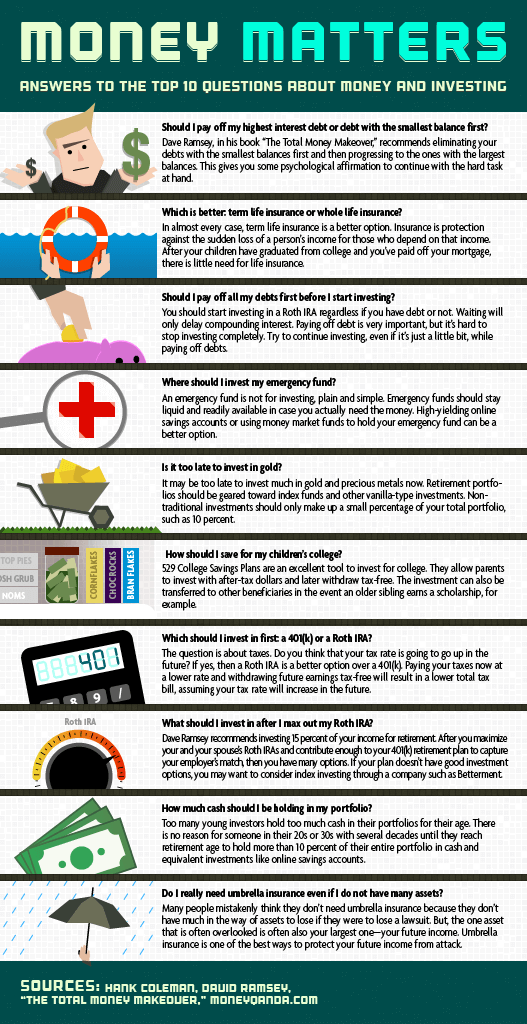

Below is an infographic showing you the ten most asked money questions that readers of Money Q&A have had over the past two years and their answers!

Embed the above image on your site

Just a Few of the Top 10 Money Questions Asked on Money Q&A

1. Should I Pay Off My Highest Interest Debt Or Debt With The Smallest Balance First?

I can understand both feelings and arguments for each of these debt reduction tactics. I’m a huge fan of Dave Ramsey and The Total Money Makeover where he recommends paying off your debts using the debt snowball method eliminating your debts with the smallest balances first and then progressing to the ones with the largest balances. This gives you some psychological affirmation to continue with the hard task at hand.

2. Which Is Better Term Life Insurance Or Whole Life Insurance?

In almost every case, term life insurance is a better option for people than a whole life insurance policy or a cash value insurance policy that builds money in a cash account for the insured to use.

There are very few reasons that you would have a permanent need for insurance. Insurance is a protection against the sudden loss of a person’s income to protect those in the family who depend on that income.

After your children have graduated from college and left the house and after you have paid off your mortgage, there is very little need for life insurance. Term life insurance provides a very low-cost insurance policy for the specific amount of time that you need coverage.

3. Should I Pay Off All My Debts First Before I Start Investing?

This is one place where I diverge from Dave Ramsey’s teachings. I personally think that you should start investing in a Roth IRA as soon as you can regardless if you have debt or not. Waiting will only delay the power of compounding interest.

Paying off debt is very important and should be at the top of everyone’s personal finance to-do list, but I personally have a hard time stopping investing completely to throw all available income at debt reduction. I like to continue investing even if it is just a little bit while paying off debts.

Did I miss any money questions that you are just dying for me to answer? Is there a better one that you think should be in the top ten? Shoot me an email Hank [at] MoneyQandA.com. I’d love to hear from you.

Hi Hank, Great job on the infographic! I do however have a problem with the image statement… How much cash should I be holding in my portfolio? Were you fully invested in Sept 2008? Whether your 20 or 30 years of age no one likes an 80% drop in portfolio performance! And if you were Cash in May 2009 you would be sitting pretty now!! Educated Investors make more in the long term!

Yes, I was fully invested in 2008. 100% in stocks except for my emergency fund, and I was continually buying more and more stocks and mutual funds during that time. I’m blessed by having 40+ years until retirement. Also, just to point out, the stock market did not fall 80%. I’m sitting extremely pretty now that I bought all that stock at the bottom of the bear market 2008 & 2009 and all the way through to today’s rise as well. I’ve got a lot of cheap stock then, and I’m glad that I wasn’t flush with cash.

You should also read my original post that the infographic was based off of about young investors holding too much cash. https://moneyqanda.com/young-investors-hold-too-much-cash/

Great tips Hank! How about making that chart into a giant refrigerator magnet?

That is an awesome idea! I will send you the first one, Paul.

I agree. Crisp, concise and to the point. I will say that if your time horizon is one where you are looking to retire “early” (for example, in your 40’s or 50’s) there might be some flexibility needed in a couple of these answers.

Good infographic in its basic form, where do you do that? Lately I have been seeing them around a lot. Also is infographic text searchable?

I read the first item, which advises people to pay MORE interest than necessary to financial institutions (by making debt an emotional “psychological” issue, as the big banks would like, rather than analyzing it rationally like the big banks do) and I stopped reading. Dave Ramsay’s “Debt Snowball” method is a snowjob, plain and simple, and it can be proven with simple math. Apply your cash to your highest interest-rate debt. You’ll have more cash flow and you’ll pay off your debt quicker.

You are absolutely right. You will pay your debt off faster by tackling the debt with the highest interest rate. But, there is something to be said about knocking off a bunch of small “ankle biter” debts fast though.

This is great…. I have to share.

This is great Hank, I’d love to share this, however, I wish there was a way we can enlarge it a little bit.

I love infographics like these.

As to a couple of the comments above I think everyone’s situation is different and what you do depends on that. Infographs like this are based on averages. Good job on investing in the stock market when it was low. I wanted to but my husband didn’t.

Also the comment about the snowball method, the reason so many promote it is because it has worked for lots and lots of people. Yes, if you are financially smart you would go the highest interest debt first, but many people need the feeling of achievement when knocking off their first small debt to propel them onwards to clear more debt.

Awesome infographic Hank! I believe that everyone has a unique financial situation and different methods work for different people, kind of like raising a child. The best thing to do is be informed as possible and determine the best strategy for your particular situation.