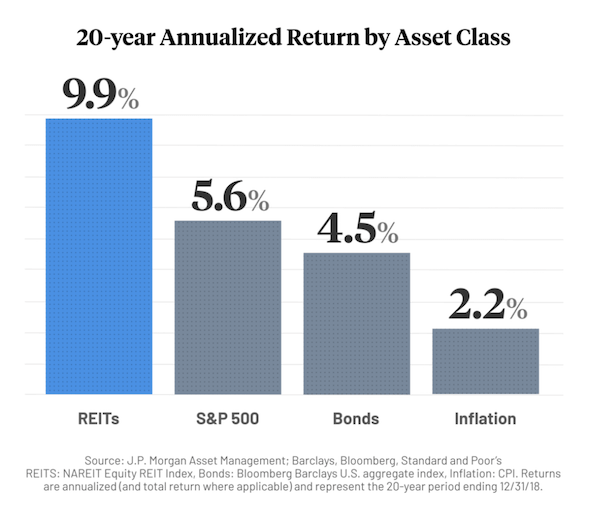

Most investors know the value of diversifying their portfolios, but few investors have access to the same assortment of options that mega-wealthy investors pour money into, such as multi-million dollar real estate projects and structures. For instance, Real Estate Investment Trusts (REIT) are popular options for investors who have a high net worth because the long-term capital appreciation on the properties frequently outpaces other types of investments (and is generally less volatile than investing purely in stocks).

Until recently, however, REITs were very exclusive entities; everyday investors seeking higher returns through cash-flowing apartment buildings and commercial properties were mostly out of luck if they didn’t have the capital necessary to invest in these real estate projects on their own.

Fortunately, innovative fintech companies like DiversyFund have made it substantially easier for folks without a 7+ figure net worth to access valuable real estate investment opportunities.

DiversyFund Review

If you’ve been wanting to invest in multi-family housing without the tremendous upfront cost typically associated with these types of investments, then DiversyFund could be a good fit for your portfolio and investment goals.

Invest Like the 1%

The premise behind DiversyFund is grounded in giving everyday investors access to investments previously reserved for the top 1% wealthiest Americans. Nothing explicitly prohibited less wealthy folks from investing in apartment buildings; instead, it was the multi-million dollar down payments and sky-high investment management fees preventing most people from adding multi-family real estate to their personal investment portfolios.

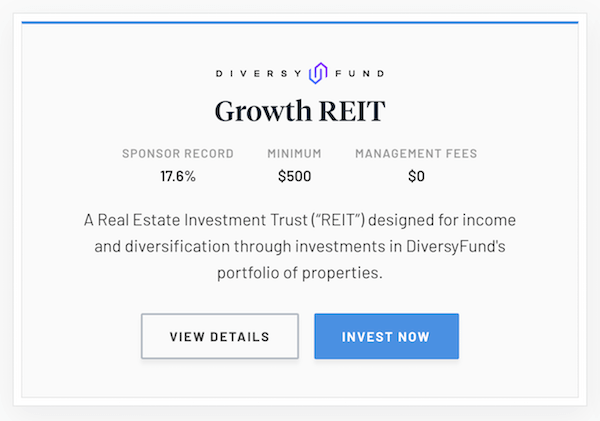

Now, thanks to DiversyFund, you don’t need to be an accredited investor to get involved and you can invest in a REIT for as little as $500 upfront. Rather than buying, renovating and renting or selling your own apartment building – which could cost several millions of dollars, even for a smaller building – you and hundreds of other DiversyFund investors pool your funds together to own shares of a DiversyFund-managed portfolio of real estate properties and mortgages.

Why Invest in the DiversyFund Growth REIT?

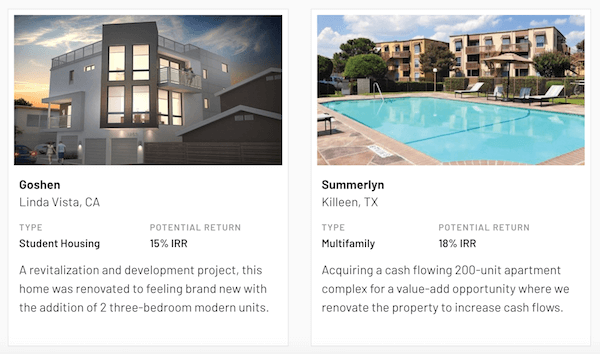

If you’re an accredited investor with at least $25,000 upfront to invest, you could access DiversyFund’s Series A Round and become a co-owner of DiversyFund itself. If you’re not an accredited investor, then you’d be a good candidate for the SEC-qualified DiversyFund Growth REIT, which has 17.6% average annualized returns and costs just $500 to get started.

The property type focus of this REIT is multi-family, cash-flowing apartment buildings throughout the U.S. and the investment strategy centers on value-add and market appreciation with the goal of liquidating the property within 5 years or so.

In other words, investing in the DiversyFund Growth REIT is an opportunity to invest in multi-million dollar apartment buildings/communities without having to pay astronomically high down payments and/or broker fees for managing these costly yet rewarding properties.

What Does DiversyFund Cost?

DiversyFund doesn’t charge any account management fees, brokerage fees or any fees for investors. So how does the company make money? Through developer fees and profits from the sale of real estate assets in their portfolio.

DiversyFund cuts out the middleman entirely to give investors unprecedented access to rewarding investment opportunities while also making a steady profit as developers instead of serving as brokers.

How Do I Sign Up for DiversyFund?

It’s easy to get started with DiversyFund – here’s a step-by-step guide to walk you through the process:

- Create an account

- Invest in the Growth REIT ($500 minimum)

- Speak with customer service representatives if you have any questions or concerns while submitting your initial investment online

- Monitor your investments’ performances on the DiversyFund Dashboard (view annual earnings, projected rates of return, etc.)

Is DiversyFund Worth It?

DiversyFund is one of the few truly fee-free fintech platforms available for investors today. While most fintech apps and websites have substantially lower fees than traditional human brokers and advisors, they still can’t compete with DiversyFund’s zero-fee structure for unaccredited investors.

This company is best for investors who’ve been on the lookout for new investment options –beyond stocks and bonds – to further diversify their own portfolios. This is also an ideal option for folks who want to get more involved in real estate investing without the common pitfalls of traditional property management (e.g., paying for an entire residence yourself, securing tenants, managing renovations and repairs, etc.).

If you’ve been waiting for a transparent, low/no fee, and lucrative investment platform to increase the diversity and decrease the volatility of investments in your own portfolio, then DiversyFund is a great option for getting higher rates of returns without having to rely primarily on stocks to meet your goals.