Top 3 Christmas Gifts to Give Your Children that Keep on Giving

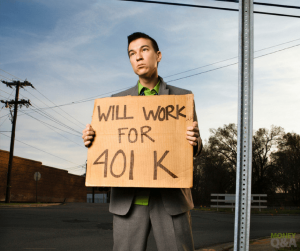

Does your child need another toy this Christmas? If your children are anything like mine, they have far too many things in their room and in their lives. But, what are some Christmas gifts for children that last long after the holiday? We are a consumer nation, and that love of stuff bleeds over into our children’s lives as well. So, what type of present do you get for a child for the holidays that seems to have everything? Christmas Gifts that Keep On Giving It doesn’t help that times are tight and often Santa is broke this year. But, here are a few examples of Christmas gifts for children that will keep on giving to your kids long after the … Read more