Back in the 1940s, you could get a four-year college degree for under $500, even at the most prestigious colleges. Back then, it wasn’t even necessary to get a degree. It was seen as an accomplishment for those going over and beyond their standard education.

Nowadays, a four-year college degree is the equivalent to a high school diploma, and the price has launched itself into orbit. On average, your typical college student will graduate with $25,000 in debt, if not more. I don’t think even our grandparents had that much in total debt in most cases, let alone student debt.

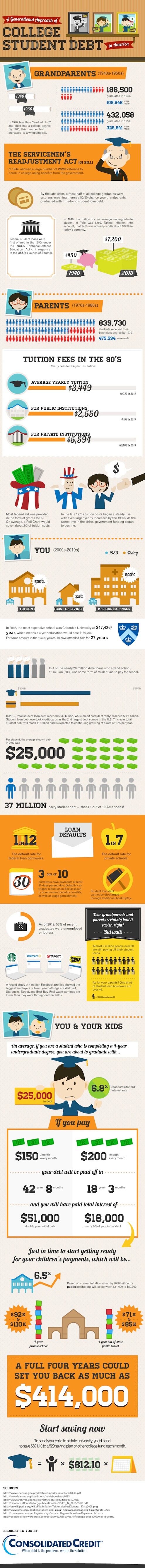

If you’re thinking about college, or if you’re a parent with college-bound kids, then the infographic below may be of some interest to you. Consolidated Credit has designed this side-by-side comparison of the difference in costs of each generation’s college educations to give you some important information you need to know.

Here you can view the differences in educational expense, how it changed over time, and hopefully you can get a little insight on how to prepare your future college finances without taking on too much student debt.

Students are making less and paying more – no matter how you adjust for inflation. As a society we have not wrapped our head around this problem. The result: 1 trillion dollars in student loan debt. Great job bringing some attention to this issue!!

The trends and statistics regarding student debt and the waning earnings of graduates is indeed worrying. Its even worse since it touches on many people and sectors and goes back to even the baby-boomers! Its an issue I believe that requires more attention and creative/innovative solutions to deal with, online universities are a great start, but we need a whole paradigm shift if we are to wrap our heads around this

My daughter heads off to school in less than a month for her freshman year. We saved lots of money for her and two other kids who will attend school.

I will be thrilled if each graduates with only the average amount of debt. One has plans for Med school, which provides a better employment outlook.

It’s pretty amazing when you think how much college has risen the last two decades. I remember during my college tuition rising about 4% per year and one year after I graduating it rose 15%. I think it’s pretty interesting what Obama is proposing recently on how to college more affordable. Basically lowering standards and relying the government to cover tuition.