The following is a guest post by MargaretAnn “Muffy” Morris, a courageous woman who is chronicling her adventures on her blog, Muffy On The Move. If you’d like to submit a guest post on Money Q&A, please check out the site’s guest posting guidelines.

Note from Hank – I’ve known Muffy for years. We went to college together. And, I have to admit, I was skeptical like many of our friends when she said she wanted to live in a tiny house.

But, we could see how serious she was when she sold all of her possessions, sold her house, and bought an RV in order to get ready to build the tiny house of her dreams. While tiny house living isn’t for everyone, you have to admire someone for going for it and following their dreams.

Be sure to follow along and learn more about her adventures on her blog, on Instagram, and Facebook.

How To Live In A Tiny House

I didn’t want debt to control my life. In fact, I decided I didn’t want debt at all. There are a billion advice columns on how to save: get a part time job or skip Starbucks. What I really heard them say was “be miserable, exhausted, and have no free time” or “deny yourself the little things you enjoy.”

I didn’t want debt to control my life. In fact, I decided I didn’t want debt at all. There are a billion advice columns on how to save: get a part time job or skip Starbucks. What I really heard them say was “be miserable, exhausted, and have no free time” or “deny yourself the little things you enjoy.”

The thought rattled around for awhile until I just couldn’t shake it. My possessions began to suffocate me. Time to redefine my own success. I was downsizing my life. Send over HGTV, I was going tiny!

While I’m not a hipster or “crunchy,” my gypsy soul is pretty recognizable. Always been one to dive right in instead of ease into cold water. For me, once the idea struck, it was time to put it into action. I had a complete life turnaround in under 3 weeks.

After deciding mortgages weren’t for me, there was no way I was going to lay down $60k for a tiny house. These hands of mine are going to build that sucker themselves. I set a goal of 3 months to learn how to build and how to live in a tiny home and $3,000 to get it done.

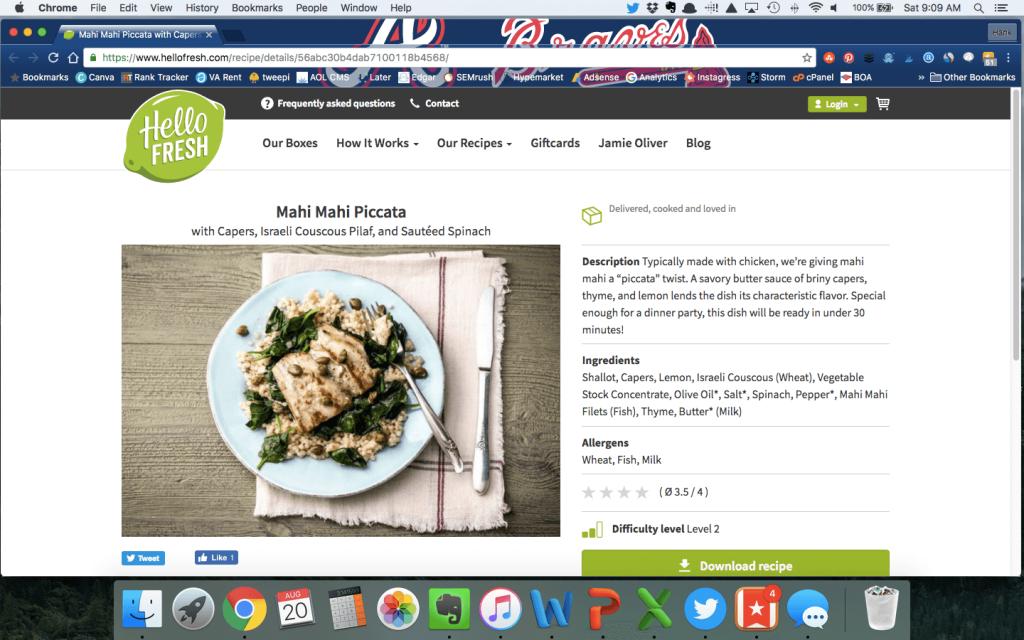

Hello Fresh typically costs around $79 per month for three prepackaged meals that you make in your own kitchen. There is a discount available to try your first order for $40 off that brings the cost down to $39 you first month.

Hello Fresh typically costs around $79 per month for three prepackaged meals that you make in your own kitchen. There is a discount available to try your first order for $40 off that brings the cost down to $39 you first month.