According to Investopedia, personal net worth is defined as “the amount by which assets exceed liabilities.” Since income isn’t always an accurate predictor of net worth – there are plenty of high earning poor people who live paycheck to paycheck or have no emergency savings fund despite earning an upper middle-class income – looking to the assets-to-liabilities ratio in net worth calculations offers a much clearer picture of a person’s financial situation. If you haven’t calculated your own net worth in a while, then here are some tips for getting started.

You need to know your net worth. I’m not talking about calculating your net worth every week with the changing fluctuations in the stock market. But, once a quarter you need to sit down and take stock at where your family is financially.

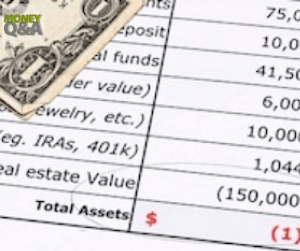

Like a business balance sheet, your net worth lists your assets and liabilities in one location. Take your assets, subtract all of your debts, and you will be left with your net worth. Many of us are far too often left with a negative value for our net worth, as we owe more than our assets can cover.

I can remember my first day of undergraduate accounting class. The professor put the fundamental accounting equation on the board. “Assets – liabilities = equity” – You need to know your net worth by understanding this basic equation.

How Do You Calculate Your Net Worth

What do you measure in your life? Do you count calories? Do you count how many visitors check out your website everyday (or every hour if you are me)? You should be counting things in your life.

Counting implies that there is a goal in the end that you are counting towards something in the end. Those with a goal have been shown in studies to ultimately be more successful in life.

Net worth is knowing the basic equation. Assets – Liabilities = EquityClick To TweetA study of Harvard MBA students in 1979 who were followed for ten years found that the 13% of the class who had made goals for themselves were earning, on average, twice as much as the other 84% who had no goals at all.

In fact, 3% who had written down those goals were earning, on average, ten times as much as the other 97% put together. What you measure in life matters. It draws our focus to it like a laser. So, what are you focusing on with your money?

Why Does Calculating Your Net Worth Matter?

If you’re sticking (mostly) to your budget and your debt burdens are low or nonexistent, then why does calculating your net worth even matter? For one, this process can help you get a better glimpse into your finances and figure out strategies for maximizing your returns on investment while minimizing wasteful spending areas that slow down your path to financial freedom.

Secondly, this can help you with long-term financial planning by giving you a comprehensive overview of your income, investments (tangible and intangible), and liabilities.

Long-term financial planning involves so much more than just funding your retirement accounts. Social Security isn’t enough to sustain the average person in their retirement years and you’re limited to how much you can save through an IRA or 401K, so building up investments in other areas such as home equity, rental property, mutual funds, bonds, and other means is crucial for securing your nest egg no matter how long you live after officially retiring.

Calculating your net worth is crucial if you want to see whether you’re on track to retiring by a certain age, and if you happen to be off-track, you’ll be able to adjust course by lowering your liabilities load and accumulating more assets for your portfolio.

You should know how much you are worth. You should keep track of this number every month. You should have it written down and should compare it to the previous month’s outcome. How did your investments do? Did you add to your credit card debt last month?

Are you on track to save for retirement or your children’s college educations? How do you know if you are not tracking how many assets you have and how much you owe in debts? You need to know your net worth so you know where you stand, where you need to be, and if you are headed in the right direction.

You Should Count Every Dollar You Spend

Every week, people details exactly what they spent for that week. This is a critical step to budgeting. It is very important o know where all of your money is going each and every month (or every week). Knowing where your money goes helps you when are you just starting out budgeting. One of the hardest things to do is know where your cash especially goes.

We all typically have automatic payments for things like our mortgage and car loans. But, do you know where that $100 from the ATM goes? We think we know where it disappears to, but that is just the thing…it disappears. We don’t monitor our cash expenditures as well as we should, and this is a spot where we see our budget start to slip away from us because we cannot account for that money.

One great way to tackle this is to carry a little notebook and pen with you and write down everything you spend money on. Try it for just a week and you will be blown away when you see where your money really goes.

We value what we quantify. We value what we track. You should track your net worth and your spending each month, especially your cash spending. These are the two most important numbers you should use to measure your finances. Knowing where your money goes is the first step in setting up or maintaining your monthly written budget.

What Counts as an Asset?

Collectible items could be incredibly valuable or they could lose all value if the hype surrounding them vanishes – although Beanie Babies are certainly making a comeback, it seems. Ultimately, it’s still worth including the potential/actual value of depreciating assets in your personal net worth calculations to get a better idea of where you’re at financially.

On a more controversial note, your primary residence might not be an asset like most people assume it to be because you’re constantly paying for it – mortgage, insurance, property taxes, repairs, maintenance, upgrades, etc. While a true asset is something that can make money for you.

The trick to including your primary home in your net worth calculations is accounting for any surplus between the market value and what you paid for it, the equity you’ve accumulated, as well as any money you might make from it (roommate rent, Airbnb income, pet-sitting, etc.) then comparing these figures to expenses incurred by your ownership of this property.

Saving for retirement? Planning a dream trip? Hosting on Airbnb can help you fund your next adventure. Get started today!

Liabilities

Simply put, liabilities are what you owe to others. These include debts (credit card, student loans, mortgage loans, auto loans, etc.), outstanding bills, and back taxes you haven’t paid yet. The reason why Americans’ median net worth seems so low – $35,000 for 35-44 year olds, for instance – is due to debts, especially mortgages.

Folks who own and pay off their homes typically have higher net worth than renters or people who are in the middle of paying off their mortgage, but again, your primary residence will still regularly incur expenses that should count as liabilities in your net worth calculations.

Your Net Worth Tells You Where You Are

Your net worth is a snapshot of where you are in life, your family’s financial health. A negative net worth can quickly show you that you may be over-leveraged, that you have more debt than investments you can sell to pay them off.

If you list every investment and debt that you have, your net worth can quickly show you how much you have saved for certain life events. There are entries on my calculations for my children’s 529 College Savings Plans as well as others for retirement accounts, IRAs, 401(k) plans and the like.

Of course, there are many ways that you can impede your net worth. Lifestyle inflation, credit card and student loan debt, no retirement planning and other land mines can decimate your net worth.

Guides You To Where You’re Going

More importantly than where you are, knowing your net worth can help guide you to where you want to go in life. You need to know your net worth.

We all have financial goals. Whether it is retiring early or sending our children to college without student loans, calculating your net worth helps you ensure that you’re on the right track.

Is your net worth on an upward trend each quarter when you’ve calculated it? It should inch its way up each month ever so slowly as you pay off debt and continue to routinely invest in the stock market.

If you’re adding to your investments through dollar cost averaging and paying off your credit card balances without adding to them, you’ll see your net worth start to climb each tie you calculate it.

Calculating Your Net Worth Starts the Conversation

By calculating your net worth, you have a starting point to build a conversation with your spouse or loved ones. Most American families have one adult who typically handles the finances for the household. Reviewing your net worth periodically will help to bring the other spouse into the conversation.

By calculating our net worth regularly, my wife and I sit down to discuss where we are and where we want to go financially with our lives. It’s a time for us to re-examine our financial goals and make new ones. Often we don’t change our goals. Our net worth confirms that we’re on the right track. But, there are times when we reassess things and make changes.

This quarterly meeting is the perfect time for me to help include my wife in the mid-term and long-term financial planning and goal setting for our family.

How Does Your Net Worth Compare?

To some, calculating a net worth raises questions. Are you winning? Are you on track with your saving and investing? And how does your net worth rank compared to others?

Only you can answer the first two. According to the Federal Reserve Survey of Consumer Finances, the median net worth of all families was $81,200 in 2013. The average net worth of families in America was $534,600. The median represents the halfway point — half of all families have higher net worths, half less. The average adds up all those net worths and divides by the number of families. It’s so high because of the immense wealth of the 1%.

The Fed survey offers other breakdowns. For example, the average net worth for persons age 35-44 was $347,200. Homeowners amassed an average net worth of $783,000, vs. just $70,300 for renters.

You can see a rough calculation on where you stack up against other people your age and income on CNNMoney’s Net Worth Calculator. It’s a good tool to give you a quick snapshot, but, of course, you should take results from all online calculators with a big grain of salt.

There’s a danger to comparing yourself to the Joneses. Instead take a moment to calculate your net worth every three months. How do you calculate your net worth? Use it as a baseline to assess your goals. Are you on the right track? Do you need to make adjustments? Tracking your net worth can be a valuable tool to achieve your financial goals.

Tracking your personal net worth can offer an enlightening snapshot into your current and projected financial situation. If you’re relatively debt-free aside from a mortgage and low-interest debts, then a negative net worth shouldn’t be too much of a concern as long as you’re consistently striving to accumulate more assets for your portfolio in the meantime. If achieving a higher net worth is one of your major financial goals, then don’t let a splurge-happy friend or neighbor’s high-roller lifestyle deter you from steadily progressing towards your goals.

If achieving a higher net worth is one of your major financial goals, then don’t let a splurge-happy friend or neighbor’s high-roller lifestyle deter you from steadily progressing towards your goals. They might look wealthy, but asset-to-liabilities ratios are ultimately the best predictors of true wealth and financial stability, so start crunching numbers as soon as possible to see how you can better achieve your financial dreams.

How do you calculate your net worth? Where do you stack up against others your age? Is your net worth on track? Do you calculate your net worth regularly? Why not?