Wouldn’t it be great if you could score high returns on your investments while supporting companies that share your values? For investors who would prefer adding environmentally friendly and/or socially responsible companies’ stocks to their portfolios, this might seem like a distant dream since socially responsible investing typically isn’t correlated with great returns. Worthy Bonds might be a great option for you!

However, there may be a silver lining on the horizon with Worthy Bonds, which sells SEC registered bonds designed to support small businesses in the U.S. Worthy Peer Capital helps small businesses grow their operations by lending proceeds of Worthy Bonds to business owners who, in turn, provide collateral (e.g., inventory) to secure the funds.

If you invest in Worthy Bonds, then you can count on reliable returns without sacrificing your personal values to build your portfolio. It’s an innovative way to support Main Street companies while getting more value from your investments. Let’s break it down to see if Worthy Bonds are worthy enough for your portfolio.

Asset-Backed Small Business Loans

The process underlying Worthy Bonds is simple: bond investors (like you) buy bonds ($10 minimum investment) and proceeds from those bond sales are lent to entrepreneurs in the form of business loans. These loans are backed by tangible assets (e.g., inventory) to secure the financing, and the small business owners repay these loans with interest. That interest grows in your Worthy account, and when you’re ready to withdraw, you get back what you originally invested plus interest.

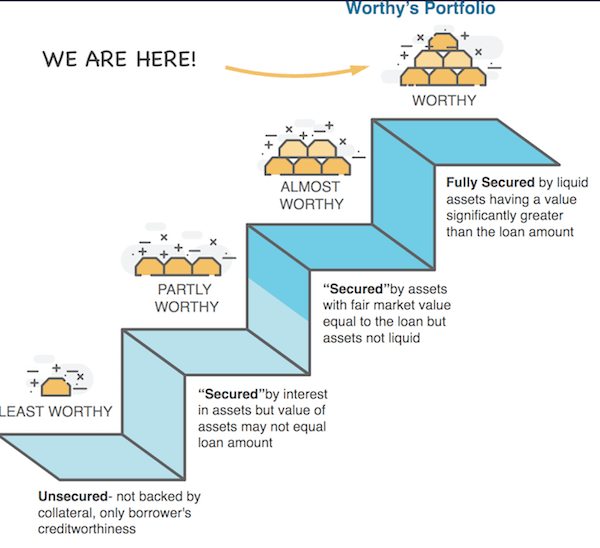

Worthy Bonds is highly secure for risk-averse investors because they only lend money to businesses with liquid assets that are worth substantially more than the loan they’re taking out. Other riskier options for peer lending include: loans secured by assets with a fair market value relatively equal to the loan value but the assets are not liquid, loans secured by assets worth less than the loan amount, and unsecured loans that are not backed by liquid collateral but rather the borrowers’ creditworthiness.

If these options sound like bad bets for your portfolio, then these bonds may be the way to go for financial stability and consistent returns.

5% Returns on Investment

With Worthy Bonds, bond buyers are guaranteed a 5% annual rate of returns for their investments. This rate is fixed, so you won’t have to worry about the volatility of the markets with these investments, and you only need $10 to get started, which makes Worthy Bonds a worthy contender for secure, low-barrier investment options.

Furthermore, Worthy Bonds come with a 36-month term, though you can cash out at any time, penalty-free. Interest is credited to your account on a weekly basis and there are no fees or penalties imposed on bond buyers at any time. Anyone over the age of 18 in the U.S. can buy Worthy Bonds, which makes this truly one of the most accessible investment options for new and experienced investors alike.

Earn a 5% rate of return on your investment. Click here to sign up for Worthy Bonds!

Help Small Businesses with Your Investments

From a personal perspective, Worthy Bonds are ideal because they offer consistent returns with a decent rate. From a society perspective, Worthy Bonds are great because they allow bond investors to team up with their entrepreneurial peers to expand small business operations while growing the investor’s portfolio value.

No investment strategy should contain 100% stocks or other aggressive investment options, so adding Worthy Bonds to your portfolio can help mitigate financial risks you might otherwise run into by investing solely in big corporations’ stocks. You’ll also be doing American society a favor by supporting local, small business owners with your investments, which can be difficult in this era of mass commercialization, Starbucks on every corner, and consumers’ preferences for cheap conveniences over local business development and community support.

Should You Invest in Worthy Bonds?

Lending to small business owners used to be reserved for big banks and/or wealthy, accredited investors. Thanks to Worthy Bonds, small-time investors who want to support local companies can now play a bigger role by investing in bonds that fund business loans and support small enterprise growth across the U.S.

Worthy Bonds is also ideal for tech-savvy investors who want to keep close tabs on their weekly interest accruals with the help of the Worthy app (iOS or Android). Worthy Peer Capital also helps non-profits through its Worthy Causes program, which asks investors to donate “spare change” by using a round-up tool for purchases made with the card synced with their Worthy accounts.

All in all, Worthy Bonds represent a relatively safe and socially responsible investment option for investors who want to diversify their portfolios, support their communities, and accrue consistent returns on their investments to worthy causes like small business loans.

Earn a 5% rate of return on your investment. Click here to sign up for Worthy Bonds!