In an ideal world, humans would be great at keeping track of their own expenses and savings or we would have robots and algorithms smart enough to autonomously manage all of our financial matters for us. Since neither of these ideal scenarios exists, it’s up to us to figure out the best solutions for managing our finances, tracking our expenses, calculating our budgets and figuring out how to avoid/overcome common personal finance problems like accumulating debt or saving money inefficiently.

There are plenty of budgeting apps, robo-advisor platforms and other great fintech apps available for everyday consumers today, but few offer the same social experience as Wismo, the budgeting and expense tracking app, made for people seeking self-improvement and social learning opportunities.

If you want greater privacy, real-world personal finance lessons, and simplified financial management tools, then Wismo could be a great addition to your iOS or Android device. Here’s why:

What is Wismo?

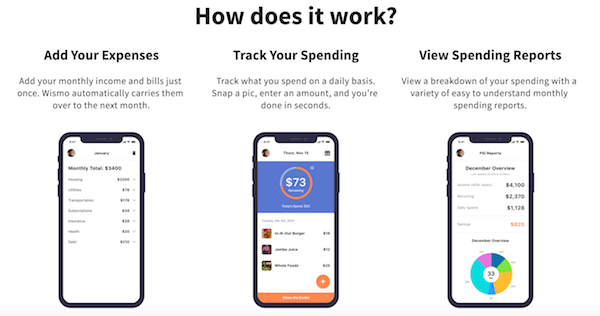

Wismo (which reportedly stands for “what I spent money on”) prides itself on being one of the easiest apps to use in the world of personal finance. Whereas many fintech apps require your personal information (including Social Security number) and bank or credit card info to get started, Wismo simply asks you 3 questions and lets you pick a username in lieu of your real name.

You can also opt to link your bank account(s) to the app if you want; your privacy is protected with Wismo’s bank-level security mechanisms and 256-bit encryption. Wismo also promises to never sell or share its users’ information to third parties or social media platforms.

The free version of the app contains ads; the ad-free paid version costs $2.99 per month or $29.99 annually and comes with a “privacy mode” option (so nobody can see what you spent money on except you).

Track Your Savings Daily, Weekly or Monthly

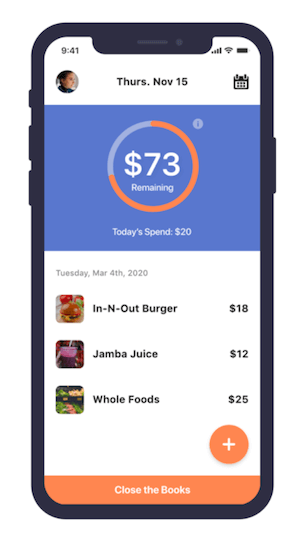

The main purpose of Wismo is to encourage users to track their spending habits and compare their expenses with their income. Wismo describes the PSI (Personal Spending Index) as expenses divided by income, multiplied by 100. If you stay under 100 each day, then you’re in good financial shape (in other words, you’re living below your means).

For example, if you spend $3,500 per month while earning $4,000 your PSI would be 87.5, which indicates you have money left over to put towards savings or investments. Of course, you wouldn’t be able to accurately assess your monthly expenses if you weren’t actively tracking your day-to-day spending habits, which is why Wismo is perfect for staying on top of your expenses without the hassle of saving receipts (just snap a photo, enter the amount and Wismo will handle the rest).

Learn from Others

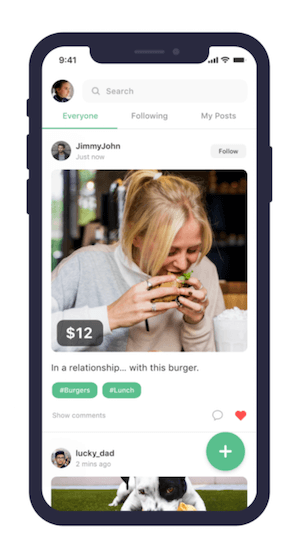

Wismo is unique because it offers a social component – without the usual downsides of social media (e.g., oversharing, constant data breaches, inescapable ads, etc.). With Wismo, you can view other users’ spending habits and their PSIs to see how you stack up against people in similar positions.

You can find people in a similar income bracket and compare how much you’re saving compared to them; you can also find people by age or occupation and use this demographic information for financial comparison purposes. Since everyone is free to use an anonymous username, there are few privacy risks involved and you can get a fairly accurate glimpse at how people in similar jobs, at similar ages and/or similar income levels compare to you.

Granted, there may be other factors influencing the PSI (e.g., number of dependents, cost-of-living, homeownership/renting status, etc.), but Wismo is nevertheless a useful way to gauge your spending and saving patterns relative to your peers.

Should I Try Wismo?

Wismo is all about making financial management safe and simplified for users. You don’t need to pay anything to access the app’s main features – though getting rid of ads undoubtedly creates a better user experience – and the app helps keep you accountable for your daily, weekly and monthly expenses in ways that regular spreadsheets or complicated budgeting apps may not.

If you want to start paying closer attention to your spending and saving habits, track your progress relative to people in similar life circumstances and become better and budgeting as a result of closely monitoring your inflow and outflow of money, then Wismo is a great, low effort option to incorporate into your personal financial management routine.