Investors often flock to gold and other precious metals when the stock market heads south because these tangible investments tend to be less prone to fluctuations based on government policies, global economic conditions, corporate profits and losses, and other common factors influencing the price of financial assets like stocks, bonds, and Treasury notes. I personally love investing with Acre Gold.

This isn’t a sales pitch. I simply just love the service and wanted to share it with the Money Q&A readers.

But is gold really all it’s hyped up to be? Let’s do some math: in the span of one year (Dec. 2018 to Dec. 2019), the value of gold per ounce rose from approximately $1,220 to $1,463. On a fifteen-year timeline, the price of gold per ounce in 2005 hovered in the low to mid-$400s, which means the value of gold has gone up almost 400% in 15 years. Can you think of any other tangible investments that offer the same level of growth potential and steady value?

Of course, it’s not easy for everyday investors to simply go to a bank or reputable precious metals seller and stockpile several ounces of gold if the markets head south. Fortunately, Acre Gold was designed to fix the problem of gold’s accessibility to investors by offering a monthly investment subscription option designed to incrementally grow your gold portfolio without detracting from your other investment goals.

If you’ve considered investing in gold but haven’t made the leap yet, here’s why Acre Gold might be an ideal solution for your precious metals investments.

What Makes Acre Gold Unique?

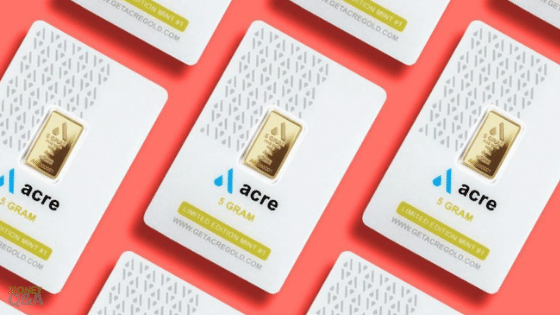

Acre Gold makes costly precious metals more accessible to everyday investors by offering a monthly gold purchase plan, a monthly gold subscription ranging from $30-50. You invest the same amount each month and watch your gold stash grow on your Acre Gold dashboard until you’ve invested enough to qualify for a 2.5g (0.0881 oz.) Acre Gold Bar.

At that point, Acre Gold ships the bar to your home in discreet and secure packaging, so you have a tangible asset to protect your financial stability against economic downturns in the future.

Your savings just got easier. Streaming into a safe asset has never been more convenient than with Gold Account’s Monthly Savings Plan! You pay $50 per month, which will accumulate until your account reaches the price of a 2.5g Acre Gold Bar. Then, they’ll ship you a gold bar every time it hits that threshold and credit any remainder to your next purchase at no extra charge for you.

It is risk-free passive investing that is now as easy as can be! It doesn’t matter if interest rates are high or low. This monthly gold purchase plan guarantees an annual return on investment greater than inflation without taking risks in volatile stock markets.

Why Invest in Gold?

Gold is a unique, tangible asset that retains value (regardless of current/future political, social, and economic conditions). As mentioned previously, it has gone up considerably in value over the past several years and it’s a much safer investment than hyped-up cryptocurrencies since gold is widely recognized around the world as a stable, valuable asset.

Gold has been a stable, consistent investment for centuries. It has survived the test of time and will continue to do so in our rapidly changing world. Gold is highly valued because it can be used as raw material or sold at an auction and on the open market, which means that its value doesn’t fluctuate like stock values often tend to do. With gold’s current market price still on the rise, now may not be a bad time to buy some if you’re interested!

Automate Your Investments

Many of us are guilty of procrastinating when it comes to optimizing our investment strategies and portfolios, which is why it’s so great to have technological advancements like robo-advisors, peer-to-peer lending, and investment subscriptions to keep us on track. When you first read the current value of gold (over $1,400 per ounce), it can seem like a steep initial investment and deter you from getting more involved in precious metals investing as a result.

However, Acre Gold automates the whole process by letting you sign up for a monthly gold subscription in which your contributions are carefully set aside until you’ve saved up enough for that 2.5g Acre Gold Bar. This incremental, automated approach to investing takes out the inhibiting factors (steep upfront costs, perceived effort required to maintain the portfolio, etc.). It makes it substantially easier for everyday investors to accumulate their own gold stores.

Is Acre Gold Legit?

There is a $12 initial membership fee required to subscribe to an Acre Gold gold subscription, but the accessibility of precious metals investments is presently unparalleled in the fintech industry. The company has been highlighted in well-known publications and programs such as Business Insider, Venture Beat, and CNBC’s Nightly Business Report. Other incremental investing options are available, such as round-ups and one-time investments into your Acre Gold account.

I’ve personally been investing and using Acre Gold for over two years now and love it. I highly recommend their service if you’re looking to invest in physical gold.

Is Acre Gold legit? Yes! Acre Gold is a great way to purchase physical gold and diversify your investments. Acre Gold is one of the leading gold bullion companies in Canada. They are publicly traded company on the TSX Venture Exchange (TSX VENTURE: AGD) and they operate out of spacious modern offices in downtown Vancouver, BC.

They have a 5 star rating in the Better Business Bureau, and they are a member in good standing of the Canadian Jewellers Association. Their prices are frequently lower than their competitors because they have an extensive network of gold scrap suppliers from where they get their gold supply.

They are passionate about gold and they want to help their customers. With so many scams in the market, it’s hard to trust any company these days. However, you can be sure that Acre Gold is legitimate.

Is Acre Gold Right for Your Investment Goals?

We don’t know what the future holds for the U.S. and global economy. Gold was popular before, during, and after the stock marketing and housing market plunged during the Great Recession. It’s unlikely that gold will lose its popularity among investors seeking safer, tangible assets any time soon.

Additionally, gold is no longer reserved for those who can afford the steep upfront costs associated with purchasing and holding your own gold bars; Acre Gold makes it easier for everyday investors to accumulate their own 99.9% purity gold bars through a “micro-investing” approach that lets you save up as much as you can over time and “cash-out” (get the gold bar) when you have enough saved up.

Overall, Acre Gold is a simple, low-cost, and investor-friendly option for diversifying your portfolio with valuable precious metals, and you can expect more people to flock to companies like Acre in the future as automated micro-investing gains more traction among new and seasoned investors alike.