelance writer covering business and personal finance. She also moonlights as an investor, micro-entrepreneur, and adventure junkie. If you’d like to write a guest post about peer to peer lending or any other topics for Money Q&A, be sure to check out our guest posting guidelines.

You want to diversify your investments, but you don’t have thousands of dollars to buy real estate or start a business. Perhaps you have an extra $300 or so a month, which you mostly invest in stocks and other paper assets. Now you want to diversify your portfolio. Peer to Peer (P2P) lending might be a good option for you.

Peer to peer lending connects investors to borrowers who need money. In this setup, P2P platforms facilitate the transaction between the investor and the borrower, so the money doesn’t come from banks. Loan interests are generally lower, and credit requirements less stringent.

How to Make Money as a P2P Investor

You’ll invest money in unfunded loans and recover your investment when the borrower pays it back. Loans that don’t get enough funding to complete the needed amount don’t push through, so the funds are returned to your account.

The different peer to peer lending platforms I will compare in this article have specific income requirements for investors. But in general, you have to prove that you earn enough money to support your needs and that you’re not going to rely on P2P investments for living expenses. There’s also an investment threshold, so you don’t invest more than a certain percentage of your net worth.

P2P Comparison: Lending Club vs Prosper vs Upstart

Loan Amounts and Terms

Lending Club

Personal loans are payable in 36 months or 60 months and range from $1,000 to $40,000. Unsecured business loans are also available for $5,000 to $300,000 payable in 12 to 60 months.

Prosper

Offer personal loans from $2,000 to $35,000 with 36 or 60 months term.

Upstart

Has the highest minimum loan amount at $3,000, but the maximum is just $35,000. Loans are also payable in term 36 or 60 months.

Investing Options

Find out the minimum and maximum investment amount, plus the investment methods available on each platform.

Lending Club

Investors buy ‘notes’ on Lending Club, which are shares or units or of unfunded loans you can reserve for investment.

The smallest ‘note’ you can invest in is $25, so it’s easier to invest in different loans of varying interest rates. Diversifying your loan portfolio also lowers your risk of losing money, in case one borrower doesn’t pay up.

You can invest in different loans manually, or input your investment criteria in Lending Club’s system to invest in qualified notes automatically.

Prosper

Like Lending Club, $25 is also the minimum investment amount. Prosper also allows you to cherry-pick loans to invest in, or automate investments using preselected criteria.

Upstart

Investment amount starts at $100. You can’t pick individual loans; you can only choose which loan grade to invest in.

Loan Grades, Interest Rates, and Borrower Profile

Peer to peer lending platforms assign a grade to each loan based on its risk and a handful of other factors specific to their platform. Each loan grade corresponds to an interest range and loan origination fee.

Lending Club

Lending Club assesses borrowers using a combination of FICO score, and their proprietary scoring model, which includes loan applications, and behavioral data among other factors. Minimum credit rating for borrowers is 660.

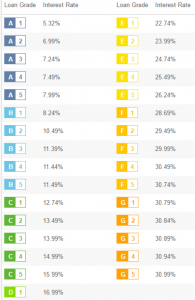

Loan grades are assigned based on the loan term, volatility rate, expected losses (non-payment), and other factors. Loan grades range from A1 to G5. Below is a table of their loan grades with the corresponding interest rates.

Prosper

Prosper has a proprietary system (Prosper Score), which uses debt-to-income ratio, number of delinquent loans, available credit, and other criteria in combination with credit scores and historical loan repayment data in assigning a grade to loan applications. The minimum credit score is 640, a bit lower than Lending Club. The average FICO score of borrowers, however, is 701.

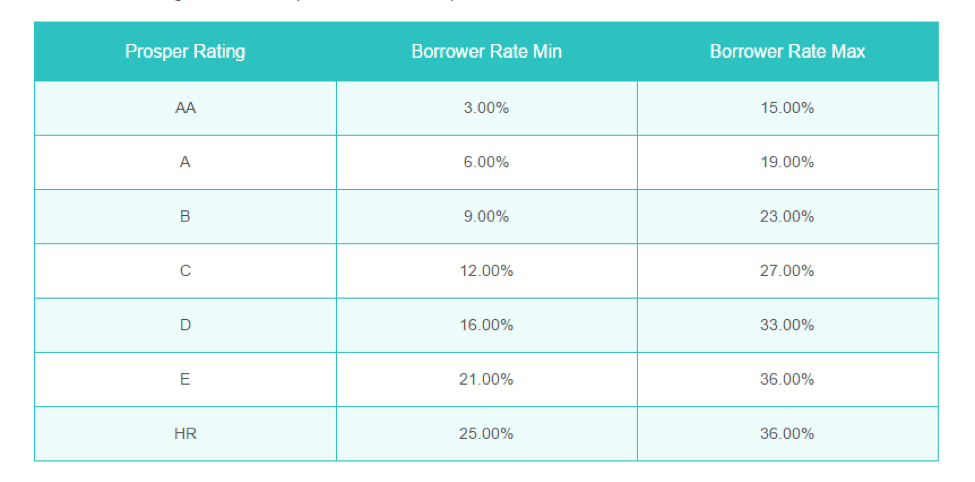

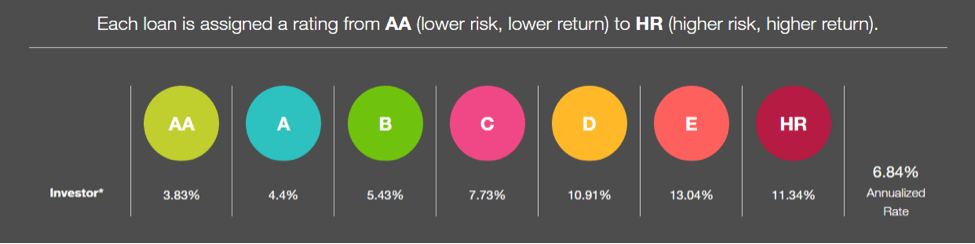

The best loan grade is AA with an interest rate of 3% to 15%, and on the other side of the spectrum is grade HR with an interest rate of 25% to 36%. Investors can see the exact interest rate for each loan listing on the marketplace.

Upstart

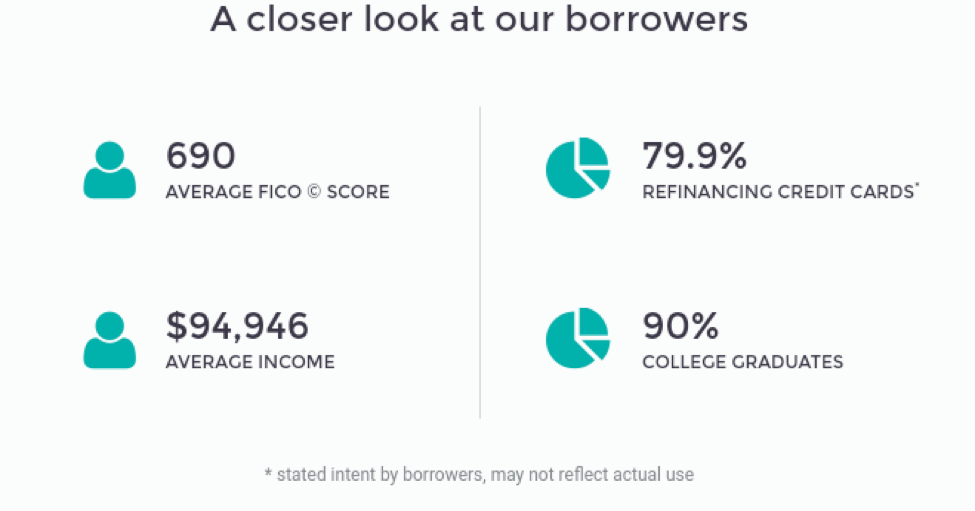

Like the other platforms, Upstart also uses FICO scores in its assessment. The minimum credit score is 640 but the average score of their borrowers is 690.

It’s the only platform that also considers the borrower’s college GPA, alma mater and SATs. It might sound weird to you, but they have the lowest default rate in the P2P industry so far, so there’s a possibility there’s some sense in their unconventional rating system.

Upstart claims their annual percentage rate (APR) is about 30% lower than other lenders. But this may also be attributed to their more selective application process, as revealed in the information about their borrowers.

Default Rates

A loan is considered in default after the borrower misses several payments, usually when it’s 120 days past due. It’s important to check the annual default rate of the loans you’re investing in, so you know the likelihood of delayed payments, or worse—a charge-off.

Lending Club

Lending Club’s safest loan grade (A) has a default rate below 1%, while the riskiest loan grade (G5) annual default rate is about 15%. The reported annual default rate for diversified investment portfolios is 2.5% as of 2014, compared to 7.5% in 2009 for 3-year loans.

Prosper

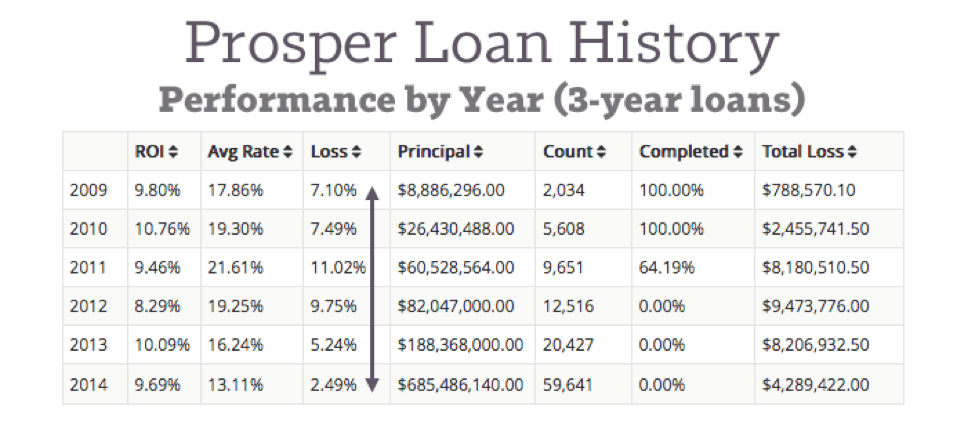

I couldn’t find any official data on Prosper’s default rate on their website, so I took to reviews and analysis from current and previous investors for some insight. According to an analysis from Lending Memo, Prosper’s default rate has decreased from 7.10% in 2009 to 2.4% as of 2014 for 3-year loans.

The default rate is similar to Lending Club, but that’s because they changed their borrower requirements after their relaunch.

Upstart

This, for me, is where Upstart, starts to look interesting. Unlike other peer to peer lending platforms, Upstart refunds default loans to investors with the help of the origination fee (1% to 5% of the loan). Their higher investment requirement and somewhat unconventional loan grading system is matched by their confidence in predicting defaults.

According to their website, 92% of their existing loans are either fully paid or current as of this writing.

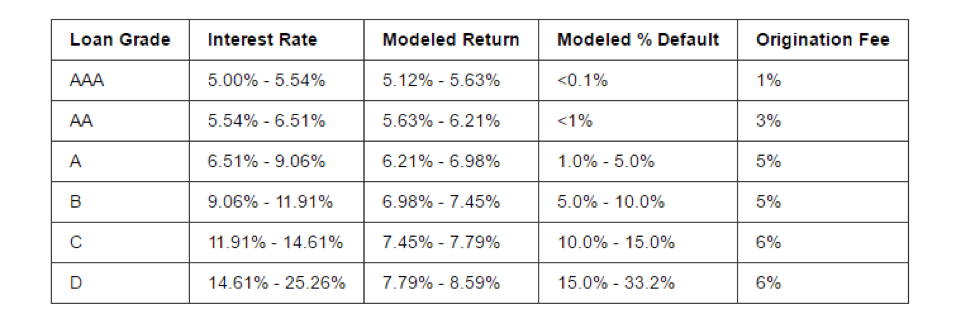

The safest grade AAA loans have a nice default rate of less than 0.1% for three year loans, while the D loans have a default rate of 15% to 30% for loans with the same term.

Fees and Charges

Lending Club

Investors are charged 1% for every loan payment received, which means you’re charged 1% for every monthly payment to all the notes you have invested in. If one of the loan payments is late, you won’t be charged until the payment is made. The good news is the impact on your annual returns is just 0.72% for a three year loan and 0.41% for a five year loan, according to Lend Academy.

For non-performing loans, investors pay 18% of any amount collected on peer to peer lending sites. But that’s only if no litigation is needed. Investors shoulder 30% of the attorney’s hourly fees or up to 35% of the amount recovered if litigation is needed.

Prosper

Investors pay 1% of the current outstanding principal amount annually as a service fee. This payment is computed using this formula.

Late repayments are handled by a collections agency. Investors pay 17% of recovered funds for loans 15 days past, and 35% for loans 120 days past due.

Upstart

Based on an old review, it looks like Upstart didn’t charge investor fees before. But loans originated from February 2016 had an investor servicing fee equal to the annual rate of 0.05% outstanding principal of every loan they invest in. This doesn’t include charged-off and canceled loans.

Potential Earning

The figures below are just estimates based on several factors, such as fees, charge-offs, actual repayment, and the amount recovered from non-paying accounts. Your actual earnings will depend on the loans you invest in.

Lending Club

Based on historical data, investments in grade A loans have a 5% return rate, while grade C loans have a 7.38% return rate. It’s interesting to note that grade C loans have a better return rate than loans with a riskier grade, when in general it’s usually higher risks, higher rewards.

David Weliver, founder of Money Under 30, invested $5225 and earned 6.62% net annualized return after investing in mostly grade A, B, and C loans. In his review, he notes that it’s not enough to base your investment decisions on loan grades, as he’s had several ‘safe’ loans go in default.

Prosper

Estimated average returns are 6.84% across different loan grades. The average return for the safest loans is 3.83%, but it could go more than 11.34% for risky grade HR loans.

One investor earned between 7.2% and 7.5% annualized net return in 2016 after starting out with a $50,000 in loans ranging from grade C to E in 2010. Another investor reported earning an annualized net return of $10.58%, and almost $400 in interests for one month based on about $38,000 spread across a more diverse portfolio (Grades A to E).

Upstart

Upstart’s estimated return for 3-year loans ranges from 5.12% 8.59% for AAA to Grade D loans respectively. These estimates account for expected losses, service fees, and recovery rates.

Because it’s relatively new, it’s hard to find investors willing to give Upstart a review that includes their portfolio’s performance. It’s partly because most of their loan investments aren’t fully paid yet. Upstart doesn’t have enough historical data unlike Lending Club and Prosper with more than five years’ worth of statistics to base on.

Risks

P2P loans aren’t insured, so if a borrower defaults and the money isn’t recovered, you lose your investment. Liquidity is also low because you won’t have access to your funds until the borrower starts paying it back. Even if the payments start coming in, you’ll only have access to a fraction of the money invested.

You don’t have a choice but to wait for the payments, unlike in mutual funds and CDs where you can cash it in after paying cancellation fees and miscellaneous charges.

Another risk is borrower fraud, as some borrowers don’t honestly disclose the purpose of their loan. You might think you’re investing money for a typical home renovation, when in fact you’re funding an outrageous expense the borrower doesn’t have an incentive to repay.

P2P platforms don’t have the resources or manpower to do thorough background checks and hire surveyors, that’s why hedge funds and investment companies that invest in P2P hire professionals to do their due diligence.

Of course, the data here on returns aren’t indicative of future earnings. Like stocks and many investment vehicles, past performance doesn’t guarantee future results, so it pays to err on the side of caution, and read other people’s P2P lending experience—the good and the bad—before you dive in.

Keep Calm and Diversify

All the reviews and people I talked to for this article say the same thing: diversify. If you want to earn a decent profit without losing your hard earned money, spread your investments across different loan grades.

There’s no shame in starting low, and only increase your investments as you get a feel of the system.

Have experience in P2P lending? Do you think it’s worth the risk? Let me know in the comments.