If you often find yourself struggling to save money on a regular basis and at the mercy of monthly fees, overdraft fees, and nearly every other type of fee your bank cheerfully tacks onto your accounts, then perhaps it’s time for a new approach to personal financial management. Chime bank and the Chime card may just be the right bank account and debit card to help you take back control over your personal finances, finally start saving, and stop paying bank fees once and for all.

Chime, for instance, is an up-and-coming online and mobile bank account that offers a simple way of tricking yourself into saving more money. Rather than gouging you on bank fees, Chime offers a spending account and a savings account with no monthly minimums or fees, no overdraft, no international fees, and a fee-free ATM network. Plus, they offer an automatic savings program that delivers weekly savings bonuses to their cardholders.

Additionally, Chime has some pretty cool features if you’re having trouble getting started savings. I had the opportunity to check out Chime for myself. And, the results were awesome!

Chime Card Review – What Is Chime Banking?

When you sign up for a Chime bank account and a Chime Visa Debit card, you can transfer funds into your new Chime account for free and use the card anywhere Visa cards are accepted. It’s a demand deposit bank account with a debit card. So, like all checking accounts, you can only pay for items with your Chime card after you’ve deposited funds into your Chime bank account.

You also have the option of setting up direct deposit from your employer directly to your Chime spending account. You also receive access to the Chime Checkbook feature, in which Chime will mail physical checks on your behalf after you authorize a payment and provide them with the name and mailing address of the recipient.

Chime members can get paid up to two days early when they fund their account through payroll direct deposit. Chime makes it easy to set up direct deposit with a form that can be emailed or printed and provided to the employer.

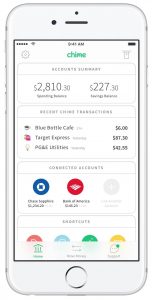

There are many different options when it comes to managing your money with Chime. Not only does Chime offer its own Spending and Savings, but Chime also offers easy access to mobile check deposits and direct deposits into your accounts through the Chime app.

The Chime app is available for both iPhones and Android devices, allowing you to access real-time updates on your account balances, recent transactions, locate nearby fee-free ATMs, and contact Chime’s customer service on-the-go.

Automatic Savings with the Chime Card

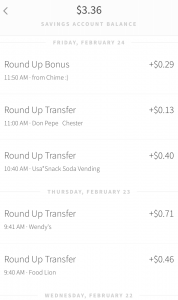

The best feature of the Chime card by far is the automatic savings program, in which every transaction on your Chime debit card is rounded up to the nearest dollar for existing customers before August 1st, 2017. Chime sets aside that rounded up savings allocated from your Chime Spending account to your Chime Savings account.

NOTE: On August 1, 2017, we are discontinuing the 10% Round Up Bonus. This change will only affect new members who open a Chime account on or after 8/1/2017. Existing members will continue to receive a 10% Round Up Bonus every week they have a qualifying Round Up Transfer.

Additionally, making purchases with your Chime card will give you instant cash-back rewards in different retail categories (such as groceries, utilities, streaming service subscriptions, internet services, and restaurants), so you don’t have to wade through confusing points programs and transfer points here and there to maximize your rewards like you would for other debit and credit cards.

Could you imagine how much you could save and how much your weekly 10% bonus would be if you used the Chime card for reoccurring purchases in your monthly budget? Paying your rent, groceries, utilities, streaming service subscriptions, internet services, and restaurant bills with your Chime card will, not only help you stay on budget, but also help ramp up your savings with bonuses and cash back rewards each week.

In Chime’s Millennial Money Mindset Report, the company found that 93% of young consumers think it’s important to save, but over 40% aren’t saving. Chime’s Automatic Savings was designed to help its members form healthy financial habits by automating the process of setting aside money in a savings account. It’s another example of awesome tricks to help you save money without even realizing that you’re doing it. Tricking yourself into saving is the way to start if you’re struggling to get going with savings.

Eliminating Banking Fees

Most banks and card companies charge their members fees in exchange for their services, whether that includes maintaining a savings account with them for a set monthly fee or using an unsecured credit card with a 20% or more interest rate that applies to statement balances.

Chime, on the other hand, does not charge its members to use its services. Instead, it takes a small cut of transaction fees from Visa (on purchases made with Chime cards) and passes along some of the savings to their members.

If you’re sick of getting hit with overdraft fees for accidentally going over your balance, paying monthly fees for bank accounts that don’t have the minimum deposit required to waive the “maintenance fee,” and paying out-of-network ATM fees, then Chime could be a valuable resource for your wallet.

There are over 24,000 fee-free ATMs in their network, and you’ll actually earn money by using Chime more often when you pay bills, dine out, and go shopping.

See Exactly How Much You’re Paying In Bank Fees

Chime has created a cool new website to help you find out how exactly how much you have been paying in fees at bankfeefinder.com. The results are pretty staggering. These bank fees are money coming directly out of your pocket and are killing your budget!

Here are some of the key findings:

- 3% of Bank Fee Finder users paid bank fees

- Average annual fees paid was $328.94

- Over 11.4% paid over $1,000 in fees

- Overdraft is by far the largest fee category

- Average annual overdraft fees paid among all users was $250.93

Here are a few average annual fees by bank that Bank Fee Finder users paid:

- US Bank: $665.57

- Bank of America: $497.18

- Wells Fargo: $302.50

- Chase: $265.41

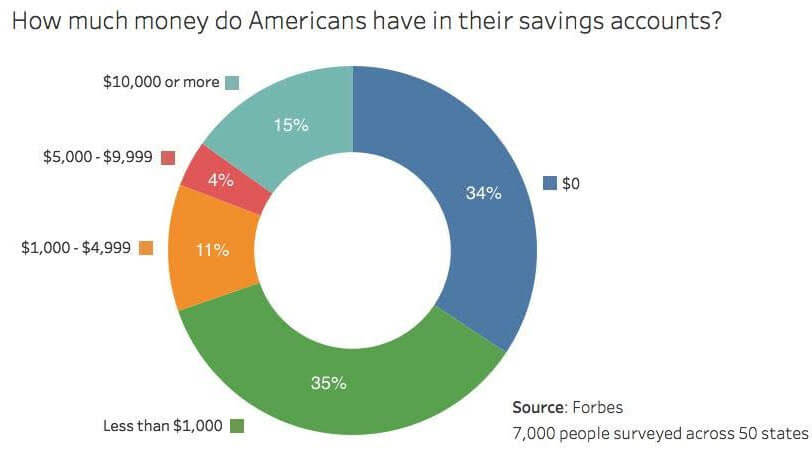

In light of recent news and the fact that many Americans struggle to save just $1000, needlessly wasting money on bank fees needs to change. And, Chime and Bank Fee Finder tool will shine a spotlight on this growing issue and help you understand just how much money you’re wasting on bank fees.

A report published by the Pew Charitable Trusts earlier this year found that over 40 million Americans paid overdraft fees, which amounted to $33 Billion in revenue for banks last year. To make matters worse, the majority of bank customers didn’t realize that they were enrolled in overdraft protection. Most would have preferred to have the transaction declined rather than pay the overdraft fee.

The average bank customer pays an average of $328.94 annually in bank fees & overdraft.Click To TweetOther Cool Features with Chime

You can pay friends and instantly send money to other Chime members. You can split the bill at a restaurant without throwing down multiple cards or chip in for that last round of drinks without opening your wallet. With Pay Friends, the money moves instantly, and there’s no waiting for funds to arrive. You can also choose a Chime Nickname, which makes it even easier to send money via Pay Friends.

If you need to divvy up the cable bill with roommates or a group dinner with friends, Chime can help you do the math and send a text message to friends with a link pay you back. If your friends are Chime members, they can pay you back instantly. If they’re not Chime members, they can pay you back through Venmo. Either way, it makes splitting the bill is easy.

Chime can also help offer you tip suggestions. Transaction notifications for restaurants and other services include a handy tip calculation. I’ve been a real stickler on tipping much to my friends’ and family’s complaints. Chime made it very easy to calculate the tip.

Members can add Chime to Apple Pay on their iPhone, which means they can enjoy all the benefits of their Chime Visa debit card plus the convenience and security of Apple Pay.

Organize Your Personal Finances

On top of everything else Chime has to offer, they also have nifty ways of staying on top of your finances, including daily balance notifications and updates on your account activity directly from the app itself. The automated aspect of Chime makes it easier for members to save money without thinking about it, and Chime even offers a helpful resource center for members to get answers to any questions they might have while organizing and managing their money.

To get started with Chime, all you need to do is enter your first and last name, email address, and a password on the Chime sign-up page. You’ll need to provide other personal identification information in the sign-up process – per U.S. governmental regulations for consumers opening new accounts – but the overall process is pretty straightforward.

Once you’re signed up for Chime, you’ll want to download the app and activate the card as soon as it arrives in the mail. Some of Chime’s features require that new members wait 30 days after opening their Chime account to use (such as the Chime Checkbook and Pay Friends money transfer service), but generally speaking, most of Chime’s features will be available as soon as you receive your debit card.

Chime Privacy and Security Provisions

Chime offers top-notch security measures for their customers, including FDIC-insured balances through their partner, The Bancorp Bank (up to $250,000), strong encryption technologies, and passcode requirements built into the Chime app, touch ID certifications for Apple devices with iOS security compatibility, and protection from unauthorized charges on your Chime card through the Visa Zero Liability Policy.

Needless to say, Chime is as safe as brick and mortar banking and other financial platforms online and through mobile devices. So, don’t let security concerns hold you back from considering the switch to Chime.

Don’t miss out on the opportunity to save money on banking fees and save money with Chime’s savings program – sign up for Chime today.

Note – This post was sponsored by Chime. I received complimentary products to facilitate my review.