When did you last have a pay rise? For a fair few people, the answer to that question might be hard to answer. Wages have been incredibly slow to recover from the financial crisis of 2007-08. Indeed, the last decade has been characterized by fairly stagnant salaries, with ‘real wages’ – accounting for inflation – falling by 10.4 per cent between 2007 and 2015.

That’s all left us with some pretty tough choices to make. With pressure on packets, many of us has had to pinpoint items of spending to trim down so that the essentials could be purchased.

Yet, there might be light at the end of the tunnel. The Bank of England predicts that wages should rise by about 3.5% in 2017. That should mean good news for your bank balance – or at least give you the chance to broach an awkward subject with your boss.

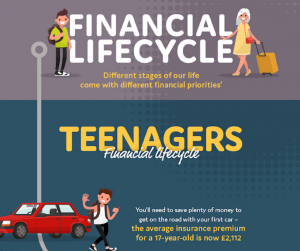

Getting the pay you deserve is important. By maximizing your earnings, you can be in a better place to be able to afford everything life throws at you. As this infographic shows, there are plenty of challenges that crop up throughout our ‘financial lifecycle’ and preparing for what’s to come is key to managing your money…