Note – The following post is the 3rd and final article in a series of retirement education blog posts on Money Q&A and sponsored by USAA. Be sure to check out the 1st and 2nd articles in the series, “Am I Saving Enough for Retirement?” and “How Long Will My Retirement Savings Last?”. Like always, all opinions are my own about every topic, including choosing a lifestyle in retirement.

With the cost of living rising at what seems like rapid rates every year, adults of all ages are beginning to wonder how they’ll ever manage to retire and still maintain the same standard of living they enjoyed during their working years. The concern to maintain a consistent standard of living during retirement is especially true for renters, who can afford the annual increases imposed by landlords right now. But what about when you’re retired and living on a fixed income?

Maintaining your lifestyle in retirement becomes even scarier when you hear that many Americans who are close to retirement only have about 12% of what they’ll need currently saved up. This statistic is based on data from the Federal Reserve, which found that Americans between the ages of 55 and 64 have a median of $120,000 saved for retirement.

$120,000 might get you through a few years, depending on your local area’s cost of living and how your health holds up during the early retirement years. But you may need at least 6, or 7-figures saved up for retirement to live comfortably over the long run.

If you think about it and use the 4% withdrawal rate rule of thumb, a $120,000 nest egg will only provide you with $4,800 of retirement income…annually! After crunching some basic numbers, you can start to see that many of us are not saving enough for retirement. Saving enough now directly impacts what kind of lifestyle you will have during retirement in your Golden Years.

But remember, retirement is not a one size fits all experience. Proper retirement planning depends on each person’s unique circumstances. Personal circumstances often may require that you save more or even less. Retirement is not a one size fits all experience. Proper retirement planning depends on each person’s unique circumstances. That’s why talking to a professional like the ones at USAA to get advice is so important.

How to Maintain Your Lifestyle in Retirement

If you’re concerned you might not have enough saved for retirement and that Social Security will barely fill in the gaps between your projected expenses and actual income, here are some of the best strategies for you to consider for maintaining your current standard of living during retirement without going broke within the first few years.

Cut Your Expenses Now and Budget

Cutting your expenses now while you’re still working and a few years away from retirement may sound intuitive, but too few people put in the effort to adjust their budgets and lifestyles while they’re still working because they can afford it. While there’s nothing wrong with “living in the moment,” this present-oriented mentality can be devastating for your long-term financial stability as you near retirement.

It is crucial to start reexamining your budget to uncover which expenses you can begin trimming right now to free up more money to put into retirement savings and rein in your spending habits now so that it won’t feel so drastic later. Do you still have credit card debt? Are you paying off student loans for your children? It would be best if you aimed to be debt-free (except for maybe a mortgage) as you head into retirement.

Remember, cutting expenses doesn’t necessarily equate to a reduction in your standard of living. It’s just finding ways to be more efficient with the money you have in your budget now, so you’ll be better off when you eventually start living on a fixed income.

And, your budget will most likely change as you hit retirement full steam. Will you still need life insurance? What hobbies will you pick up and ramp-up to keep yourself busy? How much traveling will you do during retirement?

Some areas you might consider cutting back on now may include:

- frequently dining out

- cable and other non-necessary TV expenses

- splurging on brand-name clothes

- alcohol consumption (quality & quantity)

- long-distance, pricy vacations.

Typically, most people use the rule of thumb to use only about 70% to 80% of their pre-retirement annual income during retirement. The reduction in expenses is from things related to work that you may not need anymore. During retirement, you may see your transportation costs decrease. You may also not be contributing to your retirement accounts as much (especially if you’re starting to draw them down).

Of course, you can’t list all of your expenses in your new retirement budget. It’s not going to be 100% accurate. There will be some expenses that you will guess wrong about. Like all budgets, you will have to adjust your retirement budget to meet your needs, wants, and retirement lifestyle.

But, when you create your first budget before you actually retire to account for your loss of income, retirement withdrawals, and new expenses, you have to be as accurate and thorough as you can. Then, you will revise your budget every so often based on your actual spending as you enter retirement and can see how it goes.

Rental Property Income

Reducing your expenses is just one approach to securing your long-term standard of living. You may also want to consider ways to boost your income during retirement in ways that don’t require a return to the workforce.

One way to accomplish this – if you own property – is by renting out your home or renting bedrooms. You can choose to rent out your home only while you’re on vacation or even rent out a spare room to a tenant on a monthly or annual basis. Renting out your home or a room is a relatively low-maintenance way to supplement your retirement income with the resources you already have.

Alternatively, you could choose to rent out spare bedrooms to Airbnb guests. Each municipality has its own regulations regarding Airbnb, also referred to as “short-term” rentals, so be sure to check what your city’s laws are before listing a room on the Airbnb platform.

What about other rental opportunities? If you own an RV, you could rent it out on Outdoorsy. If you own a clean, relatively new car, you could rent it out on Turo.

Passive Income Opportunities

Even if you don’t own property or don’t feel comfortable renting out a room or your home to strangers, other passive income opportunities are available to help you supplement your retirement income and maintain your current lifestyle.

I’m a huge fan of passive investing using peer-to-peer websites like Fundrise, PeerStreet, Roofstock, and others.

Roofstock is the #1 marketplace for buying and selling single-family rental homes. Roofstock has listings in over 40 markets across the US. 1 in 10 houses in the US is single-family rentals (SFR), which equates to over 15 million households.

Roofstock makes it easy to invest remotely. Over 60% of their customers are buying a rental property located more than 1,000 miles away. With their market analysis, Roofstock provides research and data analysis to help you determine which locations meet your investing objectives.

Instead of saving tens of thousands of dollars to invest in your own property, Fundrise lets starter investors begin with just $500 (or $1,000 for an “advanced portfolio”). Fundrise supports many different investment accounts, including personal, joint, and entity accounts (e.g., trusts, LLCs, C corporations, S corporations). You can even invest money using funds from your IRA account.

PeerStreet is another great marketplace for investing in real estate-backed loans. PeerStreet’s platform provides investments in high-yield, short-term loans focused 100% on real estate debt.

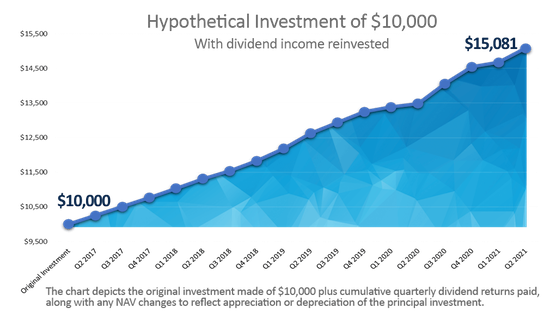

Streitwise is a real estate crowdfunding platform for both accredited and non-accredited investors. Anyone who has as little as $5,000 available to invest and a desire to diversify their portfolio beyond stocks and bonds should consider investing in commercial real estate with Streitwise.

Streitwise directly owns and operates its own commercial properties, whereas many other web-based investment platforms serve as middlemen between everyday investors and real estate property managers.

Since its inception, Streitwise has produced almost a 10% dividend for its investors, whereas public REITs produced 3.79% dividends and public bonds produced 2.78% dividend yields. Streitwise just declared their latest dividend payout for Q2 2021, at $0.21/share, or 8.4% annualized dividends. The site has hit its target return range for a 17th straight quarterly distribution with each dividend payout over 8%.

You can also check out my complete review of Streitwise on Money Q&A. If you’ve been wanting to get more active in real estate investing for just a small sum, then a platform like Streitwise might be a great addition to your investment portfolio.

Enjoyable Side Gigs

Having a hobby that actually earns money instead of costings money never really hit me until my wife brought it up the other day. We talked with a friend who just got out of the military about hobbies and how to fill time afterlife in the military is over.

My friend likes to fly. He’s an Army aviator. And, he’s been thinking about buying a little Cessna-type airplane. That’s all fine and dandy. But planes are expensive! Even the little ones!

Don’t get me wrong. I’ve got plenty of expensive hobbies. I love the ride my expensive all graphite road bicycle. I just took up the hobby of brewing my own beer at home. I also love to buy camping gear and go camping and hiking with my Boy Scout sons and their troop.

But, above all else…I love to write about personal finance. Who would have known that love of writing that I’ve had since being a little kid and a love of personal finance, investing, and the like in early adulthood would be a hobby that turned into a profitable side gig?

The thing about side gigs and side hustles is that they don’t feel like work. It’s a labor of love.

There are so many side hustles out there now. But, when you are looking to retire, you don’t want to go back to work. With the gig economy, you can supplement a pension or retirement income with work like driving for Uber or delivering food for Postmates. But, do you really want to do that during retirement?

The beauty of a hobby is that it doesn’t feel like work. It’s a labor of love. Do you have a hobby that you can into side income while in retirement?

Maybe, like my friend with the airplane, he can give flying tours around a city. Or, perhaps he can eventually teach other people interested in earning their pilots license? Or, even better…maybe he can use his plane to run a skydiving business?

Side gigs, side hustles, and hobbies – whatever you want to call them – are a great way to supplement your retirement income. Initially, you may think you can’t turn your hobby into a profitable business, but maybe you can. You might have to get creative. Think outside the box.

I never thought that a blog like Money Q&A could ultimately let me retire from the military at age 42 and supplement my military pension. I started Money Q&A in 2010 simply because there was a void in the space and such lousy information being spread around.

I wanted to help people. I had a background in finance and writing. I loved reading blogs, and starting one of my own was the next logical step. Almost 10 years later, the little passion project has grown enormously, and I couldn’t be more surprised or happy.

But, don’t be like me. Don’t forget to file your quarterly taxes if you work from home with a side hustle.

Cover Your Essential Expenses with Your Pension

For members of the military and others with a pension, a pension is a great way to help you maintain your lifestyle in retirement.

The key to funding your expenses is to determine your “income floor.” That’s the minimum amount of guaranteed income that you will need to cover your basic expenses like your mortgage, food, transportation, and other relatively fixed costs. If you find a way to always keep that amount of income available, you won’t worry about running out of money, no matter how long you live.

You should estimate your critical living expenses for each year of retirement. Things like food, shelter, baseline healthcare coverage, and insurance. Total up the monthly costs of each expense category. These are the costs that you’ll need to cover as long as you live.

That’s the beauty of having a pension. You have a set amount of income coming in every month. If you use that for your fixed costs, withdrawals from your retirement investments can help you fund your variable costs such as travel and hobbies. You also need to consider how your retirement is taxed.

Asset Growth for Discretionary Spending and Inflation

So, you’ve got ideas on how to keep the income flowing when you get to retirement age. But what types of investments should you have? What if you don’t want a side hustle or to rent out your spare bedroom on Airbnb?

Having the right mix of investments, your asset allocation is a major key to successful retirement planning. But, many people aren’t sure how much they should have in stocks versus bonds, for instance.

Many people also don’t understand their risk tolerance or consider how far in the future they are actually investing for retirement. I see a lot of young professionals in their 20s and 30s with a very conservative investment portfolio. Some of my friends talk about holding a lot of cash, cash equivalents like money market funds, and bonds in their investment portfolios.

One rule of thumb that many financial advisors look towards is having 100 minus your age set aside in stocks (and stock mutual funds) and the rest invested in bonds. For example, if you were 40 years old, the rule of thumb would recommend that you have 60% of your retirement investments allocated to stocks (100-40 = 60) and the other 40% invested in bonds.

Then as you get older, your investment portfolio becomes less risky as you increase your bond allocation and reduce the number of stocks and stock mutual funds in your overall holdings.

Remember, retirement is not a one size fits all experience. Proper retirement planning depends on each person’s unique circumstances. The amount of allocations in your retirement accounts depends on your individual circumstances. That is why you should consider seeking help from a qualified financial advisor like the advisors at USAA.

Tools and Calculators Are a Great Starting Point

Find out if you’re on track to meet your retirement goals. To get more details on your retirement planning needs, check out USAA’s advanced retirement calculators. They can help you determine how long your savings could last. You tell the calculators how much you’re saving and how you typically invest. Then, they will show you how much you may need to retire and how to allocate your investments.

You can also discuss your results with a USAA advisor. Tools and calculators are a great starting point. But then an advisor can help make sense of the data – especially if an advisor is free!

USAA Financial Advisors can help you:

- Review your savings strategy.

- Determine how long your savings could last.

- Help protect your savings from market volatility.

Get your retirement review today.

Call 800-531-3392 to speak to an advisor.