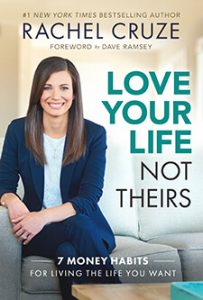

The following is a guest post by Rachel Cruze, who you may know also as Dave Ramsey’s daughter. An incredible speaker and author in her own right, Rachel has a new book coming out in October, “Love Your Life, Not Theirs“. If you’d like to submit a guest post on Money Q&A, please check out the site’s guest posting guidelines.

Some of the most difficult conversations you’ll ever have will probably involve money. For example, consider these statements:

“How much did you spend on that dress? You didn’t even tell me about it!”

“Retirement is only five years away, Dad. Do you think you’ll be ready?”

“Josh, I can’t keep loaning you money if you aren’t going to pay me back. Sorry, I know you’re my brother, but I can’t do it again.”

Ouch. Those are probably going to be difficult discussions, right? But even though they’re difficult, those money conversations are absolutely necessary.

The Importance of Talking About Money

In my upcoming book, “Love Your Life, Not Theirs“, I discuss the seven money habits you need to live the life you want. One of them is simply this: Talk about money, even when it’s hard.

In my upcoming book, “Love Your Life, Not Theirs“, I discuss the seven money habits you need to live the life you want. One of them is simply this: Talk about money, even when it’s hard.

What should you do when . . .

Your husband won’t stick to the budget? Talk about it.

Your parents aren’t prepared to live a comfortable retirement? Talk about it.

Your brother won’t stop asking you for money? Talk about it.

Yes, it won’t be easy. You may even have “words” or shed a few tears. But, ultimately, it’s one of the habits you have to practice to have a healthy relationship with money.