A wise person once said, “Most stress is caused by three things: family, money, and family with no money.” Family means the world to a lot of us, but when they start asking for money, that’s when things start to get complicated. A recent study found that over a third of respondents said that money was the primary cause of friction in their relationships, and stress in any relationship can be detrimental.

Whether your spouse is bad with money, a family member was hit hard by unexpected financial setbacks, or a friend keeps asking you for money to get by (or possibly fund an addiction), there are a few things you should consider when a loved one seeks financial help from you.

Money is oftentimes one of the greatest causes of conflict in interpersonal relationships, especially when it involves people you live with and/or are related to. A survey from Ally in 2018 found that money was the #1 cause of stress in relationships for 36% of respondents (and 44% of adults aged 18-54 years old), which suggests that it’s rarely a good idea to entangle finances with your loved ones due to its potential to spark disagreements or even disrupt your relationship altogether.

When a family member is struggling to make ends meet, however, it’s not so easy to leave them on their own, especially if their financial insecurity was caused by reasons outside of their control, such as pandemic-related unemployment, surprise medical bills, natural disaster damage to their home or a series of really unlucky and costly incidents.

How do you turn down family and friends who keep asking for money? It can be a touchy subject. Here’s how to handle this delicate situation and say no.

What to Do If Someone Keeps Asking You for Money

One Time Bailout or Repeat Requester?

If your friend or family member is generally pretty good about saving money regularly, but they run into an unexpected crisis – a huge medical bill, car totaled by an uninsured driver, home disaster, etc. – then helping them out in any way you feasibly can is a viable option because you know they have a proven track record of financial stability.

If someone who racks up a ton of credit card debt gets trapped in high-interest payday loans and can’t even live paycheck to paycheck without acquiring more debt in between pay periods…this person may not pay you back because they clearly haven’t developed the money-savvy skills to control their own spending.

Automatically turning down someone’s plea for financial help is difficult for most people, so examine your options before responding to their request. If a loved one is dealing with a life emergency that they couldn’t have anticipated, you could offer to set up a GoFundMe for them if you don’t personally have the money to help them at the moment.

If someone seems to be broke or “on the brink” all the time (they’ll probably speak with emotionally charged urgency when hitting you up for money), then you have a few options: set up a system of repayment (e.g., a contract), offer them non-monetary resources (job websites, food stamp application, carpooling opportunities to their job, etc.), or flat-out tell them “no”.

Why Do They Need the Money?

Life is hard, and sometimes a person may genuinely have the worst possible luck befall them. Maybe they just lost their job, and medical bills are devouring their savings while their landlord is jacking up rent prices all at the same time.

Many people don’t have enough money in savings to weather multiple financial setbacks, although encouraging them to start an emergency fund is golden advice. And, they may genuinely need assistance to get by this difficult time in their lives.

Although most people will act like they have an excellent reason to need money from you when they ask for it, some instances may not be as desperate as they’re made out to be. The fact of the matter is, some people – including your closest loved ones and friends – may rely on others to bail them out of bad situations, even if their poor decisions got them there in the first place.

If you know someone who struggles with an addiction – whether it’s drugs, alcohol, gambling, or any number of costly addictions – refer them to someone who can help instead of giving them money. Here are a few resources:

- Gambling addiction

- Drug and alcohol abuse

- Shopaholic and compulsive spending help

- Online shopping addictions

8 Ways to Help Family Members When They’re Struggling

If you want to financially support your family member(s) without risking the stability of your relationship (or your own financial well-being), here are some ways to help them out:

1. Help Them Locate Financial Resources

Perhaps you don’t have a lot of spare cash yourself right now, but you still want to help your family members get out of a tough situation. If this applies in your case, you can support them by offering to research different resources available to them.

You may be able to help them research options such as credit counseling or financial planning services, supplemental food assistance programs, local nonprofits offering groceries and/or supplies for low-income households, employment opportunities, subsidized housing options, and even low-cost mental health services, considering the psychological toll that financial stress can have on people.

2. Pay for Financial Planning Services

If you have some funds available and want to ensure your struggling family member can get back on track to long-term financial sustainability, you could hire a fee-based financial planner to help them improve their financial management practices.

A financial planner would work with them to develop a realistic budget customized to their needs and current financial obligations, in addition to providing personalized advice for debt repayment strategies, optimal savings plans, and other best practices of personal financial management.

3. Offer Cash in Exchange for Labor

Do you need help with things like data entry, email organization, transcribing text, editing documents or videos, running errands, caretaking for pets, babysitting, or other tasks?

If so, consider outsourcing some of this work to your family member in exchange for money for each job they complete. This is a great option for supporting unemployed family members without simply giving them no-strings-attached cash, and you’ll also enjoy the benefits of fewer items on your to-do list as a result.

4. Pay Their Bills

If your family member was irresponsible with money and got into debt, giving them money may not work as a solution if they haven’t resolved the problem that got them in debt in the first place (e.g., gambling addiction, impulsive shopping problem, poor credit card management). Still, they’re family, so you can help them out by offering to pay for some of their bills.

You can do this by asking them to add you to one or more of their bill accounts (utilities, car, rent/mortgage, credit cards, loans, etc.) and make payments directly from your bank or credit union account. As an important note, however: do not save your payment information in your family member’s billing account.

There’s a huge potential for trust issues to occur when someone else has access to cash in your accounts, so if you decide to pay their bills, manually enter the payment information each time to avoid the possibility of conflicts arising.

5. Cash or Gift Cards

In some instances, it might make more sense to simply give your family members cash or gift cards to bail them out of a bad financial situation. This solution works best for otherwise responsible family members who have encountered an unexpected emergency, such as prolonged unemployment, skyrocketing medical bills, significant property damage, car accidents, or other major incidents.

Sure, they could’ve had money set aside in case of emergency – and perhaps they did! – but a one-time influx of cash or gift cards to help your family cover their basic living needs while riding out a difficult situation, particularly when it’s no fault of their own.

6. Help Them to Negotiate Their Repayments

If someone is truly desperate for money with no recourse – maxed out credit cards, bad credit and can’t qualify for loans, no savings, etc. – then one option is to help them out with stipulations. Most people immediately balk at the idea of attaching strings to monetary help for family and friends. But, sometimes, it’s necessary to protect yourself from getting dragged down into financial despair.

You could offer to co-sign a loan for them. But, this may be too risky if that person hasn’t been too good about paying back debts in the past.

7. Loan Them the Money

Instead, you could set up a loan contract for family and friends and offer them an interest-free loan if they agree to pay back the full (or at least partial) amount within a reasonable timeframe. It’s an uncomfortable option for some folks, but if the only alternative is saying “no” then perhaps this is a better idea for all parties involved.

If you have family or friends who need money but don’t feel comfortable lending them the cash without an interest rate in place, then setting up a loan contract is your best option. Many people are uncomfortable borrowing from family and friends because it’s hard to know what might happen if they default on the debt. But this way, both parties can agree that there will be no penalty fees incurred by either party as long as repayment occurs within some agreed-upon timeframe.

If giving cash without eventual repayment is something you’d rather avoid for whatever reason, then creating an IRS-approved loan contract between you and your family member can ensure that you’ll likely be paid back on time. There are regulations in place regarding how much money you can gift a family member ($10,000 annually, as of this writing), but there are fewer restrictions on how much you can lend a family member. Some things to keep in mind when writing your loan contract include:

- How much money are they borrowing from you and how will they receive the funds (cash, check or e-payment)?

- Will they be required to pay back 100% of what they borrowed or only a portion?

- Are you charging interest on the loan? If so, how much is reasonably fair?

- Why are you lending money to this family member and are they likely to pay it back, considering their income, assets, liabilities, financial management habits, and other relevant qualities?

- How frequent will the payments be, when will the repayment period begin, and how much do you expect from each payment? (the more specific your repayment plan is, the better)

To ensure your contract would hold up in a court of law, both parties should sign and date it, agreeing to abide by the terms established between you two.

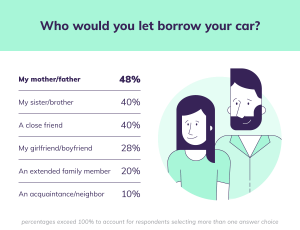

8. What About Lending Them Your Car?

Car trouble is one of the most stressful situations that people can find themselves in. If you have money troubles, it can be even more difficult to handle. But what do you do when a friend with car problems needs help? Should you lend them your car?

According to a recent survey conducted by Esurance, 36% would feel comfortable lending their car to someone not on their insurance policy. Young drivers are significantly less likely to trust someone with their car. More people trust friends (40%) than significant others (28%) with their car.

So, what happens when someone else gets into an accident with your car? Who’s responsible? As it turns out, the whole thing can get pretty messy.

There is confusion surrounding “permissive use” — that is, who’s covered and who’s not when it comes to lending out your car.

Laws vary by state, but here are some situations where lending your car could cost you:

- If your friend borrows your car and gets in a wreck, you’d be responsible for filing a claim and paying the deductible; plus, your rate may increase.

- If your friend borrows your car and causes damages that exceed your car insurance limits, the rest may come out of your pocket.

Depending on your state, your liability limits may drop to the state’s minimum if an unlisted person drives your car and causes an injury or accident. That means you’d have to foot the bill for costs beyond these limits.

Lending out your car may or may not be a good idea, depending on the circumstances. There may be other options for helping out your friends with their situation.

Learning to Say “No”

If you’re not in the best financial situation yourself at the moment, then turning down someone else’s request for money is the best way out of a potentially long-term problem. There’s no need to lie to them. Just tell them straight up: “I need to pay off my credit cards and student loans,” or “I’m trying to save up for a car, I’m sorry,” or whatever else pertains to your current situation.

Saying no to family members can be incredibly difficult for some people, especially if that person – such as a parent – helped you out a long time ago.

However, you can’t put your wallet at risk based on some internalized guilt you have for not being able to help them out financially. And, even if you’re not struggling financially, but the person repeatedly hits you up for money every couple of weeks, you have to nip it in the bud and say no before it becomes a recurring problem. If you never put your foot down, they may start relying on you for a steady stream of cash simply because you never refuse them.

On the one hand, they may not react well when you first turn them down, but the initial discomfort will eventually disappear. On the other hand, financial bloodletting will create much bigger concerns in the future. It might even ruin the relationship if they become dependent on you and you feel taken advantage of and respond by cutting them off, so saying “no” right off the bat is probably preferable to the alternate scenario.

Mixing family and finances can be tricky, but it’s preferable to leaving your loved ones to fend for themselves when they fall into a financial rut. After all, wouldn’t you want your family members stepping in to help if you were suddenly out of work, in serious debt, or physically unable to make ends meet for a while?

By following the strategies above, you’ll be in a much better position to help your family members get back on the path to financial stability without risking your own finances through alternative means, such as co-signing loans (BIG no) or reluctantly giving them money regularly without enforcing boundaries.

Money is the primary cause of conflict in many relationships, including parents, relatives, and friends. The last thing you want to do is burn bridges with someone you care about, but if they constantly hound you for “just a few dollars” or disappear after you lend them a considerable chunk of money, then the relationship might be doomed.

Don’t let money control your relations with your loved ones. By following the advice above, you can help them out without abandoning them or losing your financial stability along the way.

How do you turn down family and friends who keep asking for money? It can be a touchy subject. What do you do?

This is such a juicy topic. But I honestly feel a little queasy thinking about being in this situation. My brother has never been good with money, and our parents constantly bail him out. I’m just waiting for the day when he comes to me instead… These are great tips for staying rational in that situation!

Wow, I am in the same situation as you although I am scared of how he may react. He gets depressed fast. 🙁

Pull away a little at a time.

Yeah, my 64 year old sister in-law keeps asking for “loans” that somehow never get paid back in full. My dear wife loves her sister but I’m getting sick of it!

So yes your brother will absolutely come to you after the parents finally cut him off. My wife’s Dad won’t lend/give her any $ anymore so here we are.

We’re on fixed retirement income and the economy sucks these days. It’s starting to affect our marriage! I’m an adult and will take control now. You should do the same.

I’m at the end of my rope, family, friends and others, no, calls or how I’m going, just what they want, never seen my money return to me, I work so hard for my money ,hot whorehouse, how can I stop,

First, tell them to get rid of their 200 a month cable bill.

My parents support my 49 yr. old brother. He manipulates and cons them into giving him money. I stopped giving him money years ago, and now he doesn’t speak to me because I no longer am manipulated. Same thing with my brother in law and my husband. My husband has pulled the reigns in quite a bit, but funnels him money occasionally. Not one phone call from either one of them when we lost our home in a hurricane. The true feelings of others come out, when you can’t support them. My brother and brother in law have spent their adult lives not working and living off other people’s income. Selfish

people are toxic. Keep them far away and keep your income/lifestyle secret from them.

My friend has been knowing this lady for over 10yrs an she ask her to borrow money because she knows that she gets SSD, and she is waiting on hers she gave her a 100.00 to keep when she ask to borrow money then afew weeks later she ask her to borrow $300 and she said she would paid it back on a certain day and she didnt, almost a month later she finally paid it back, and she is still asking her to borrow money, an she is afraid to say no to her, she is taking advantage of her mentally, she knows that she is a big push over, and she can get away with It. I think because she helped her get ssd she is entitled to her coins. I think this lady also is addicted to prescription pain pills cause always look sleepy when she is around her. How do I help my friend to say no to her without feeling guilty, bad out it

It’s overwhelming, never repaying, how can I stop?

My mom is always asking me for money and using my credit cards. I understand that she’s broke, but I’m broke too and I have a high balance on both credit cards. I usually get cash from my father and I only want to use it for necessities, but she is quick to ask for cash and is not the type of person to take no for an answer. What did I do?

You have to nip it in the bud. Recommend jobs for her so she can make her own money. Perhaps she can start a side business for extra income.

You will need to explain to her that she is ruining your credit, will will affect your ability to get a house, car or even a job in the future.

Your mother unless she is for some reason mentally and physically unable to work- should be paying her own way.

Perhaps have a discussion about why she overspending. Maybe have a discussion about how the both of you can budget – that way you can actually save for the important things that you want to do.

In worst case scenario- pay off one credit card, then cancel it so she doesn’t have access to it.

This is a challenge bc it’s your mom, but she also can’t be living off of you and putting you into greater debt.

I understand your frustration. My mom ask me for money all the time and if I don’t give it to her she talks mean to me. I’m suffering from depression and anxiety and she don’t care. She ask for money everyday. I have a client I work with that she spend all her ssi every month and don’t make payment on some of her bills and I have to help her. What to do help. I’m tired of it all

I completely understood your situation and frustration. My mum and dad keep asking me to give them money all of the time even when i always buy them so many nice things with my own money. Getting so fed up and sick and tired of it as they are doing this very often.

My sister in law asks for money. She does not handle her money well. Over spends and then quit working and got on disability. She could have continued working. She asks/demands money. We said no and she got nasty….stopped communicating which was fine with us. But spreads gossip stating we are” estranged” to relatives and whomever. A relative contacted us stating that she said we were estranged…we have not responded because I feel another “request/demand” is coming. In fact my mother in law also asked for money and had the nerve to state how much!!! She had originally asked us to pay her every month as if she was working for us….the answer was NO. I call it financial blackmail-you wither give me money or I will spread lies about you. Answer is still NO.