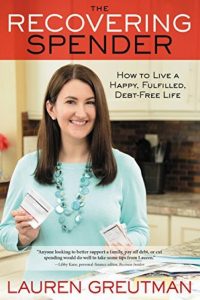

Lauren Greutman is everywoman. And her tale of coming back from a life of debt is inspiring. In her new book, The Recovering Spender, Lauren Greutman lays out her mistakes (like many of us), how she overcame them, and then how you can too.

Lauren Greutman is everywoman. And her tale of coming back from a life of debt is inspiring. In her new book, The Recovering Spender, Lauren Greutman lays out her mistakes (like many of us), how she overcame them, and then how you can too.

The Recovering Spender by Lauren Greutman is half memoir and half “how to” book on taking back control over your finances and control over your spending.

I’ve often been critical of my fellow personal finance bloggers. Most of them fall into two camps. They typically are: #1 – fall along as I chronicle my life getting out of the massive credit card and student loan debt that I’ve created. #2 – financial experts with the degrees and background to back up the actionable advice and tips they provide.

I personally like, and fall into, the second category. I often do think that readers would care about my personal life. But, often, I’m in the minority of the personal finance blogging scene.

Lauren’s story is a classic personal finance blogger’s tale of too much credit card debt and overspending. Bloggers love to share their stories of coming back, and Lauren’s book is no different. If you love reading personal finance blogs, you’ll love Lauren’s new book.

A lot of readers love to follow along with the underdog and witness the comeback story first hand. And, most personal finance blogs provide that coverage for readers.

That’s what’s made Lauren’s blog, IAmThatLady.com (later rebranded into LaurenGreutman.com) so popular. If you haven’t checked out her awesome blog that started it all, you definitely should.

I have to admit…I was sucked into her story about working her way up the chain at a Multi-Level Marketing (MLM) company and using her credit cards to get ahead. Like most readers, I’m fascinated by the story. And, the book didn’t disappoint…it has a great opening story of Lauren’s fall and then ultimate comeback.

The Recovering Spender by Lauren Greutman

Lauren Greutman has been where many of you find yourself today. She’s been in debt and struggling. And, she’s clawed her way back. Her book, The Recovering Spender, shares her story, and it also provides readers with simple and successful strategies to overcome your debt.

The Recovering Spender Offers Hope

The Recovering Spender by Lauren Greutman is a book that offers hope. It’s a book for the American spender, those who don’t necessarily have Roth IRAs and stock portfolios. But, it’s for those guys too (believe it or not).

The Recovering Spender is a book for people who hate talking about money, who hate to budget. It talks about getting out of debt in plain English, which is something that should resonate with the readers of Money Q&A too.

It’s a book for people who have struggled with debt, continue to struggle, and want to get out of debt.

Spending Is a Reflection of Values

Our spending is a reflection of our values. It shows us what is really important to us, whether we want to believe it or not. Do you value spending money on possessions? Or, do you valuing spending your cash on experiences?

Our spending is a reflection of our values. It shows us what is really important to us, whether we want to believe it or not. Do you value spending money on possessions? Or, do you valuing spending your cash on experiences?

Do you spend your money on yourself? Or, are you spending all your money on raising a family?

“Budgeting is actually a spender’s best kept secret and friend.” – Lauren Greutman

Our money, budget, and subsequently our debt says a lot about what we value personally. It might not be a bad thing. It is just something to realize and understand.

Or, our spending can shed light on a bigger problem.

'Budgeting is actually a spender's best kept secret and friend.' @LaurenGreutman #therecoveringspenderClick To Tweet2nd Half of the Book – 12 Recovering Spender Steps

The second half of Lauren’s book provide actionable steps that you can take in order to get back control over your finances. This second of the book is set up much like the 12 Step program of Alcoholics Anonymous.

- Admit that you have a problem

- Get help from the One above

- Admit your spending to one person

- Make a list of all your debt

- Take inventory of your spending

- Set your new budget

- Create your boundaries

- Declutter your life

- Declutter your finances

- Do an expense audit

- Get out of debt

- Curb your spending and define your values

After each chapter, which contains its own step, there are easy, actionable tips that you can put to work in your life right away.

I say that Lauren Greutman is an everywoman. Her story isn’t all that different than each of us. Most of us struggle with credit card debt and student loans. Many are still burdened by home mortgages that are underwater.

The start of Lauren’s story is not much different than yours and mine probably. Her incredible story is in the comeback. And, then the book is filled with actionable steps that you can take in order to get back control of your financial life.

Bottom Line – I loved Lauren’s book. It’s a great read and a fast read. It reminded me of Dave Ramsey’s classic, “The Total Money Makeover” but with a personal tale that most people can relate to.

You should definitely check it out and pick up to a copy from your local bookstore or on Amazon.

Have you read The Recovering Spender by Lauren Greutman? What did you think? Could you see yourself in her story of debt? Can you see yourself climbing out of that debt? Where do you struggle the most with debt?