I’ve been saving money through Digit for the past year, and now I’m starting to have friends and relatives ask questions about the money saving smartphone app and the service that Digit provides. So, I figured that I should just let everyone know about the great experience that I’ve had with Digit so far during my 15+ months of trying the service out.

What is Digit? Save Money On Your Smartphone With Digit

I’m a huge fan of Digit, and I use the service everyday to help save money without me even knowing it. I highly recommend everyone checking Digit out.

What Is Digit?

Digit is a free smartphone app and financial service that evaluates your spending habits, transfers money to a savings account from your checking, and helps you save money without even letting you realize that’s what’s going on. It’s often seamless and transparent to you.

After you link your checking account to the app, Digit studies your day-to-day spending habits. The service looks for areas and opportunities where it can save pennies or a few dollars every two or three days where you won’t even notice the amounts coming out of your checking account and moved into your Digit savings account.

Digit watches several attributes of your checking account. The service looks at your checking account balance, upcoming deposits that have been historically made in the past, any upcoming bills you might have, and your recent spending patterns. These are the factors the app looks at when deciding how much money to squirrel away for you every few days.

Digit’s algorithm determines a nonessential amount of money that you won’t notice the app moving from your checking account to a Digit savings account. The amount is based on how much you’ve earned as well as spent in the past.

Digit’s savings accounts are insured like regular brick and mortar banks with FDIC insurance for account balances of up to $250,000.

Want to save cash without thinking about it? Check out @hellodigit, it's like magic. And it’s free!Click To TweetThe Best Thing About the Digit Savings App

The best thing about Digit is its simplicity. The app and service make it amazingly easy to save money. There is no action that you need to take. You simply link your checking account to the app, and the service does that rest.

It saves you money in the background without you having to do anything, without you noticing, without it interfering with your life. It doesn’t get more simpler than that. But, if you wanted to interact and save even more, then you’re able to do that too!

How Does Digit Work?

Digit is very easy to use. I mean – that’s the whole point. It’s simple to use, and it barely feels like you’re saving money.

To use the service, you simply need to download the smartphone app and connect your checking account to the service. Then, Digit will analyze your income and spending habits based on your account history. Digit then finds small amounts of money that the service can safely set aside in a separate savings account for you.

Like all financial institutions doing business on the web and through smartphone apps, Digit is very safe. The app uses 128-bit security, the same level of security that banks use for their customers. Additionally, the Digit app does not store your bank’s login information.

Digit saves a little bit of money from your checking account and sets it aside in a savings account every week. Digit pulls money out of your checking account, sometimes a few pennies – sometimes a few dollars, based on your spending habits, account deposits, and account balance histories.

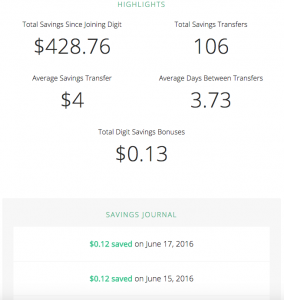

Every two or three days, Digit then transfers a small amount of money from your checking account to your own Digit savings account. Digit typically transfers between $2 and $17 based on your checking account transaction history.

If you have a relatively small checking account balance without many credits and debits, you could see far less transferred to your savings account. I’ve typically seen $0.25 to $2 transferred every couple of days, but I have Digit linked to my business checking account for Money Q&A, which doesn’t see a lot of fluctuation each week. You can see below a screen shot of the recent transactions Digit sets aside from my checking account.

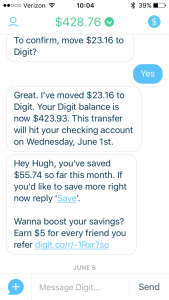

Another feature of Digit’s that I love and use almost every week is the ability to increase your savings. Each week, I get a text from Digit telling me how much it’s saved and then my checking account balance. The smartphone app then asks me if I’d like to make a one-time transfer from my checking account to my Digit savings account. It’s been another great way to boost my savings!

Digit never transfers more than you can afford from your checking account. There is no need to worry about over draft fees and bouncing checks from your checking account. Digit has a no-overdraft guarantee to help give you peace of mind.

Digit believes so strongly in their algorithm and math, that they guarantee not to withdrawal more than your checking account can handle. The app safely identifies the amount of money that you can afford to save, but if Digit overdrafts your account, the company will cover the overdraft fee from your bank, up to two times for each customer.

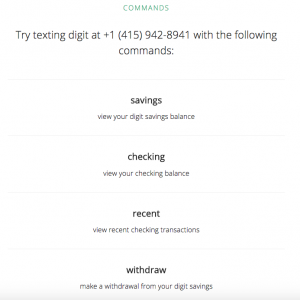

With Digit, you have access to your savings at any time. Most people are saving money for a big purchase, a vacation, or a rainy day. Eventually, you’ll need to withdrawal your money, and Digit makes it easy. You can withdraw money directly from the site or sending Digit a text message. You can control Digit with commands through text, which is one of the coolest and most simple features of the personal finance saving smartphone app.

After you’ve initiated the withdrawal, Digit transfers your money from your Digit savings back into your checking account on the next business day. Digit allows an unlimited amount of transfers, and there are no minimums or fees.

How Much Does Digit Cost?

The smartphone app uses text (SMS) messages as the primary way to communicate with the service. Standard text messaging rates apply when using the Digit smartphone app. But, you can limit, pause, or reduce the amount of times the service texts you. But, now that most of us have unlimited text messages (or you should!), this really doesn’t apply. So, the service is truly free with no hidden costs.

Recently, the company recently updated their Apple iOS smartphone app that allows users to skip paying for SMS text messages if they use messaging function of the app instead of SMS text messages.

How Does Digit Make Money?

My wife asked me the other day, “How does Digit make money then?”. And, I was embarrassed that I hadn’t thought about it before. Not my finest hour as a personal finance blogger.

I had been completely intrigued by the service and saving money using the Digit app that I forgot to even look at how the company earns an income.

Digit earns an income through the interest rate earned by your savings. The company earns interest, keeps some of it, and pay out a small portion in interest. It pays out approximately 0.05% to you on your savings.

Is Digit going to make you a fortune? No. Should you mind that they earn their living by taking a cut of the interest that you could have earned? What about your earnings in a savings account through a traditional brick and mortar bank? No.

But, that’s not what Digit designed the service to do. Digit is not a service that will make you rich. That isn’t the intent. Digit is a way to save and save without even realizing that you’re saving. Digit is the best for those who struggle to save money for a rainy day, vacations, or other large purchases.

The app is a great way to stash away extra month that you won’t even miss. You never realized it was there or that it was gone.

Sign up for Digit and try out the service. I don’t think that you’ll be disappointed.

Have you wondered, What is Digit? Have you tried the savings app? How much have you saved?