If you often find yourself struggling to save money on a regular basis and at the mercy of monthly fees, overdraft fees, and nearly every other type of fee your bank cheerfully tacks onto your accounts, then perhaps it’s time for a new approach to personal financial management. Chime bank and the Chime card may just be the right bank account and debit card to help you take back control over your personal finances, finally start saving, and stop paying bank fees once and for all.

Chime, for instance, is an up-and-coming online and mobile bank account that offers a simple way of tricking yourself into saving more money. Rather than gouging you on bank fees, Chime offers a spending account and a savings account with no monthly minimums or fees, no overdraft, no international fees, and a fee-free ATM network. Plus, they offer an automatic savings program that delivers weekly savings bonuses to their cardholders.

Additionally, Chime has some pretty cool features if you’re having trouble getting started savings. I had the opportunity to check out Chime for myself. And, the results were awesome!

Chime Card Review – What Is Chime Banking?

When you sign up for a Chime bank account and a Chime Visa Debit card, you can transfer funds into your new Chime account for free and use the card anywhere Visa cards are accepted. It’s a demand deposit bank account with a debit card. So, like all checking accounts, you can only pay for items with your Chime card after you’ve deposited funds into your Chime bank account.

You also have the option of setting up direct deposit from your employer directly to your Chime spending account. You also receive access to the Chime Checkbook feature, in which Chime will mail physical checks on your behalf after you authorize a payment and provide them with the name and mailing address of the recipient.

Chime members can get paid up to two days early when they fund their account through payroll direct deposit. Chime makes it easy to set up direct deposit with a form that can be emailed or printed and provided to the employer.

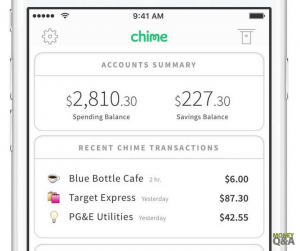

There are many different options when it comes to managing your money with Chime. Not only does Chime offer its own Spending and Savings, but Chime also offers easy access to mobile check deposits and direct deposits into your accounts through the Chime app.

The Chime app is available for both iPhones and Android devices, allowing you to access real-time updates on your account balances, recent transactions, locate nearby fee-free ATMs, and contact Chime’s customer service on-the-go.