Real estate is one of the most consistently lucrative investment opportunities firms limited to the likes of investors and exclusive investment firms with large rental properties and commercial real estate. But, not with Streitwise. They are one of the only fintech investments that allow non-accredited investors. They are still open to non-accredited investors and accredited investors alike.

Thanks to the expansion of fintech (financial technology) innovations, it appears the exclusivity of commercial real estate investments is going away, in favor of letting everyday investors access the profitable world of big-time real estate investing. For instance, Streitwise allows people to invest in commercial properties for as little as $5,000 upfront, and since the company is primarily web-based, they offer substantially lower fees than their non-traded REIT competitors.

If you’ve been wanting to get more active in real estate investing for just a small sum, then a platform like Streitwise might be a great addition to your investment portfolio. Here’s what they have to offer everyday investors just like you.

Commercial Real Estate Investing for Everyone

Streitwise was founded on the premise of making commercial real estate investments more accessible to the average investor, who likely doesn’t have tens of thousands of dollars just lying around, ready to be pumped into an office building, warehouse, or other commercial property. This online-based real estate investment trust uses advanced technologies and top-of-the-line market research to determine which commercial properties and markets offer the best possible risk-return scenarios for their investors.

The company is also backed by 40+ years of combined real estate investing experience among its 3 founders, who have collectively managed real estate investments and transactions worth more than $5.4 billion over the course of their careers. Additionally, their founders have over $5 million of their own money (their own skin in the game) invested in Streitwise.

Best of all, Streitwise directly owns and operates its own commercial properties, whereas many other web-based investment platforms serve as middlemen between everyday investors and real estate property managers. This hands-on approach to asset management is nearly unparalleled in the real estate segment of the fintech industry, which arguably could lead to better performance for these assets over time.

Strong Performance Through the Recession

As of July 2021, they have collected 100% of contractual rent obligations from every tenant in the portfolio. Overall, their strong credit tenants have done well through the recession, and they’re confident going forward that this will continue.

They were also one of the only investing platforms not to pause redemptions through the recession. And, that’s saying something. They’re consistent, and they deliver a high rate of return.

High Rates of Return for Real Estate

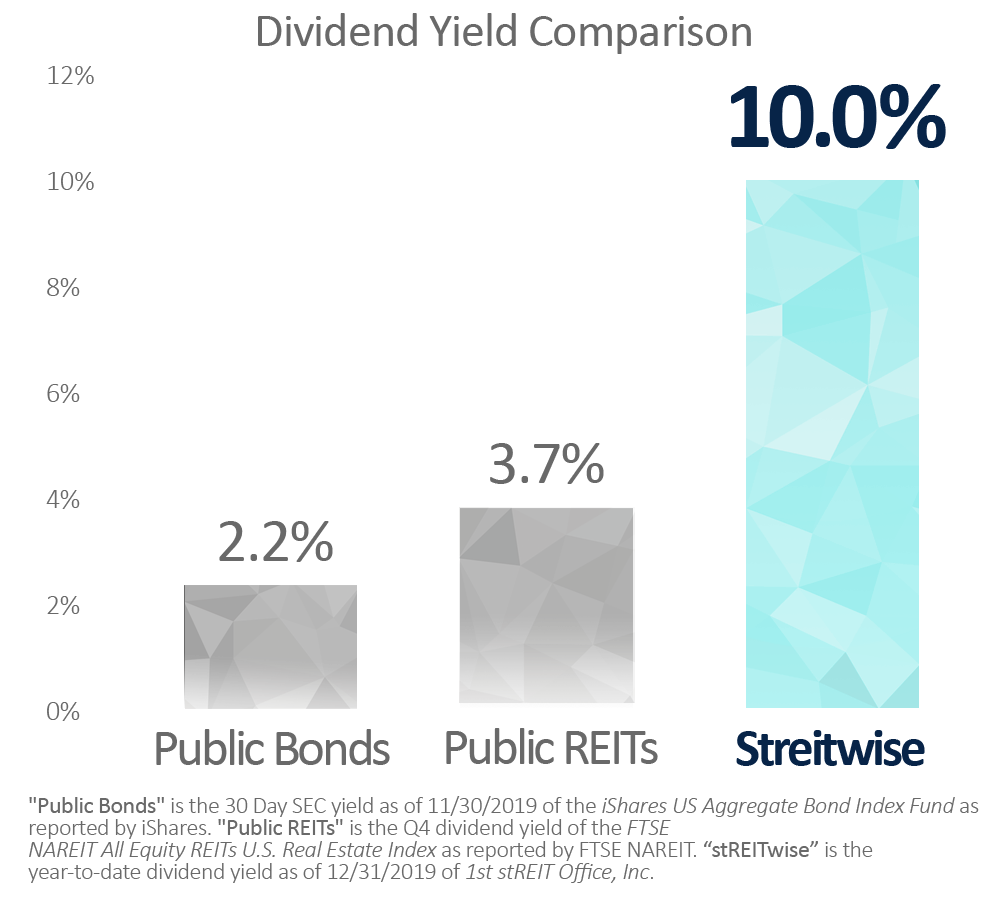

According to Streitwise records, its investment properties have substantially outperformed other similar types of investments over the past several years. Since its inception, Streitwise has produced almost a 10% dividend for its investors, whereas public REITs produced 3.79% dividends and public bonds produced 2.78% dividend yields.

Streitwise just declared their latest dividend payout for Q2 2021, at $0.21/share, or 8.4% annualized dividends. The site has hit its target return range for a 17th straight quarterly distribution with each dividend payout over 8%. Their target return indefinitely is an 8-9% rate of return on your investment.

Meanwhile, the internal rate of return on realized investments has surpassed 33%, which signifies the strength and quality of its investment properties and overall management strategy.

When it comes to fees, you can expect to pay 3% upfront and an ongoing 2% management fee (note: the almost 10% annualized dividends Streitwise produces for investors is net fees, which means the fees are deducted before dividend rates are calculated). Compare this low fee structure to the 12-15% fees that other REITs charge for asset management, acquisition, disposition, financing, and performance and you’ll see why Streitwise can be so advantageous for investors who want to maximize their returns on investment without losing too much money to exorbitant fees.

Passive Income Earning Potential

Streitwise presents an excellent opportunity for investors to create passive income streams with commercial real estate investments. They disburse dividends to shareholders on a quarterly basis (typically averaging almost 10%), which means you could have a check arriving in the mail or money depositing into your bank account every 3 months while the value of the properties you invest in continues to grow.

Streitwise also offers a dividend reinvestment program to significantly accumulate more wealth for investors who opt-in. DRIPs are beneficial for investors who prefer to maximize their long-term returns instead of using dividends as a source of passive income, so it’s up to you to decide what you want to do with your Streitwise dividends.

Finally, you can’t ignore the tremendous tax advantages of REITs, which allow investors to deduct up to 20% of their dividends thanks to the IRS’s “pass-through deductions.” REITs are also not subject to double taxation (in which you’d pay both your personal income tax rate and the corporate tax rate).

Ability to Invest with Cryptocurrency

Streitwise investors can now invest using Bitcoin or Ethereum, along with standard options such as ACH (bank), check, wire. Streitwise investors now have the ability to invest in high-quality real estate using Bitcoin (BTC) and Ethereum (ETH).

With this additional payment option, Streitwise becomes one of the growing numbers of companies that accept the two cryptocurrencies as a form of payment. This is uniquely an investment vehicle that’s possible to invest completely with Bitcoin and Ethereum without utilizing a cash account.

This service is now available using Streitwise’s escrow agent, Primetrust, who will facilitate the cryptocurrency payment. Once your registration is complete on the Start Investing page, the site will redirect you will to a wallet address to send your funds to.

iOS App Just Launched

Streitwise just launched an iOS app for investors to keep track of their holdings, add more funds, enroll in dividend reinvestment, access tax returns, and more.

As an investor in Streitwise, you now have the ability to monitor your investments and add more funds from your iOS device through the Streitwise App from the Apple App Store. This will allow you to view your holdings, view your returns, graph your total returns over time, monitor our quarterly reports, and add funds.

Should You Invest with Streitwise?

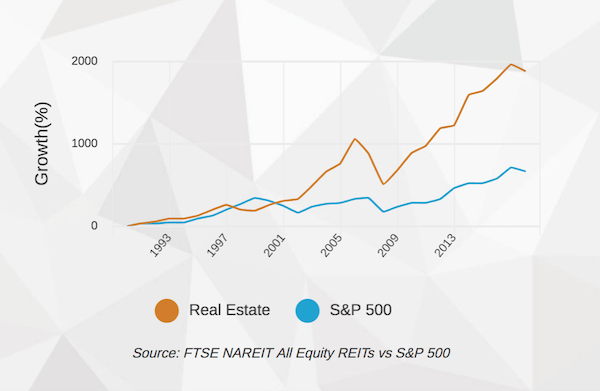

Anyone who has at least $5,000 available to invest and a desire to diversify their portfolio beyond stocks and bonds should consider investing in commercial real estate with Streitwise. The low fees, the potential for high returns, proven historical performance and passive income earning potential are ideal for everyday investors who were previously shut out of commercial investments due to the enormous entry barriers and complexity of this particular market.

Rather than having to wait several years to save for a down payment on your own rental property, you can get involved in REIT investing for as little as $5,000 upfront. Just like any investment, nothing is truly guaranteed, but investing in properties has historically outperformed stock and bond markets so don’t miss this valuable opportunity to get access to commercial property investments with Streitwise.

Disclaimer – Be sure to check out the Streitwise Offering Circular at https://streitwise.com/oc.