Of all the mistakes young parents can make, not teaching your kids how to manage money from an early age is one of the most concerning because of this widespread lack of personal financial literacy among high school and college students today. With the BusyKid smartphone app, however, you’ll be able to stay on top of your kids’ financial education and teach them fun ways to allocate their money along the way.

Review of BusyKid Smartphone Financial App

Here’s the lowdown on BusyKid to help you determine if it’s a good fit for your situation:

Why Use BusyKid Instead of a Regular Cash Allowance

The app is pretty simple for anyone in the family to use, and there are tons of instructional videos on their website to help you learn how to use the BusyKid app. While it costs $14.95 per year to use (after a 30-day free trial), it’s well worth the minimal expense considering how many useful features it offers. Additionally, BusyKid syncs up with your bank account so you don’t have to go to the ATM or pull out your credit card if your kids request a gift card or want to allocate some funds into investments (the money is simply withdrawn from your account only with your final approval).

Teaching Budgeting Skills for Kids

One of the best personal finance skills you can teach your kids before they’re old enough to go out and earn money on their own is how to create and maintain a budget. The problem is: while most of us know how to budget for our own situations, teaching this skill to others is considerably more difficult.

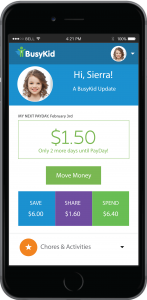

Luckily, the BusyKid app is pretty much designed to do this work for you as well as giving you more input over your kids’ spending, investing, and donating habits. Rather than just giving your kids money for completing chores and hoping they don’t blow it all on candy within 3 days, you have the ability to approve their spending decisions through the app.

Spending, Investing, or Donating

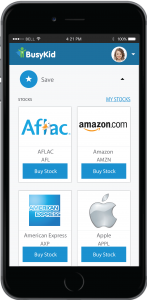

When they click “Cash Out” on the app, then you are notified of how much cash you owe them. The second option is opting for a gift card from kid-favorite retailers like Amazon and Best Buy (BusyKid offers over 250 options for gift cards!). The third option is investing in company stocks such as Amazon, Apple, or Netflix.

If your children choose to invest their allowance money, you’ll have to sign up for a custodial account with their partner company, Stockpile, with no transaction fee. The final option is donating to charities such as the American Red Cross, the Boys & Girls Clubs of America, Make-A-Wish, the Ronald McDonald House, and much more.

Is BusyKid Right for Your Family?

Although actively discussing money with your kids can be uncomfortable at times, this is a crucial phase of their lives to learn skills that will impact them well into adulthood. To avoid the pitfalls of parenting styles that designate money conversations as “adults only” topics, BusyKid gives you a simple way to engage and teach your kids how to earn money, budget their allowances, and decide how to best spend, save, or invest their money from an early age.

BusyKid even takes the guesswork out of deciding what chores are appropriate for your kids based on their ages (BusyKid offers recommendations for its users) and how much you should pay your kids each week. The average in the U.S. is $65 per month, but you can customize your allowance schedule for whatever suits your family’s financial situation. Despite the $14.95/year cost to use the BusyKid app, it offers so many useful features and important financial lessons for kids that the fee is arguably a bargain for what you’re getting.