Lots of people have heard stories of people making serious money investing in the stock market. Yet they believe stories like that only happen to people who are already rich or financially smart. They think the stock market is too complex for them to understand, so they don’t tend to view it as an option for building wealth.

Lots of people have heard stories of people making serious money investing in the stock market. Yet they believe stories like that only happen to people who are already rich or financially smart. They think the stock market is too complex for them to understand, so they don’t tend to view it as an option for building wealth.

In reality, anyone at all can invest in the stock market. You don’t need to be rich to start. It’s possible to begin with small amounts of capital. You also don’t need to be a stock market expert to get started.

All you need is the desire to invest for your financial future and the willingness to learn some basic investing principles.

An Average Joe’s Guide to Investing in the Stock Market

Here is a quick guide to successfully investing in the stock market for the average investor.

Educate Yourself

Once you start learning the basics of how the stock market works, you’ll soon find it’s not as daunting as it first appeared. The more you learn about buying and selling stocks through your share trading platform, the more comfortable you’ll become with the process.

However, it all begins with education. There are plenty of tutorials and educational tools available. There are also lots of sites that allow you to learn about new price information or apps that let you monitor market movements in real-time.

Most Americans have a car or want a car. The question is, “How will you be paying?”. Paying off a car loan should not be a difficult task. It starts with the type of car loan you choose when buying a car.

Most Americans have a car or want a car. The question is, “How will you be paying?”. Paying off a car loan should not be a difficult task. It starts with the type of car loan you choose when buying a car.

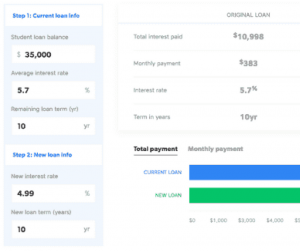

How far would you go to pay off your student loans? While 40% of borrowers from a recent survey would reportedly be willing to take a year off of their life expectancy in exchange for debt-free living, such drastic measures aren’t necessary thanks to helpful websites such as Student Loan Hero.

How far would you go to pay off your student loans? While 40% of borrowers from a recent survey would reportedly be willing to take a year off of their life expectancy in exchange for debt-free living, such drastic measures aren’t necessary thanks to helpful websites such as Student Loan Hero.