Are you losing in the financial game of life? If you answered yes, you’re not alone. In 2008, 1 in 10 workers were made redundant. As a result, thousands of people were forced to open new lines of credit just to pay for basic necessities, and are now struggling to repay those debts.

Financial games can be tricky when it comes down to financial decisions. Some financial mistakes can haunt us for years if we don’t act fast enough! Whether your financial game is on point or needs improvement, here are 8 things that could be holding you back financially:

- You’re paying too much interest on loans

- You’re overspending in areas where you need less money

- You’re not saving any money

- Your retirement plan is below average

- You can’t afford to pay for your financial emergencies

- Your financial game is too focused on financial security instead of financial freedom

- You’re avoiding investing outside your comfort zone because you’re afraid of losing money

- You don’t have a financial game plan!

Who has time to check their financial game every month just to see whether financial progress has been made?

What is the financial game of life?

The financial game of life is your responsibility to make financial choices that lead you in a direction toward financial freedom. Your financial game plan, financial strategies, and financial goals are all part of this process. However, when money doesn’t come in when it should, and financial problems keep piling up, it can be difficult to keep your financial game on point.

Financial emergencies and failures are inevitable, but having financial loss and financial self-sabotage isn’t. If you’re currently struggling with financial issues or if you believe that you may not be playing the financial game of life as well as you should, there are a few financial triggers you can implement to help turn financial failures into financial wins.

Do you have a financial game plan?

A financial game plan is your key to financial success. Having a financial strategy in place will give you the upper hand in increasing your income while decreasing expenses, financial growth, financial stability, financial security, financial independence, and financial freedom.

What are financial goals?

Your financial goals should be realistic to create a plan that can actually benefit your overall financial game. If you’re currently at the bottom of the financial ladder with very little income coming in but high expenses going out, financial goals are the financial tools you need to get back to where you want to be.

How can financial success affect your life?

Financial success impacts every aspect of your life. If you’re constantly struggling with financial obstacles, financial challenges, financial emergencies, financial failures, and financial stress, you’ll never have enough time to focus on financial growth and financial happiness.

How can financial security affect your life?

Financial security is the financial step between financial stability and financial independence. If you’re currently satisfied with your financial situation, congratulations! But if you want to climb up to financial success faster, financial security will help you get there faster.

What are financial strategies?

Financial strategies are financial options that you may or may not have the financial resources for, but they can increase your financial game when used strategically. When financial emergencies happen, financial strategies are the financial tools you need to make it through today while working on consistent financial growth tomorrow.

What is financial stability?

Being financially stable is being in financial harmony. This financial status directly impacts financial security, financial independence, financial growth, financial self-sabotage, financial stress, financial loss, financial failure, and financial emergencies.

If you’re currently experiencing any of the aforementioned financial issues or if you think your current financial situation is about to spiral out of control, consider making a few financial changes to improve your financial harmony.

What is financial self-sabotage?

Financial self-sabotage is the financial answer for financial loss, financial failure, financial stress, and financial emergencies. This financial issue happens when you’re not confident in yourself, or you don’t trust yourself with your financial decisions. Financial self-sabotage is the financial answer for financial game players who don’t think they can ever reach financial success.

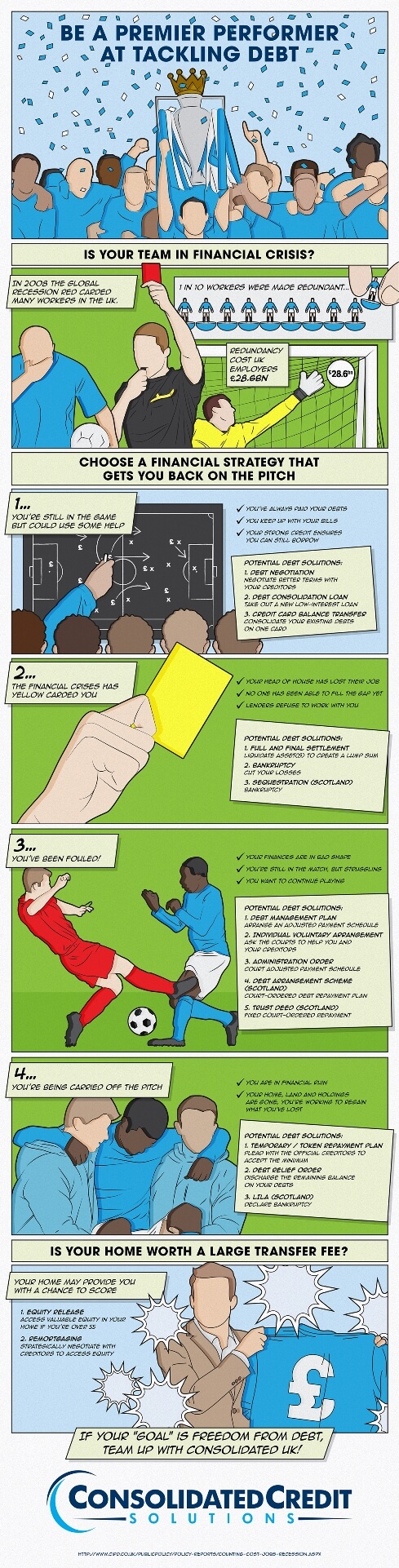

Whether you’re in a position where you’re still able to pay your bills or have been exiled by the lending community altogether, the experts at Consolidated Credit can help. For your convenience, they’ve compiled a comprehensive infographic to help you identify which league you fall into and then take the appropriate action.

They offer a variety of debt management services including debt negotiation, debt consolidation, and even bankruptcy as a last resort. Don’t put off the struggle any longer. Make a conscious effort to say goodbye to financial ruin for good with the guidance of trained professionals.

Kind of a fun infographic. Luckily, we have no debt and are saving 50% of our income. So I suppose we are ahead in the financial game of life.