Many investors understand the benefits of investing in real estate, but there are high barriers to entry involved that can prevent people from investing in more than one or two properties at a time. If you don’t want (or are unable) to pay tens of thousands of dollars for a down payment on a single property (not to mention other time and financial resources demanded by property and tenant management), then what options are left for you?

Enter PeerStreet: an online marketplace that offers tremendous access to high-quality real estate loan investments. This company blends Big Data with in-depth real estate investing expertise to provide a variety of property investment opportunities for people seeking greater diversification within their portfolios.

Whether you simply want to expand the real estate component of your portfolio or grow your retirement savings, PeerStreet could be a good fit for your financial goals.

What is PeerStreet?

PeerStreet was founded in 2015 on the premise that diversified real estate investment opportunities ought to be more widely available to investors and that big data analytics could provide a pathway for giving those investors access to viable real estate loans with promising potential for excellent returns.

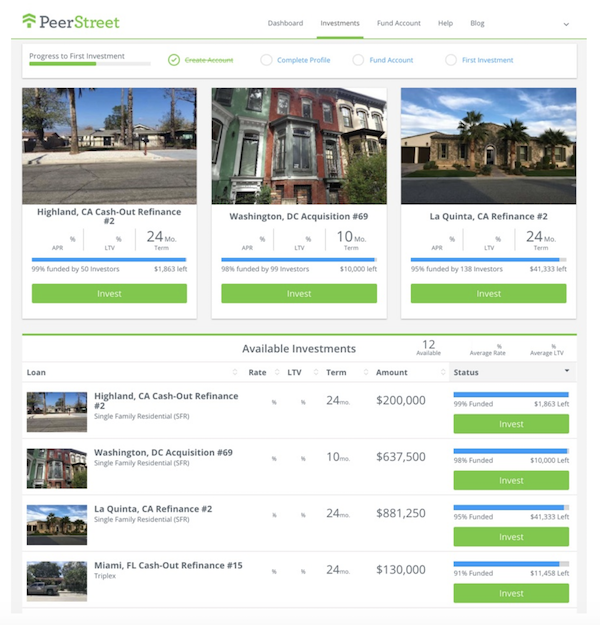

PeerStreet is different from a Real Estate Investment Trust (REIT) in that it offers greater flexibility and transparency by letting investors self-select loans from a list of pre-vetted borrowers. In addition to simpler fee structures, PeerStreet investors get the added ability to build portfolios based on geographic areas, property types, and more.

PeerStreet is also different from traditional forms of real estate investing in that you do not directly own the property or borrow directly from a lender. Instead, investors have issued mortgage dependent promissory notes (MDPN), which are linked to the performance of the loan affiliated with your investment. But, it is also important to understand that traditional private leaders such as Crescent Lenders exist as well and may be worthwhile for you to check out.

Who Can Invest with PeerStreet?

Not just anyone can invest with PeerStreet. SEC regulations applicable to PeerStreet’s investments mandate that investors must be accredited. An accredited investor is someone with an annual income of $200,000 or more ($300,000 or more for joint filers) or someone who has a net worth of at least $1 million.

Note: This figure excludes the value of your primary residence. The accredited investor requirement means that most PeerStreet investors are high-net-worth individuals, families, businesses, and institutions, rather than everyday investors with more limited incomes and abilities to invest large amounts into real estate loans.

For those who meet the accredited investor prerequisite, PeerStreet requires just $1,000 minimum investments on each real estate loan, though eligibility for the automated investing option requires a minimum of $100,000 in a PeerStreet account, as well as specified criteria outlined for different investment types and loan amounts.

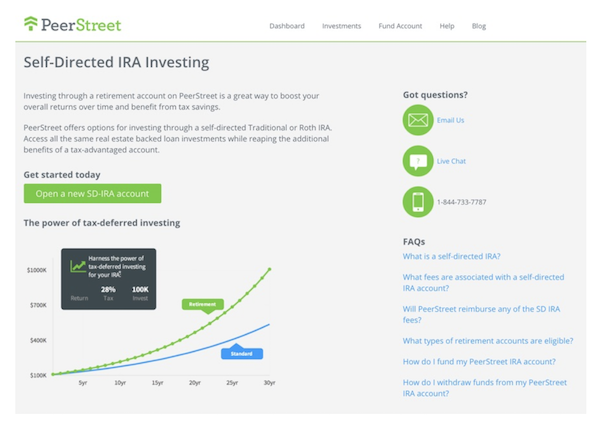

PeerStreet Self-Directed IRA

In addition to general investment accounts, PeerStreet offers a self-directed IRA (traditional or Roth) through STRATA Trust Company. The fees involved in setting up an IRA with PeerStreet include $50 account set-up, $100 annual account fee and $50 processing fee. If your initial deposit is $5,000 or more, PeerStreet will reimburse the fees once the $100 annual account fee will still apply each year thereafter.

The self-directed IRA is an excellent way to benefit from tax-deferred investment accounts and bolster your retirement savings strategy with real estate backed loans.

How Much Could I Earn with PeerStreet?

Loans offered through PeerStreet tend to be short-term (6-36 months on average) and they are underwritten at a moderate LTV ratio of 75% or less, which suggests less risk is involved for investors. PeerStreet is more advantageous for investors seeking more returns on their investments and more diversified portfolios because it offers easier access to lucrative investment opportunities.

PeerStreet loans must pass through two separate layers of underwriting and due diligence; PeerStreet lets investors effortlessly reinvest earnings to maximize gains; and PeerStreet minimizes issues with borrowers by rigorously monitoring loan performance, enforcing contracts and pursuing remedies against borrowers who default (if/when that occurs, which is rarely).

So how much could you earn with PeerStreet? According to their research, PeerStreet investors yield approximately 6-9% over a 12-month timeframe on their real estate backed loans. At this time, you cannot sell your PeerStreet investments, but the company’s website says it may offer this ability at some point in the future.

Is PeerStreet Right for Me?

If you’re an accredited investor seeking new opportunities to diversify your portfolio with real estate backed loans, then PeerStreet is a great place to start (or continue) accumulating more wealth from investments in properties. Just like any other investment, there’s always an element of risk involved. However, PeerStreet’s combination of big data analytics, real estate expertise and reasonable pricing structure makes this platform an ideal addition to any investment strategy in need of greater diversification.