Everyone, at one point or another, has fantasized about what they would do with a million dollars. Perhaps you’d buy a ski boat and spend the summers out on the water. Maybe you’d build the best and biggest entertainment center to watch your favorite action movies and the big games. What about being a real estate mogul?

Or, you might have your eyes set on something greater. That’s what former professional basketball player Luol Deng was thinking. After earning over $150 million on the court, Deng has turned to real estate where he owns over $125 million worth of properties. Becoming a property owner is also one of the “quickest” ways to become a self-made millionaire.

So, why don’t more and more people become property owners? For starters, it’s not easy. Not all of us can be blessed with basketball abilities like Luol Deng or build up enough equity to own multiple places.

Secondly, it’s not for everyone. Being a property owner, property manager or landlord is hard, especially when all three are wrapped together.

How to Become a Real Estate Mogul

There are many things to consider when determining if you’re ready, but we’ve highlighted a couple of the main ones below.

Consider the Location

Even real estate novices can rattle off the most important rule of real estate without thinking too much: location, location, location. Location is key for purchasing property and turning it into profit.

If you’re lucky enough to be situated around a big housing market, there could be plenty of potential leads and possibilities for you to start your journey. Even though you may not have the cash flow right now, you could see yourself starting off well in the area.

The Money Issue

Speaking of cash flow, money is (obviously) a key factor in determining whether or not you’re on your path. It is often the biggest hurdle to overcome in the early stages.

More than likely, you’re going to be needing financing for your purchase. While home mortgages are often satisfied with as little as 3% down, you’ll be needing to put at least 20% down to qualify.

In addition to the initial payment, lenders will also be checking out your income, savings, and other properties. If you’re already a property owner, you will need to have at least two years of experience before that income can factor into any calculations.

Finding Tenants

Obviously, the location plays a huge role in how quickly you can go about finding tenants. But it takes more than simply hammering down a “for rent” sign in the front yard to be a real estate mogul. You’re going to have to think about how you’re going to find tenants.

Once you do, you might want to perform background checks on them and go through interviews as well. This is your property, and you’d rather not just have some random people move in without much investigation.

Finding tenants can also take time, meaning there’s another item that can be added to your agenda.

Hired Help

It’s dangerous to go alone to be a real estate mogul! When you’re purchasing property, you might have to put on a lot of hats. But that doesn’t mean you have to ride solo.

As with homes, you can enlist the help of a realtor to find a prime rental property. After that, you may need the help of a contractor for flipping the house or apartment to make it livable. In the end, a property manager could be worth the cost once you start purchasing more and more properties.

With your finances, you’ll have to weigh out and see if hiring extra help is worth the cost. Fixing up a house on your own is obviously going to be cheaper than hiring someone to do it. Managing the property will save you money but cost you a lot of time, especially if you have multiple places you’ll need to drive to.

Consider your finances carefully when thinking about hiring others.

Investing in Real Estate with Streitwise

If actually owning real estate isn’t your thing, you should consider investing in real estate through Streitwise. Streitwise is a fintech crowdfunding real estate platform for both accredited and non-accredited investors. You can invest with as little as $5,000 and easily diversify your portfolio beyond stocks and bonds with a real estate investment trust (REIT) from Streitwise.

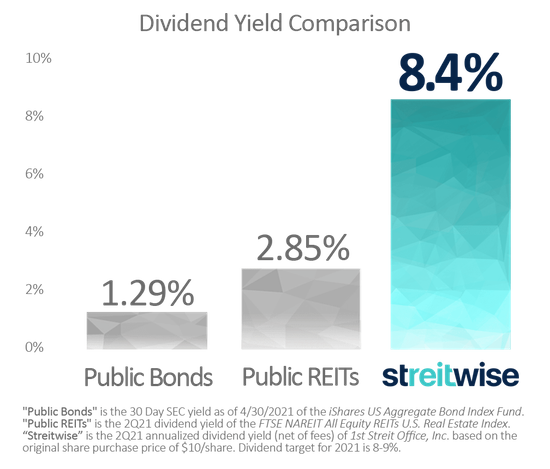

Streitwise directly owns and operates its own commercial properties. And, since its inception, the company has produced almost a 10% dividend for its investors. Where publicly traded REITs have produced an average of 2.85% in dividend yields. Streitwise’s last dividend payout for Q2 2021 was $0.21 per share, which is an 8.4% annualized return from dividends.

You can also check out my complete review of Streitwise on Money Q&A. If you’ve been wanting to get more active in real estate investing for just a small sum, then a platform like Streitwise might be a great addition to your investment portfolio.

Investing in Real Estate with Roofstock

But, you don’t have to buy homes and rental properties to make a great ROI, there are several different crowdsourced real estate investment options that have a small minimum initial investment such as Roofstock, PeerStreet, and Fundrise. For just a few hundred dollars in many cases, you can now invest in real estate.

Roofstock is the #1 marketplace for buying and selling single-family rental homes. Roofstock has listings in over 40 markets across the US. 1 in 10 homes in the U.S. is single-family rentals (SFR), which equates to over 15 million households.

Single-family rentals are a stable asset class with considerably less volatility than stocks. Single-family rentals prices have remained almost perfectly uncorrelated with stock prices since 1971, with a correlation coefficient of only 0.07.

Their online marketplace empowers everyday investors to own cash-flowing income properties and build wealth through real estate and become a real estate mogul. Roofstock makes it easy to invest remotely. Over 60% of their customers are buying a rental property located more than 1,000 miles away. With their market analysis, Roofstock provides research and data analysis to help you determine which locations meet your investing objectives.

Roofstock’s marketplace offers rental homes for sale in 40 markets and 21 states nationwide, and they are continuing to expand. Roofstock surpassed $1 billion of collective transaction volume within two years of its marketplace launch, making it one of the fastest-growing FinTech startups of all time.