When you read about student loan debt in the news nowadays, there’s rarely good news about this phenomenon that’s more frequently referred to as a “crisis.” Just look at the latest student loan debt figures if you need proof: $1.56 trillion in outstanding student loans, 44+ million borrowers (including the parents/grandparents/relatives who co-signed the loans), 11.4% default/delinquency rate, and $101+ billion in default for more than 360 days.

If you want to have kids soon or you currently have young kids and you’re concerned about their ability to pay for college in the future, then you’re no alone. Millions of parents around the U.S. – many of whom are still paying off their own student loans – want to create the best possible financial futures for their kids and higher education seems like it’ll remain the primary pathway to a successful career and comfortable income for the foreseeable future.

However, considering just how much college tuition, textbooks, and other related expenses have outpaced the regular inflation rate since the 1980s, it can be downright terrifying to imagine how much college might cost in the next decade or two. Rather than waiting until your kids are older to begin saving for their post-secondary education expenses, it’s important to begin saving right away (alongside your retirement savings strategy, of course).

A common barrier to saving for college is the sheer complexity of 529 plans. Just opening an account can involve 1-2+ hours of consultations with a financial advisor, plus pages and pages of paperwork to fill out and sign. This frustrating process is what ultimately inspired Ksenia Yudina – a mother of 3 young kids herself – to create U-Nest, a 529 college savings platform that makes opening and funding college savings accounts for your kids a breeze.

If you like the idea of signing up for a 529 college savings plan within minutes and paying lower monthly management fees, then here are some reasons why you should consider U-Nest to begin saving for your child’s future in higher education.

Simplify College Savings

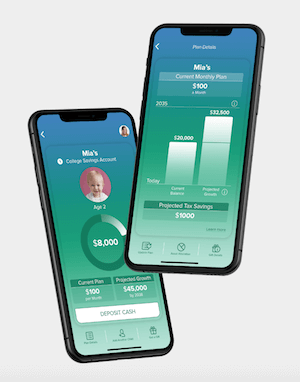

The premise behind U-Nest involves making college savings plans as quick and painless as possible for parents who simply want the best for their children. You can create an account within 5 minutes right on your smartphone or tablet and begin funding it once you sync your bank account with the app.

U-Nest also has a nifty college savings calculator, which lets you see how much you could earn with a U-Nest account compared to a regular savings account by the time your child is ready to go off to college. For example, if you currently have a 2 year-old child (in 2019) and can regularly save $300 per month for college, then you would have approximately $90,000 saved up in a U-Nest account by 2035 or just $58,000 saved up by 2035 if you relegated that money to a personal savings account with a bank or credit union instead.

Tax Advantages of College Savings Plans

The enormous advantage of 529 college savings plans is that your account’s growth is entirely tax-free. This means you won’t have to pay taxes later on when you begin withdrawing funds to pay for tuition bills. U-Nest offers the additional advantage over traditional savings plans by factoring in your child’s age and year when they’ll need money for college.

U-Nest Pricing & Minimum Investments

Whereas traditional financial advisors charge hundreds (or in some cases, thousands) of dollars to set up and manage a 529 college savings plan, U-Nest is a much more affordable option for parents. It costs just $3 per month to manage your account with U-Nest, and you can begin investing with as little as $25 per month. This is a stark contrast from traditional 529 plans, which may require a large upfront investment or larger monthly investments to avoid additional fees.

U-Nest also has plans to begin offering investment gift options for family/friends who want to contribute to your child’s college savings in the future, so be on the lookout for this useful feature coming soon to U-Nest.

Should I Sign Up for U-Nest?

There’s never a guarantee that any child will go to college and successfully complete a degree, but this uncertainty shouldn’t be an excuse to procrastinate on investing for the future while the long-term rate of returns is on your side. Even if your child decides not to go to college, you can change the beneficiary of your 529 U-Nest account to yourself, another child, or a family member and withdraw funds (which will then be subject to state and federal income taxes, as well as a 10% federal tax penalty on earnings if you use the funds for non-educational purposes).

For other scenarios – such as your child getting a scholarship – you may be surprised by how many expenses qualify under 529 college savings regulations, including tuition, fees, textbooks, class materials, and even room & board. It’s truly one of the best ways to ensure your child’s college education is financially covered, so explore your options with U-Nest while your kids are still young to take advantage of all the benefits these accounts have to offer.