Since the early 2000s, the percentage of working Americans enrolled in a high deductible health plan (HDHP) without a health savings account (HSA) increased from 10.6% to 24.5% in 2017. Meanwhile, the percentage of people in the same demographic enrolled in an HDHP with health savings accounts increased from 4.2% to 18.9%.

Are you one of the millions of Americans who have a high deductible health plan without a tax-advantaged HSA to mitigate the costs of medical care? If so, opening a free, FDIC-insured health savings account with a provider like Lively could be an enormously beneficial financial decision when it comes to protecting yourself and your family against the potentially high costs of medical treatments.

You may not think you need an HSA, but the cost savings and tax benefits of HSAs are too good to pass up. Let’s explore what HSAs are and how opening one can help you save a lot of money on health-related expenses throughout your lifetime.

What is a Health Savings Account?

In a nutshell, a health savings account combines tax-favored savings plans with high-deductible health insurance plans. The money you deposit into an HSA can be used to pay for a wide variety of medical expenses, including your deductible (which must be met before insurance kicks in and covers the rest).

HSAs are incredibly beneficial for people covered by high-deductible health plans because they allow you to grow an interest-accruing, tax-deferred emergency fund to fill in the gaps between what you’re responsible for (annual deductible amount) and what the insurance company will pay for after the deductible is met.

Some people balk at HDHPs – defined by the IRS in 2019 as “any plan with a deductible of at least $1,350 for an individual or $2,700 for a family” – because they don’t think they could afford to cover a $1,000+ medical bill without the help of insurance. However, HDHPs are known for having more affordable monthly payments substantially, and the ability to use an HSA to supplement your medical savings offers a considerable advantage that nobody with a high-deductible plan should ignore.

What Can You Use an HSA For?

You may withdraw funds tax-free from your health savings account if the money will be used for “qualified medical expenses.” The IRS defines these as costs associated with preventing or treating physical/mental illness or injuries (including dental and vision-related health concerns). You can use funds from an HSA to cover a family member’s medical expenses (spouse, domestic partner, dependents only), as long as they wouldn’t get reimbursed for those expenses otherwise.

HSAs do not cover Non-essential expenses such as cosmetic surgery, gym memberships, and toiletries (if you use your funds for these, you’ll be subject to taxes and possibly fees on the withdrawn amount).

Tax Benefits of HSAs

Many financial professionals highlight the similarities between health savings accounts and retirement savings plans. For example, cash contributions to your HSA are 100% federal income tax-deductible, and the interest on your savings grows tax-deferred. A third tax advantage HSAs offer consumers are to cover their “qualified medical expenses” without paying federal income taxes on the amount.

Why Lively HSA?

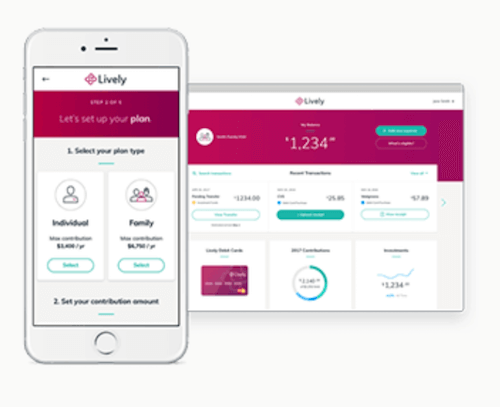

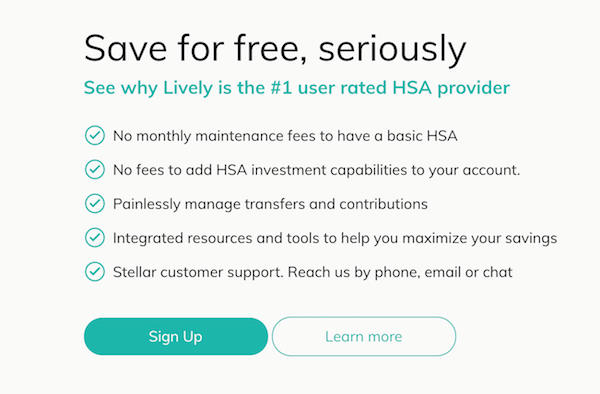

Lively offers some of the best health savings account options for consumers with high deductible health plans. Lively HSAs are free (no hidden fees or account maintenance fees), and FDIC-insured through an accredited bank and the whole process of signing up and funding your HSA is one of the easiest financial moves you could make (it only takes five minutes or so to establish your account). Lively HSAs are 100% FREE for individuals and families. Sign up today and start saving for your health.

Lively is also known for its user-friendly dashboards, where you can view every detail of your HSA, medical expense withdrawal history and receipts, ongoing contributions and accumulated interest, and many other features. You’ll get a Lively debit card to directly withdraw funds from your HSA when paying for a medical expense. If you pay for a medical bill without the Lively card, you’ll be able to get reimbursed after submitting payment verification swiftly.

There are plenty of HSA companies out there, but few make the process of signing up and getting reimbursed as easy as Lively makes it (and don’t forget: Lively is entirely free!). Lively health savings accounts are FREE for individuals & families. Sign up today and save for tomorrow.

Do You Need a Health Savings Account?

If you currently have a high deductible health plan without an HSA, now is the best time to open one and start saving big time on your medical bills in the future. It can be difficult finding the motivation to save for medical expenses when you’re at least covered by some health insurance plan and simultaneously trying to balance many other savings goals like a down payment on a home or retirement.

However, regularly contributing to a tax-advantaged HSA can save you thousands of dollars in the future if you’re hit with an unexpected and/or large hospital bill, so protect your long-term financial stability by investing in your health with a Lively HSA today.