Whether you’re 10 years away from retirement or retiring this year, money management and saving doesn’t stop when your regular job income does. In fact, financial management in retirement can be a stressful experience if you don’t plan carefully beforehand and continue your saving habits during your golden years.

To avoid the panic-inducing question of whether your current nest egg will last as long as you do, there are several retirement mistakes to avoid. Mistakes such as increasing your spending, ignoring potential income opportunities, and borrowing money from your retirement account for nonessential purposes.

Luckily, there are many ways to financially secure yourself and your spouse during your retirement years, and these strategies don’t necessarily involve taking on a part-time job to supplement your income. Instead, you might opt for a passive income, which requires minimal effort for considerably good financial rewards.

The Best Ideas for Passive Income After Retirement

Monetizing Your Hobbies

Your hobbies may seem like active endeavors, but since you were planning on doing these activities regardless of their monetary potential, they’re definitely forms of passive income. Monetizing a hobby can be as simple as distributing flyers throughout your neighborhood to advertise your services. Whether that be gardening, lawn mowing, tutoring, childcare, pet-sitting, auto repairs, or tailoring. Or, you could advertise on social media with a free account on Facebook or Twitter.

If you love creating handmade items, you could sell them online through sites like Etsy or local trade fairs. Sky’s the limit when it comes to monetizing your hobbies so don’t overlook this potentially great opportunity to supplement your retirement income doing something you were planning on doing for free anyway.

Investing in Peer-to-Peer Loans

When you’re retired, you’re probably not interested in long-term investment strategies anymore. Instead, you should try to generate a passive income stream through short-term investment options, such as peer-to-peer lending platforms.

Peer-to-peer lending is highly customizable and typically leads to higher yields compared to other investment options like bonds and CDs. Retirees with a high personal net worth are particularly well-suited for peer-to-peer lending due to investor accreditation regulations, and the income potential for these types of investments is favorable by most standards.

For instance, Lending Club is a great passive income source because you can choose which type of borrowers you want to lend money to and automate investing through monthly deductions from your bank account. Through Lending Club, you’re essentially lending other consumers money for their personal, mortgage or student loans and receiving returns on your investments in the form of interest paid on those loans.

Peer-to-peer lending is an awesome opportunity to get great returns on your investments in a relatively short time frame. You can try out different platforms like PeerStreet or RealtyShares to see which one works best for your investment plans. Although there is always some risk involved in investing, you can minimize your portfolio’s risk by choosing to lend to borrowers with good credit scores and stable financial histories.

Hosting with Airbnb

If you’ve considered downsizing your living situation to reduce your monthly expenses and dedicate more time to hobbies, then renting out your home might be a great idea for generating a passive income. Thanks to Airbnb’s massive, easy-to-use platform, you can temporarily rent out your home to individuals and families from all over the world.

Many retirees have turned to Airbnb to supplement their retirement income. The website is so easy to navigate and you get significant control over how much you charge. You can decide if you want to charge a cleaning fee, and check-in/check-out times for guests, among other policies.

If you don’t want to be on the premises when guests are present, you can even install key locks or number pad door entry systems to allow guests to access the property when you’re not there. That means you don’t have to revolve your schedule around guest arrivals and departures all the time.

Ultimately, Airbnb is an incredibly flexible passive income option that can free up much more money in your budget for things like traveling or investments. It also comes with the added benefit of being able to meet fascinating people from all walks of life.

Investing in Real Estate with Roofstock

But, you don’t have to buy homes and rental properties to make a great ROI, there are several different crowdsourced real estate investment options that have a small minimum initial investment such as Roofstock, PeerStreet, and Fundrise. For just a few hundred dollars in many cases, you can now invest in real estate.

Roofstock is the #1 marketplace for buying and selling single-family rental homes. Roofstock has listings in over 40 markets across the US. 1 in 10 homes in the U.S. is single-family rentals (SFR), which equates to over 15 million households.

Single-family rentals are a stable asset class with considerably less volatility than stocks. Single-family rentals prices have remained almost perfectly uncorrelated with stock prices since 1971, with a correlation coefficient of only 0.07.

Their online marketplace empowers everyday investors to own cash-flowing income properties and build wealth through real estate. Roofstock makes it easy to invest remotely. Over 60% of their customers are buying a rental property located more than 1,000 miles away. With their market analysis, Roofstock provides research and data analysis to help you determine which locations meet your investing objectives.

Roofstock’s marketplace offers rental homes for sale in 40 markets and 21 states nationwide, and they are continuing to expand. Roofstock surpassed $1 billion of collective transaction volume within two years of its marketplace launch, making it one of the fastest-growing FinTech startups of all time.

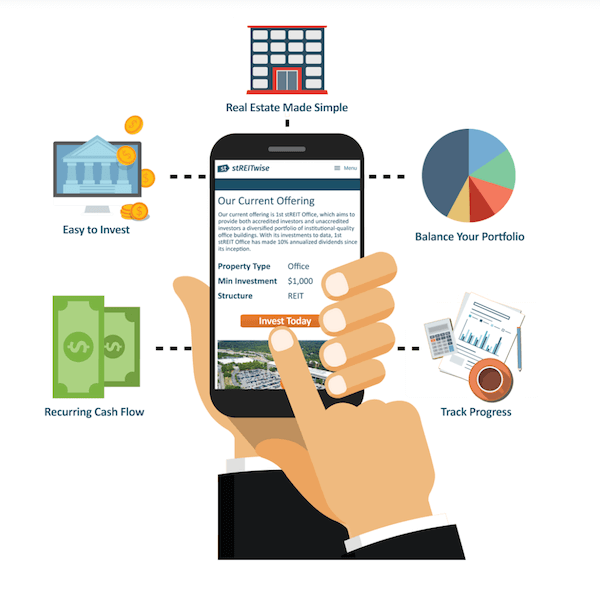

Passive Income with Streitwise

Streitwise presents an excellent opportunity for investors to create passive income streams with commercial real estate investments. Dividends are disbursed to shareholders on a quarterly basis (typically averaging 10%), which means you could have a check arriving in the mail or money depositing into your bank account every 3 months while the value of the properties you invest in continues to grow.

Streitwise also offers a dividend reinvestment program to significantly accumulate more wealth for investors who opt-in. DRIPs are beneficial for investors who prefer to maximize their long-term returns instead of using dividends as a source of passive income, so it’s up to you to decide what you want to do with your Streitwise dividends.

If you’re like most people who worry about whether they have enough money in their retirement nest eggs, passive income opportunities are ideal for preserving your savings and even making more money to fund your adventures.

Even if you currently have little to no retirement savings and you’re 60+ years old, these three passive income options are perfect for covering your expenses without having to keep working for 5-10 more years.