If you’ve followed Money Q&A for any amount of time, you’re probably aware of how I feel about life insurance. I’m a huge fan of term life insurance. Term life insurance, in my opinion, is the only way to go.

I recently realized that I don’t have enough life insurance coverage for my wife. Even though she is a stay-at-home mom, the paltry amount of life insurance coverage that I have on her through my work just isn’t enough. There are so many benefits that stay-at-home parents provide for the family. And, those costs are easy to overlook if you’re not careful.

Stay-at-home spouses don’t have any income. And, life insurance is meant to be an income replacement tool to protect families if an income earner should die prematurely. But, if you don’t provide life insurance coverage for a stay-at-home spouse, you could find yourself with huge out of pocket costs for childcare, cooking, cleaning, and the myriad of other tasks that stay-at-home spouses provide the family.

Term Life Insurance Through Haven Life

Other life insurance providers let you compare quotes online. But, with Haven Life, you can also apply online for dependable term life insurance issued by the Massachusetts Mutual Life Insurance Company (MassMutual) all online.

Why Haven Life Is Different

Shopping for term life insurance is different because Haven Life is completely online. Other insurance comparison websites let you search for insurance policies online, but they often require you to complete the process offline by filling out extra forms, taking a medical exam, or having blood work drawn in a lab near your house.

Haven Life isn’t like that. You fill out the application online, and you can immediately find out if you are approved for coverage and start it right away. The entire application process only takes a few minutes. In some cases, qualified applicants may not need to take a medical exam. Keep in mind: issuance of the policy or payment of benefits may depend upon the answers given in the application and the truthfulness thereof.

There are also tools available on the site that can help you determine how much life insurance coverage you need and also allow you to compare your quote to the pricing of other top insurers. With the Haven Term policy, you can apply for up to a 30-year term and $2 million dollars in coverage.

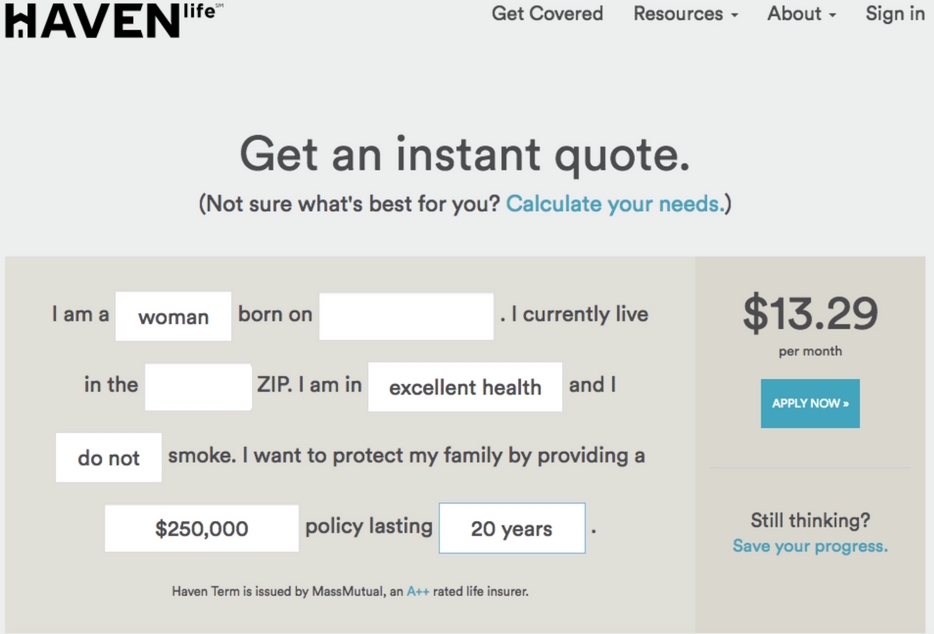

Below is a screen capture of a 20-year term life insurance quote for $250,000 that I received for my wife. Only $13.29 per month.

MassMutual Backs and Owns Haven Life

Haven Life is backed and wholly owned by MassMutual. So, you know you are dealing with a reputable life insurance company that has a long history of financial strength. Like annuities, life insurance, homeowner’s insurance, and any insurance, your protection is only as good as the company who is backing it. MassMutual is rated A++ by AM Best.

You do not want to choose a fly by night company for an insurance policy, especially your life insurance. You want to be able to sleep at night and know that it is there if you ever need it (heaven forbid).

Availability of Haven Term

Haven Term is now available in all 50 states! California was the final state to jump on board. Adding states might not seem like a significant accomplishment, but it really is. In the life insurance industry, each state must grant approval for a life insurance product.

It’s also interesting to note that insurance policies sold through Haven Life are not currently available for members of the United States military. And, they have no real plans to enter that market due to the competitive advantages that the federal government’s Service Members Group Life Insurance plan (SGLI) and USAA have in that arena.

How Haven Life Determines Your Approval

The quick turnaround onHaven Term approval decisions is powered by a proprietary underwriting algorithm that is able to evaluate applicants in real-time. In the underwriting process, insurers are reviewing information from your lifestyle and health information to determine coverage eligibility and pricing.

This includes medications you take or have taken in the past, which are available from prescription drug databases, along with Department of Motor Vehicle records. They also look at information that the MIB collects about you. Traditionally, this took several weeks for a human underwriter to accomplish.

The MIB Group, which was originally called the Medical Information Bureau, is an information clearinghouse. Approximately 430 insurance companies in the United States and Canada own MIB Group. Many consumers aren’t aware that there are databases, much like the credit bureaus, that maintain reports on people’s health, past illnesses and prescriptions, and prior applications for life insurance, disability insurance, and long-term care insurance.

While MIB data will not be the sole determinant regarding your application, it can be the basis for the company to need to ask further questions about your health history, and thus, why they might need you to take a medical exam.

The Fair Credit Reporting Act regulates MIB reports. And, all consumers can request a copy of their MIB report once each year — just like credit reports from the three credit bureaus. You can request a copy of your MIB consumer file from their website, www.mib.com.

Worth mentioning: this is all the same stuff that other life insurance companies look at to determine coverage eligibility and pricing. Haven Life just does it in real-time and entirely online.

Haven Life provides you with fast and cost-effective term life insurance. Shopping for term life insurance is different because Haven Life is completely online, you receive an instant decision, and, if approved, your coverage starts immediately. And, an excellent, leading life insurance company issues the policy sold through Haven Life. You should check out Haven Life if you are shopping for term life insurance for you or your family.

Are you in the market for new life insurance? What do you look for in a life insurance company? I’d love to hear your thoughts in the comment section below.

UPDATE – Haven Life’s LifeLink App

The FCC estimates that more than 70% of 911 calls come from mobile phones. And, most of these calls can’t be properly located, which is why Haven Life created LifeLink. Emergency responders do an incredible job saving lives, but their job isn’t easy. It’s especially difficult when they can’t find you with poor data from your cell phone.

LifeLink users can connect to 911 at the touch of a button and precisely transmit their location, share critical data (such as allergies and blood type), and simultaneously notify all of their emergency contacts if they have an issue. In situations where users are unable to speak, text messages can be used to communicate with 911.

LifeLink also includes a feature called Family Connect. Family Connect not only lets loved ones share their locations with each other in real-time, but it enables you to call 911 on a family member’s behalf remotely. You can download the app from the iTunes app store.

This post was sponsored by Haven Life. All opinions are my own.

Haven Term is a Term Life Insurance Policy (ICC15DTC) issued by Massachusetts Mutual Life Insurance Company (MassMutual), Springfield, MA 01111 and offered exclusively through Haven Life Insurance Agency, LLC