Note – I’m an affiliate of Tally. While all of the opinions are my own (like always), but I’ll receive a small commission if you slick on a link and choose to sign up. These commissions help keep Money Q&A going.

Wouldn’t it be great if there was a magical calculator that told you exactly how much you needed to pay towards what cards/loans in order to stretch your dollar furthest? Surprise: it already exists in the form of an automated debt management app called Tally.

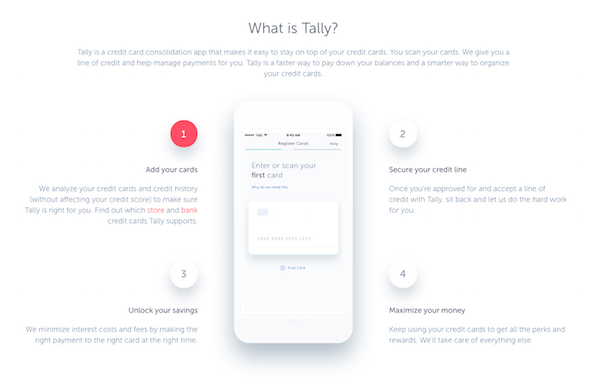

Commonly described as a “robo-advisor for credit card debt,” Tally has become enormously popular with consumers juggling multiple credit cards and loans because this nifty app makes debt repayments a breeze. Rather than having to keep track of several different due dates (and different minimum payment amounts) on your own, Tally manages all the confusing work and meets deadlines for you. Better yet: Tally helps you save money on credit card interest while managing your debts for you!

Whether you simply want more help with remembering payment deadlines or you want to create a pathway out of the maze of debt you presently find yourself in, here are a few reasons why Tally might be the perfect personal finance app for you.

Automated Debt Management

One of Tally’s most useful features is its ability to keep all of your payment information (due dates, minimum payments, APRs) in one place and help you determine the fastest, most efficient way to pay off your debts. For instance, if you have $1,400 on a card with a 21% interest rate and $4,000 on a card with a 14% interest rate, Tally can help you determine whether you should pay off the card with the higher balance or higher interest rate first.

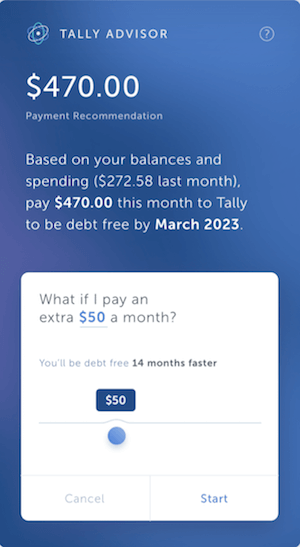

Tally can also automatically calculate when you’ll be debt-free based on your income, current (and simulated) payments, and desired payoff timeline. Monthly recommendations are based on your unique spending patterns and debt repayment goals – not some run-of-the-mill financial advice that could apply to anyone’s situation. If you’re looking for an app that goes above and beyond the usual advice of “follow a budget” and “save money” then Tally is the hyper-customized app you’ve been waiting for.

Line of Credit

With Tally, you could potentially qualify for a line of credit. This is different from a personal loan because a revolving line of credit offers more flexibility, while a personal loan only gives you a set amount of money and a set repayment schedule.

Tally’s line of credit lets you pay interest only on the money you borrow – this annual interest rate typically ranges from 7.9% to 19.9% depending on your credit score (you’ll need at least a 660 to be eligible). Best of all, this line of credit means you only have to make one payment per month (to Tally) while continuing to use your credit cards and loans as you normally would.

If you have a card with a 0% or lower interest rate than what Tally can offer you, then the automated credit card repayment manager only pays off the minimum balance for you until the rate expires, so your repayment strategy can efficiently prioritize higher-interest debts.

Late Fee Protection

If you’ve run into issues with late fees on credit card or loan payments in the past, then Tally would be like a breath of fresh air for your finances. If you don’t have the funds available in your bank account when a payment is due, then a Tally line of credit kicks in and covers the payment for you (yes, you still need to pay the Tally line of credit back, but it’ll likely have a lower interest rate than your credit card did).

This is an incredibly convenient feature because late fees are not just bad for your wallet – they’re bad for your credit score. A history of timely payments is crucial for maintaining a solid credit score, so Tally offers an excellent shield against the damaging potential of late payments.

Should I Download Tally?

Tally is only available as an app (iOS and Android devices), but it’s free to use! The only time you’d be paying would be if you take out a line of credit through Tally, but even then, you’re still saving money on the interest you’d be squandering on credit card and other loan debts anyway. Tally’s analysis of your credit history and score does not affect your credit report, and more than a dozen major banks’ cards are presently supported by Tally (e.g., Chase, Bank of America, American Express, Capital One, Discover, etc.).

If you feel like you’ve been trapped in a cycle of debt for too long, then don’t wait any longer – download Tally to see how the automated debt manager can help you reorganize your finances and escape debt once and for all.