Disclaimer – This is a sponsored post by PSECU, a credit union in Pennsylvania.

When was the last time you re-evaluated your budget? The task of reviewing, pruning, and re-allocating our money often gets lost in the minutiae of life.

You get too busy earning money that you forget to manage what you already have.

What’s the point of going back out to the field to get a bigger harvest if the veggies you picked last week are rotting at home because you didn’t take the time to can, dry, or preserve.

Similarly, good money management is about how much you earn and spend and what you do with the rest sitting in your bank account.

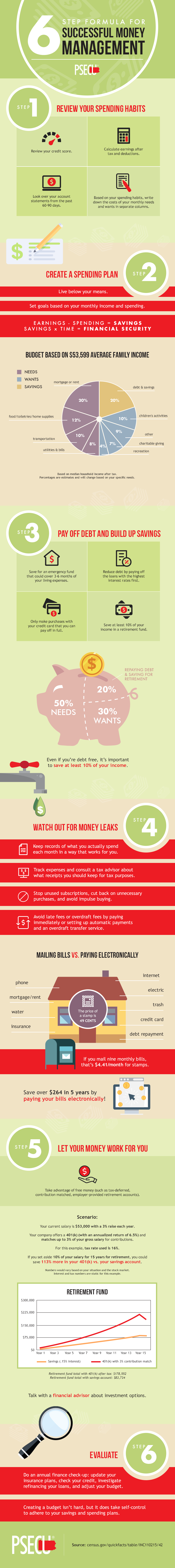

Use the infographic below by PSECU to help you take a fresh look at your money management plan.

How should you manage your money? Good money management is about how much you earn and spend and what you do with the money.

Here are the top steps to help you better manage your money.

- Review your spending habits

- Create a spending plan

- Pay off debt and build up savings

- Watch out for money leaks

- Let your money work for you

- Evaluate your financial plan

When was the last time you re-evaluated your budget? The task of reviewing, pruning, and re-allocating our money often gets lost in the minutiae of life.

You get too busy earning money that you forget to manage what you already have. What’s the point of going back out to the field to get a bigger harvest if the veggies you picked last week are rotting at home because you didn’t take the time to can, dry, or preserve.

Similarly, good money management is about how much you earn and spend and what you do with the rest sitting in your bank account.

Review your spending habits

The first step to manage your money is to manage where it goes. Take a look at your bank account balances and spending habits over the last three months. Do you see any patterns? If so, what are they?

To improve your fiscal habits, you need to find out where you can make some tweaks. Do you eat out more often than you should or spend too much on takeout? You may be able to save serious cash by bringing lunch from home every day instead of buying it at work or by packing an extra snack for when hunger strikes during the day. Is there room in your budget to buy generic brands rather than brand-name items, which are almost always more expensive?

Another that many people don’t realize is how much money they could save by turning off appliances that aren’t being used. A 2005 study from the National Resources Defense Council found that Americans spend a whopping $19 billion a year powering electronic devices while keeping them turned off! Even if you only manage to cut your electricity usage in half, it would still be worth hundreds of dollars a year for no extra work at all.

Create a spending plan

Okay, now you know what you can cut back on and hopefully have some cash left at the end of the month. Where should it go? Create a detailed list of financial goals for yourself with both short-term and long-term targets, as well as the steps needed to reach each one.

The good thing about this exercise is that it does not necessarily require you to have huge amounts of money. Even if all you manage to put away each month is $20, that’s still a great move because every little bit helps.

Here are some common financial goals:

– Pay off debt or make extra payments on credit cards or student loans

– Save for college tuition

– Build up an emergency savings account in case life throws you a curveball and you need some backup cash

Pay off debt and build up savings

One of the best ways to manage your money and build wealth is to pay down your debts and make additional deposits into savings accounts. The federal government and banks pay interest on savings accounts, while most credit card companies charge high-interest rates and compound interest.

The beauty of this approach is that you’ll never be rich enough to take advantage of it – the less money you manage to save, the more your savings accumulate because your debts are paid off first. The hardest part in saving is often getting started in the first place, but once you manage it even a little bit, momentum starts building up behind you.

Watch out for money leaks

Even if you manage to find extra cash in your budget or make some wise financial decisions, there will always be expenses coming up that you didn’t expect at all. These are known as “money leaks” because they drain your resources without any future benefit. For example, eating lunch with co-workers instead of bringing it from home or getting a soda out of the office vending machine.

These can often be stopped once you are aware of them, for instance, by bringing your own snacks to work every day. You can also recalibrate your thinking to view money as a finite resource that needs to be managed.

Once you manage this, it will help you be more mindful of your spending habits and manage your money better. After all, no matter how much money you have in the bank, if it’s constantly leaking out, you won’t have anything to fall back on when an emergency comes up, or a big purchase is necessary.

Let your money work for you

Take advantage of your employer’s matching contribution in your retirement plan.

Stocks in a company’s retirement plan offer a fantastic rate of return on your money, and most employers will match a portion of what you manage to save each year. This is essentially free money from them so take advantage of it! Invest sensibly in domestic and international markets, and your account value will soon start growing faster than ever before. Even if you manage to add just $50 a month, over time, the contributions compound up to thousands of dollars that can be spent later for things like college tuition or retirement.

Extra:

– Invest wisely using an automatic investing service such as Betterment.

– Try Mobile apps like Acorns that round transactions up and invest the difference automatically for you.

Evaluate your financial plan

After you manage to find the extra cash somewhere, determine where it should go. This is not just about how much you earn and spend but also what you do with the money. For example, if you are paying off debt, which debts should be prioritized first? What are the side effects of getting that 40″ TV on credit? All these questions can be answered when you manage your resources well.

Once this part is clear in your mind, try creating a detailed plan for each financial goal by taking into account monthly income vs. expenses and any savings goals. Evaluate whether they are realistic in light of your existing expenses or lifestyle choices. If not, maybe it’ time to change one or more aspects of what you are doing to manage your money better.

You should consistently reevaluate your financial plan. Your financial habits change over time, so manage your resources accordingly. Remember that this is not just about saving up for something specific but also making sure you don’t spend too much money on an impulse buy or waste money on unnecessary things.

The longer you manage your money well, the easier it gets to manage it because the problems get smaller and smaller compared to what you manage to save. This allows you to focus more of your energy on other aspects of life. And once you get used to managing your resources better than before, the idea of throwing away all that extra money becomes increasingly uncomfortable!

The key here is patience and consistency – manage your resources better today than yesterday and manage them better tomorrow than today! When managed correctly, money can give you freedom and happiness later in life. In the end, manage your money well to manage your life well!

Manage your money well

There is no way around it: It will be even more difficult tomorrow if you manage your resources poorly today. Being in debt makes everything harder – not only does it lower your credit score and make borrowing more expensive, but also it feels horrible to be swimming in bills while others are enjoying their new car or vacation.

It’s important to get started sooner rather than later so that you don’t experience long-term consequences such as health problems due to stress or an inability to buy that dream house.

Make sure you manage your money well so that you can relax and enjoy life later on, whether it is tomorrow or decades down the road!

These six steps will help you manage your money better than ever before. Even if you manage to cut back just a little bit, it will pay off big time over the long term.