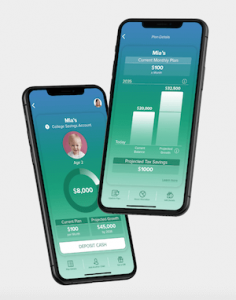

U-Nest Review – Easy College Savings App

When you read about student loan debt in the news nowadays, there’s rarely good news about this phenomenon that’s more frequently referred to as a “crisis.” Just look at the latest student loan debt figures if you need proof: $1.56 trillion in outstanding student loans, 44+ million borrowers (including the parents/grandparents/relatives who co-signed the loans), 11.4% default/delinquency rate, and $101+ billion in default for more than 360 days. If you want to have kids soon or you currently have young kids and you’re concerned about their ability to pay for college in the future, then you’re no alone. Millions of parents around the U.S. – many of whom are still paying off their own student loans – want to create … Read more