Stockbroking involves the buying and selling of stocks and other securities for both institutional and retail clients. Over the years the brokerage industry has advanced since brokers not only compete by relationship, service and price, they also compete regarding commission and the quality of duty.

Stockbroking involves the buying and selling of stocks and other securities for both institutional and retail clients. Over the years the brokerage industry has advanced since brokers not only compete by relationship, service and price, they also compete regarding commission and the quality of duty.

There are many companies at the top of the brokerage industry like CMC markets, but there are many more still fighting for their fair share of the top ranks in the brokerage industry.

National Bank Direct Brokerage is a company to watch out for since it has decided to improve it services and approach and most especially ensuring investor satisfaction. NBDB decided to get serious and stop the motions. It has an online advice support called InvestCube and also provides an all-round service for DIY investors. NBDB has decided to up its game and should be watched out for.

TD Direct Investing is also among 20 up and comers in the brokerage industry since it has managed to iron out its flaws by providing account reporting tool and has also managed to modernize its website this is a strategy to attract more clients, and therefore it is upcoming in the industry.

Raymond James Financial, which was also not doing well, has decided to come up and improve diversification, therefore, reducing investment risk.

eOption is also coming up in its respect as it offers lower commissions hence making trading cost effective. It has also enhanced the front end of its platform to make it more user-friendly and client efficient.

Capital One Sharebuilder is also a company to look out for as it has improved its services through adding features that enable the client to understand their portfolio.

Wells trade is also working to be at the top as it provided personalized service to its customers, with online and mobile support. Also, there is no minimum balance to establish an account hence its attractive to clients. Therefore, this will help in making it climb the ladder.

LPL Financial was not doing so well as of 2015 final quarter. Hence it has drawn it energy towards improving operation and capital plans; through introducing multi-client portfolios designed to improve efficiency and save time.

BMO Investorline is another superior firm that has not been leading since 2005 but is working towards adding commission-free trading of exchange trade funds as its strategy to be at the top.

FirstTrade is also back eyeing for the top ranks as it has improved its services by introducing a mobile application provide better services to clients and a more interactive site like translation to Chinese.

Sky’s the limit when it comes to summer vacation ideas. If you’re looking for an affordable yet exotic trip for the upcoming warmer months, then you can’t go wrong with a cruise! Not sure if/how you’ll be able to afford it? These cheap cruise tips lay out everything you need to know to minimize your vacation expenses while maximizing fun while sailing the seven seas!

Sky’s the limit when it comes to summer vacation ideas. If you’re looking for an affordable yet exotic trip for the upcoming warmer months, then you can’t go wrong with a cruise! Not sure if/how you’ll be able to afford it? These cheap cruise tips lay out everything you need to know to minimize your vacation expenses while maximizing fun while sailing the seven seas!

What is Digit? I’ve been obsessed with

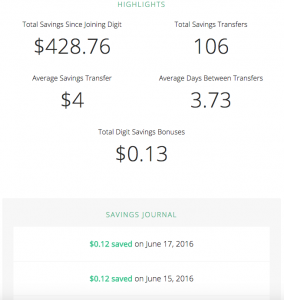

What is Digit? I’ve been obsessed with  Here’s what their smartphone all and my account looks like with Digit. It is super simple, even with their design. They make it simple to save, and the app keeps it simple too.

Here’s what their smartphone all and my account looks like with Digit. It is super simple, even with their design. They make it simple to save, and the app keeps it simple too.