Don’t get me wrong. I’m not mad, and I know that I shouldn’t be comparing myself to others. We’re all in separate places with different goals and situations in life. But, I can’t help but continue to dwell on J Money’s net worth updates when he posts them every month.

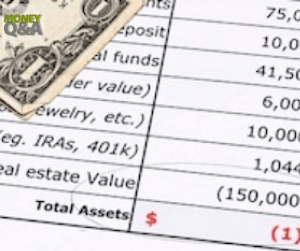

But, this time, I think I’m onto something. I think that he’s forgetting something, and subsequently so am I. We all might be forgetting something in our calculations. We all might be richer than we realize! Are you making this key mistake when you calculate your net worth? I bet you are, and you’re not alone.

Maybe there is more to these net worth numbers and the simple calculations of our assets and liabilities. I think J Money is unrepresenting his net worth and leaving money on the table. I think we all are. Our net worth numbers can be even larger, and maybe some of us are closer to J Money than we think.

You’re Leaving Out a Few Assets

But, we are leaving out key assets to our calculations. It struck me when I had an argument with my friend Blake a few months ago whether or not your cars deserve to be included in your net worth as an asset. It does! I agree with J in that respect. My friend was leaving out his cars as an asset, but he was surely including his car loans in the list of liabilities. This greatly underestimated his net worth.

So, that got me thinking about other assets that we typically do not include in our net worth calculations. I think that we are a little better off in our wealth than we all think.