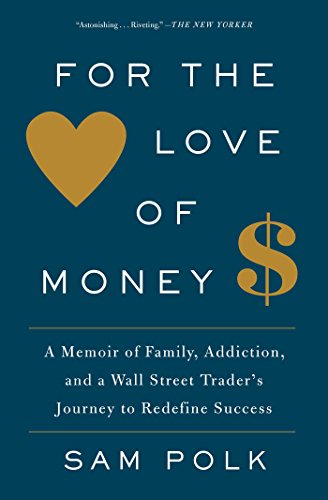

“For The Love of Money: A Memoir” by Sam Polk is a brand new book telling the behind the scenes story of a Wall Street trader, focusing on credit default swaps, distressed assets, and all of the shenanigans that captured America’s attention during the 2008 financial crisis.

“For The Love of Money: A Memoir” by Sam Polk is a brand new book telling the behind the scenes story of a Wall Street trader, focusing on credit default swaps, distressed assets, and all of the shenanigans that captured America’s attention during the 2008 financial crisis.

How much money is too much? How large of a salary are you willing to walk away from because of your core beliefs? Sam Polk was put to the test on Wall Street, and his book paints an incredible picture of what it takes to be a stock and bond trader.

“For The Love Of Money” by Sam Polk

In 2014, a former hedge fund trader’s New York Times Sunday Review front page article about wealth addiction instantly went viral. This is his unflinching memoir a coming of age story about Sam Polk’s life on Wall Street. The memoir is telling and focuses on his fight to overcome his addictions (drugs, alcohol, women, etc.) and find a new way to define success based on his deep core values and beliefs.

At just thirty years old, Sam Polk was a senior trader for one of the biggest hedge funds on Wall Street. He was on the verge of making it to the very top of the Wall Street ladder and earning hundreds of millions of dollars.

When he was offered an annual bonus of $3.75 million, he grew angry because it was not enough. In that moment he knew he had lost himself in his obsessive pursuit of money. He came to despise the Wall Street culture that he had grown up in with its shallowness, sexism, crude machismo, and the use of wealth as the sole measure of a person’s worth.

For the Love of Money: A Memoir

Price:

Despite making millions each year as a young man and the very real possibility of earning much more, Sam Polk decided to walk away from Wall Street and his life.

For Sam Polk, becoming a Wall Street trader was the fulfillment of his life-long dream. But, in reality, it was just the culmination of a life of addictive and self-destructive behaviors, overeating, bulimia, and alcohol and drug abuse.

Like “Liar’s Poker” by Michael Lewis and “Barbarians at the Gate” by Bryan Burrough and John Helyar (both books are also Honorable Mentions in my Top 10 Personal Finance Books list that you should read), Sam Polk brings readers into the rarefied world of Wall Street trading floors in “For The Love of Money: A Memoir“.

Sam Polk captures the frustrations of young college graduates who are drawn to Wall Street in the lure of fast riches. The book explores the creation of a young hedge fund trader, his disillusionment with life on Wall Street, and the radical new way he has come to define success.