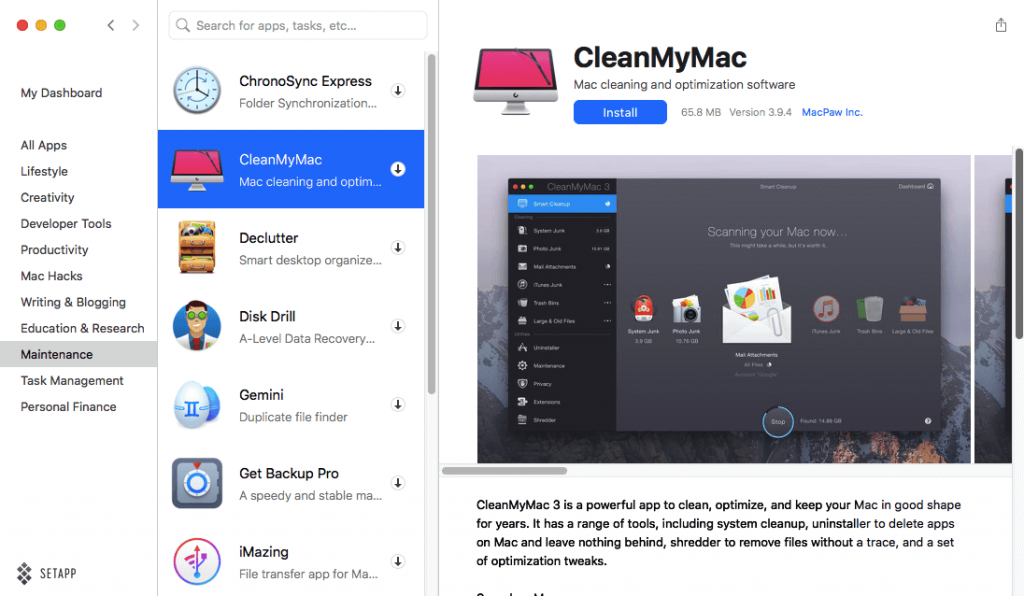

Do you ever wish there was an easy, affordable solution to transform your productivity with the click of a button? As impossible as this may sound, it actually exists: a nifty subscription service called Setapp (also referred to as the “Spotify of Mac apps”). Launched in 2017, Setapp has since acquired more than 15,000 subscribers for its multi-app access service, which is designed to make your academic, professional and personal tasks as simple as possible with the help of more than one hundred apps included in the subscription package. Setapp is your shortcut to prime apps for the Mac.

If you want to clean up your computer, prevent viruses and malware from invading your Mac, organize everything imaginable on your Mac, use tech to develop your financial plans, and increase your productivity, then you won’t want to overlook the treasure chest of useful apps available to Setapp users for a nominal monthly fee (instead of paying for the app itself). Here’s everything you need to know before getting started:

Simplify Your Mac Life with Setapp

Whether you’re a busy student or professional on-the-go, Setapp can be a lifesaver for anyone who wants to clean up their Mac, get organized and save money all at the same time. Of the 111 total apps that Setapp currently offers its monthly subscribers, the most popular apps include:

- iStat Menus ($9.99 in Mac app store)

- Capto ($29.99 in Mac app store)

- Gemini ($19.99 in Mac app store)

- ChronoSync Express ($24.99 in Mac app store)

- MoneyWiz ($5.99 per month the the Mac app store)

- …and many more!

The apps included in Setapp’s monthly membership are designed to simplify your life, increase your productivity, keep your Mac running smoothly, and organize your files to declutter your desktop. The company aims to eventually add a total of 350 Mac apps to its monthly subscription option, so don’t miss this valuable opportunity to get organized with the best tools available for just a fraction of the price you might otherwise pay for them individually.

Save Money on Paid Apps

Setapp costs just $9.99 per month, which might sound pricey until you realize how much time and money the subscription service can actually save you. Instead of paying for individual apps, regularly checking for updates, and struggling to choose between an ad-filled free version or a cleaner paid version of an app, Setapp makes the whole process super simple by doing all the work for you.

Since many of the apps cost over $20 apiece, you could pay about $120 per year for access to 100+ apps on Setapp or $120 for just 5-6 apps total. Whether you want to organize your finances, streamline your writing and blogging activities, or simply maintain your Mac more efficiently, Setapp offers useful and highly-rated apps for almost any task you might need help with.

No Distracting Ads

It’s hard to stay productive when bright, annoying ads keep popping up on your screen. Instead of opting for free, ad-filled versions of your favorite apps, Setapp grants you access to pro-level Mac apps with no annoying advertisements to get in the way of your work.

Personal Finance Apps Available with Setapp

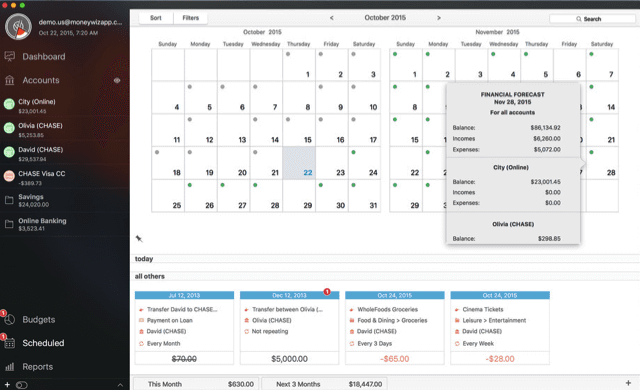

There are also a couple of personal finance apps available on Setapp including the MoneyWiz app. MoneyWiz helps lets you control your finances all in one place. It’s one finance App for all devices and accounts with simple sync!

MoneyWiz App

Even if you dread having to do more than the bare minimum when it comes to budgeting, MoneyWiz can help you become a pro at financial management with minimal effort in no time. If this sounds too good to be true, just check out some of the 400+ features MoneyWiz has to offer:

Comprehensive Budget Management

There are plenty of budgeting apps out there, but few can compare to MoneyWiz in terms of the quality and quantity of features available to users. For one, MoneyWiz allows you to create completely customizable and automated budgets, so you can divvy up your dollars into different categories with minimal effort once it’s all set up.

You can differentiate between one-time and recurring expenses (a feature many other budgeting apps sadly lack) and access nifty features to help with budgeting on an irregular income or even accounting for multiple currencies!

Best of all, you can sync up your bank, credit card and loan accounts with the MoneyWiz app, allowing the software to automatically account for transactions without needing any manual input on your part. MoneyWiz makes budgeting easy by handling your income and outflow of expenses, allowing you to see your account balances and keep track of your progress with notifications and the Smart Progress feature (which lets you see if you’re coming close to going over budget for a particular time period).

Generate Customized Reports

You don’t need to be an accountant or good with Excel to generate clear and informative reports with MoneyWiz. The app offers a whopping 29 different options for reports, including:

- Accounts (historical bank balances, cash flow, net worth tracking, etc.)

- Budgets (compare different budgets and track your progress over time)

- Categories (compare your income/expense records for multiple budget categories)

- Payees

- Spreadsheets

- Transactions

- …and many more!

MoneyWiz is useful for when you’ve gone over budget because you can compare your past financial records with current records to see how you can get back on track to financial stability. The ability to customize your reports based on what you’re concerned about (such as credit card debt, a missed payment, loss of income, etc.) is unparalleled in other budgeting apps, which makes MoneyWiz one of the best options available for consumers, regardless of your ability to create spreadsheets because the app does all the complicated work for you.

Sync All Your Accounts and Devices

Do you have an Android phone but a MacBook laptop? What if you also have an iPad or tablet that you want to use to monitor your financial information? MoneyWiz is perfect for users with multiple devices because you can sync all of your information in one place without the headache of switching between Apple and Android platforms.

MoneyWiz is also highly secure, using SYNCbits, backdoor-free security encryption, PIN entry, security questions, touch ID, and a privacy screen to ensure nobody can access your financial records without your consent. Since you won’t have to worry about your information being at risk with MoneyWiz, you can enjoy greater peace of mind and organization by syncing your bank, credit card, loan, brokerage, and investment accounts all in one convenient location.

The biggest benefit of syncing everything together is that you’ll no longer have to manually track your financial records. Transactions are automatically accounted for within the app and your balances are adjusted accordingly. Why risk missing a payment deadline, ignoring an investment account, or going over your spending limit when MoneyWiz’s platform is designed to keep track of everything for you?

MoneyWiz Tutorials

Some people may want to learn more about financial management instead of simply leaving it all to MoneyWiz. This is where the tutorials’ section comes in – to help you resolve any issues you may run into while using MoneyWiz, get assistance with setting up your MoneyWiz profile and syncing your accounts with the app, and learn how to contact a human representative if you still need assistance.

Should I Pay for MoneyWiz?

MoneyWiz offers one free version, but it’s supported by advertisements, which can be annoying for some users to see when they’re trying to manage their financial records. If you want to use MoneyWiz’s impressive array of services without interruption, then the MoneyWiz Premium service costs $5.99 per month (or $59.99 annually, if you pay for a year in advance). OR…you can pay just pay $9.99 per month for Setapp and receive MoneyWiz and over 100 other apps for that low monthly fee instead

All in all, it’s a small price to pay for top-of-the-line financial support with 400+ features, unlimited accounts/bills/budgets/transactions accounted for, and top-notch security ensuring your private information remains protected at all times. If you’re ready to have effortless and extensive financial management, then MoneyWiz is your best bet for long-term stability and attaining your personal financial goals.

More Setapp Information

Setapp for Education

If you’re a student or the parent of a student, then Setapp is perfect for improving study habits, writing skills, and organization for school. There are several apps available to help you with academic writing (such as Manuscripts), research (such as Findings), and dozens of productivity apps to help students stay on top of deadlines, ace exams, and excel in all areas of school.

Best of all, Setapp offers a 50% discount for students with a valid .edu email address, so it’s truly one of the most affordable options for students who want to do better in school without racking up more student loan debt.

Should You Sign Up for Setapp?

Unless you never use a Mac computer for anything other than lightly browsing the Internet, chances are you could save quite a bit of time and money by signing up with Setapp. With more than 100 apps currently available on the Setapp platform, it’s already an extremely cost-effective way to achieve a work/life balance, protect your computer from digital threats like malware, and supercharge your productivity. You can cancel at any time, so there’s nothing to lose and so much to gain from signing up for Setapp.

If you’re ready to access the best technologies available for Mac users at a fraction of the cost, join Setapp today and enjoy the amazing productivity-boosting benefits that Setapp has to offer.