Stockpile Review – Stockpile Is an Easy Way to Start Investing in Stocks

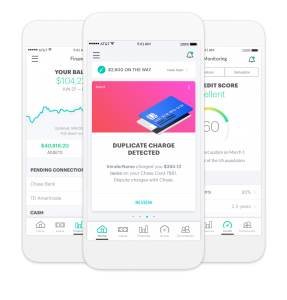

One of the biggest barriers people face when they want to get started in investing is the perception that they don’t have enough money to set aside in an investment portfolio. If you’re in a similar situation, then low-cost investment options are the perfect solution to help you build interest-accruing savings with minimal upfront monetary requirements. Take Stockpile, for instance, which allows investors to get started with as little as $5. Many of us can afford to invest $5-10 per month, though a platform as easy-to-use as Stockpile, you might find yourself investing more. To learn more about how Stockpile works and whether or not it’s a good fit for your financial situation, check out what Stockpile has to offer: … Read more