According to a Careerbuilder survey, a whopping 56% of workers have never asked for a raise, and women are less likely to ask than men. An analysis by Salary.com found that failing to negotiate could potentially cost you more than a million dollars over the course of your career.

But, how do you ask for a pay raise? There are a couple of techniques that you can use to learn how to ask for a pay raise.

Although unemployment rates are currently at their lowest levels since before 9/11, a major problem for many people in the workforce is stagnant wage growth. Some local and state governments have increased their minimum wages in an attempt to keep up with the ever-increasing cost of living, but even so, workers appear to be getting the short end of the stick even in this booming period of economic growth.

How to Ask for a Pay Raise

If it’s been a while since you got a pay raise or you’ve been with a new company for 6-18 months and haven’t discussed a potential increase with your employer yet, don’t give up. Here are a few strategies for getting out of a wage rut and respectfully – but firmly –to increase your odds of being successful to learn how to ask for a pay raise:

Boost Your Value to the Company

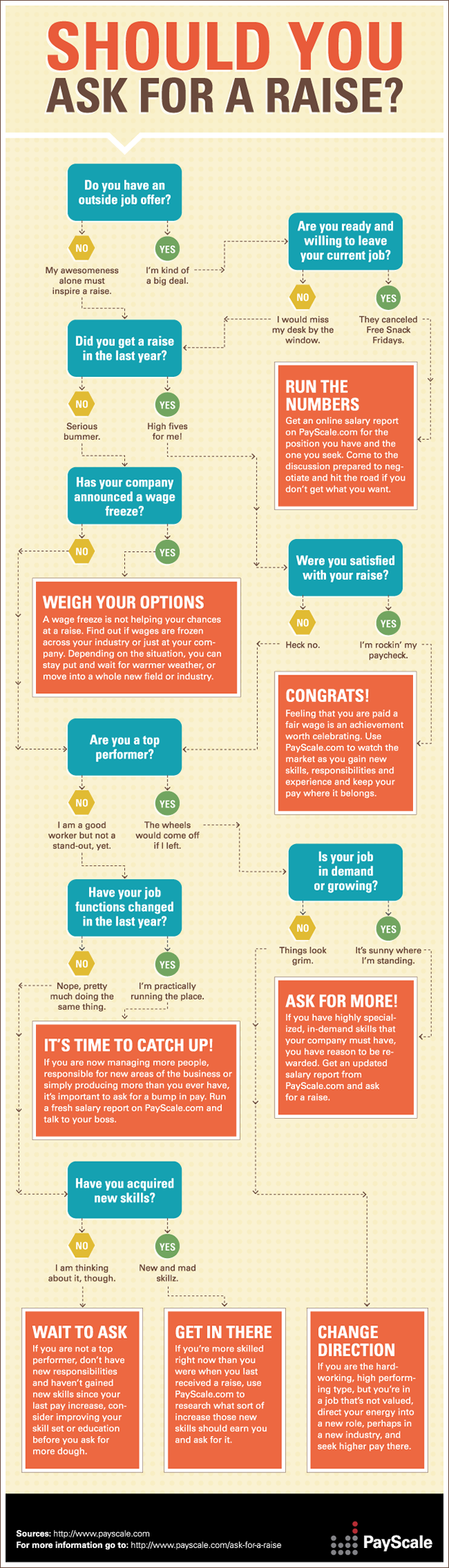

How valuable are you to your company? If you were to leave today, would they have trouble replacing you? If you want to be able to ask for a pay raise, you have to make yourself invaluable to your company.

You have to make your personal stock (if you were a company in and of itself) so valuable that your company could not risk losing you. That is one way how a company fights a hostile takeover.

If you can make your stock so valuable, no one would want to sell it. The same thing applies to find out how to ask for a raise. If you are valuable, you will have so much more leverage, and the company will not want to lose you and your services.

You won’t get too far with salary information from websites like PayScale if you can’t persuade your boss that you’re worth that much money, to begin with. Unless you’re clearly outperforming most or all of your colleagues and you’ve been noticeably more productive than anyone else, how is your boss supposed to know why you’re worth a few (or several) thousand dollars more per year?

Unless your boss is a masterful micromanager, they might not see every single thing you have done for the company. So, it’s important to show up to your pre-planned salary meeting with a clear outline of what tangible (and possibly intangible) benefits you’ve brought to the company, how your work is instrumental in the future success of the company, and how you’re a stellar employee who motivates others, rather than dragging them down.

Know How Much You’re Worth Beforehand

Many workers don’t seem to realize how much they’re truly worth. As long as their coworkers with similar workloads, education, and experience get paid around the same amount, it’s generally assumed that the pay is fair and they’re fortunate to have a stable job at all after a rocky few years since 2008.

However, with the unemployment rate as low as it is, there are several more opportunities for career advancement and job changes for individual employees compared to the recession era. So, why settle for what your current company is offering if there could be higher paying jobs in your field at another company?

PayScale offers free salary reports designed to help you determine how much people in your industry and location are making hourly and annually. Using data-driven research to prove to your boss that you deserve a higher salary (in addition to personal factors, such as the value you contribute to the company’s success) can significantly build your case for a pay increase if your boss is open to negotiations later on.

You need to know what other companies are paying employees that hold your job. Researching the current market rates for pay in your career field has never been more important, and luckily it has also never been easier to find out this information thanks to the internet.

There are many great free websites out there that can give you a range of what jobs in your career field are earning and also tell you how much their annual pay raise typically has been. There are also several websites that allow you use a salary calculator on their website much like you would use a mortgage calculator or loan calculator to find out how much house or car you could afford to purchase.

You should check out sites like the Bureau of Labor Statistics, CareerBuilder.com, Moster.com, and Salary.com to get an idea of how much others with your same job are earning. Knowing this information can make you a much better negotiator when it comes to finding out how to ask for a pay raise.

Have the Hard Conversation

Now that you are armed with as much information as possible and worked tons of overtime and taken on new projects to make yourself incredibly valuable to your company, it is now time to go to your boss to have “the talk”. You should schedule a time on your boss’ calendar or the calendar of the decision maker in your case.

Do not have these types of conversations over the phone or through email if you can help it. Make sure that you present yourself and your evidence in the best light possible. Dress for success, be on time to the meeting and rehearse so you don’t have to constantly look up your quantified accomplishments.

Get the Timing Right

Maybe your boss loves the work you’ve done over the last several months. Your work ethic fits well with your colleagues, and you go above and beyond the minimum requirements for your position. These qualities in an employee typically lead to a pay raise at some point. But, if your company traditionally offers pay raises only after annual reviews at a certain point in the year.

Then, your timing might be completely off if you try asking for a raise five months before your next review. Review your company’s policies and/or ask a trusted co-worker before approaching your boss. If the company currently isn’t doing so well financially, you might want to hold off asking for more money until the corporate balance sheets get out of the red.

Timing is everything. Even asking a stressed-out boss on an unusually hectic workday can be detrimental to your chances. So, plan out what you’ll say and when you’ll say it.

Be Direct

Who actually likes beating around the bush when it comes to important conversations? Money is already an uncomfortable topic to discuss, so don’t make it more anxiety-inducing for yourself or frustrating for your boss by starting with small talk and eventually leading into the big question of, “Can I get a pay raise?”

On the other hand, you don’t want to be too blunt. Demanding a pay raise within the first two sentences of the discussion can sour the conversation very quickly, as well as any language that might come across as overly self-interested (e.g., “You haven’t given me a raise in __ years” or “I’m not making the money I deserve”).

Instead, give your boss a heads up beforehand – “Could we meet sometime next week to discuss my salary?” – and demonstrate how giving you more money would be a win-win for everyone involved, rather than taking a self-centered “I deserve this” approach.

If you approach asking for a pay raise as a business decision and try not to get emotional about it, you will have much better success in finding the perfect way how to ask for a pay raise.

How to Spend Your Pay Raise

Now that you’ve earned a pay raise, what should you do with it?

Far too many of us simply do nothing. We treat it like the pay raise didn’t even exist. Many of us find ourselves simply spending more without even realizing it – granted it’s often on $50 or so each month,

A friend and I were talking after work one day, and she told me that she’s been living off the same paycheck figure that her employer paid her five years ago, despite having earned a promotion and a couple of pay raises since that time.

I’ve actually been doing the same thing. I simply pretended that my new promotion at work didn’t include a pay raise. Instead, I diverted that extra money each month into separate savings accounts automatically. I’ve been fooling myself into living off my lower salary from a few years ago.

So, what should you do with your next pay raise? Here are a few tactics for you to make the most of your pay raise.

Pay Off High Interest Rate Debt

One great thing that you can do with a pay raise is to pay off high interest rate debt or any debt for that matter. You can like that the annual percentage rate (APR) that you would have paid on your debt as your rate of return.

Who would not kill for a rate of return on your investments to be 18% or more? You have to think of paying off your debt as earning a return on your investment.

You’ve gone into debt. There is nothing that you can do about the past. You have to look towards the future. Paying off your debt is the same as investing in your future. You can look at using the debt snowball plan to help you come up with your plan of attack.

Start Investing For Retirement

Another great use of for your pay raise is to start saving for your retirement. Or, if you’ve already begun saving, increase your retirement savings.

Any pay raise that you earn is “found money”. It’s money that wasn’t there before in your budget. It’s new money. If you allocate it to add to your retirement investments, you’ll never realize that the money is missing.

You’ll never miss that money. You didn’t even realize it was there. Increase your automatic allotments to your 401k retirement plan or Roth IRA by the same amount you receive in a pay raise. Live off of your last year’s salary. Pretend like you never even got that raise.

Far too many investors choose to reduce their Roth IRA contributions when times get tough. Time is the most important factor that young investors have going for them. You will never be able to get these years back that you have not been investing in the stock market. Now is the time to slowly work your way back into maximizing your Roth IRA contributions. Using your new pay raise is an excellent task for that new money.

Build Up Your Emergency Fund

We all know that we should have three to six months of living expenses saved in a fully funded emergency fund. But, for many Americans, that’s a lot of money to set aside.

Now is the time to pump up your emergency fund with your new pay raise. You should consider doing it now while you are still living off your old salary and won’t miss the new money as it is deposited atomically into the savings account or money market fund where you keep your emergency fund stashed.

For example, if you earn $60,000 per year, you would need to have approximately $10,000 to $20,000 set aside just for living expenses. If you wanted to continue with your current standard of living, you’d need to increase your emergency fund to $15,000 to $30,000 to cover your entire take home pay amount.

I know that I have struggled in the past with building up that much of a stockpile of cash in an emergency fund. You can add your new pay raise each month to your emergency fund as another way to help you build up to that level.

Almost every financial planner on the planet shouts from the rooftops that we should all have at least three to six months of living expenses saved in an emergency fund. But, far too many people have not been able to reach that mark.

Add Some Insurance That You Are Missing

Do you have enough life insurance to cover your family? Most people recognize the fact that we need life insurance to protect our loved ones who rely on our incomes to survive. But, do you have umbrella insurance in case you were to get sued? Do you have enough disability insurance?

Disability insurance is one of the most underinsured areas where American workers are prone to be severely lacking in coverage, and it is one of the most needed areas of insurance coverage. One out of three American workers can expect to be disabled and unable to work for a significant amount of time at some point during their careers. That is too big of a gamble not to have insurance in place.

Spend A Little Of Your Pay Raise

Finally, many experts recommend that you use a little bit of your new pay raise as well. You earned it. You should reward yourself. One thought or rule of thumb may be to spend a certain percentage of your new pay raise on yourself or on something that you truly want to buy or do and have been waiting. This isn’t a carte blanche to go further into debt.

But, there is nothing wrong with using 10% of a pay raise to go to the spa, take a long weekend vacation, celebrate with a nice dinner out on the town, or any other similar things.

The Danger Of Lifestyle Creep

There is a danger of lifestyle creep when you receive a small pay raise. If you earn $5,000 per month before taxes and earn a 3% pay raise, you’ll only see an additional $75 in each two-week paycheck.

When you start talking about such small amounts, it is very easy to simply roll that money into your spending without realizing it. Your new pay raise could very easily equate into an additional night out on the town, a movie, eating out at a restaurant, and other fun activities.

Before you know it, you will simply just have absorbed that pay raise into your life. That’s lifestyle creep.

Is lifestyle creep necessarily a bad thing? Should we not enjoy a few of the fruits of our labor? Splurging every once in a while isn’t a bad thing. The danger comes from simply looking the other way and not deliberately and thoughtfully putting our pay raises to good use.

Now is the time to use your next pay raise to shore up your financial plan. If you have not been as diligent a saver or investor as you should have been, using a pay raise can be a great way to get you back up on the horse to a more consistent and better financial future.

A pay raise is like found money. You were living fine without it the month before. Using your new pay raise for an emergency fund, increase your investing, or shore up your insurance plan will allow you to do those things without sacrificing your current standard of living. Live off of your old paycheck and put your new pay raise to good use.

Are you receiving a pay raise this year? What do you plan to do with it?

In this post-recession workforce, pay increases no longer seem to fall from the sky – instead, employees asking for pay raises has become more of the norm, which means you’ll need some persuasive techniques for approaching your boss with your request. By finding the opportune time to ask, knowing how much you’re worth and how much your work benefits the company before diving into this serious money conversation, you’ll increase the likelihood of your boss approving your request for a pay increase.

What about you? Do you know how to ask for a pay raise? What have been your best tactics to get a raise? What techniques have been successful for you in the past when asking for more money at work? Please share them in the comment section below.