For the past few months, my wife and I have been testing out Hello Fresh. So, I thought that it would be fun to tell you what we found in a Hello Fresh review on Money Q&A.

Note – This article may contain affiliate links.

We’ve actually really loved the HelloFresh service! Here’s why…

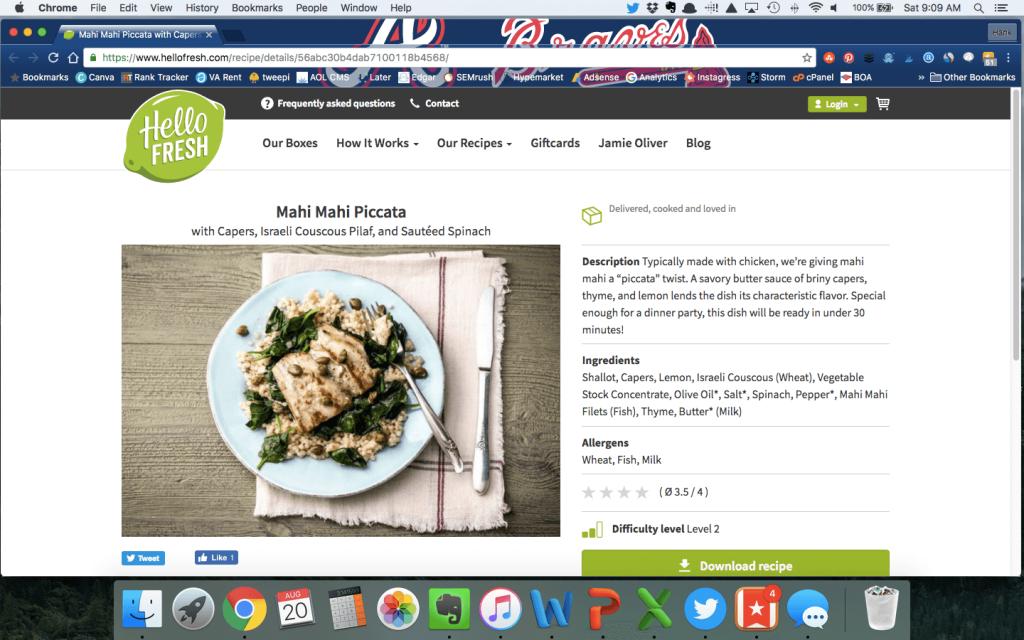

Hello Fresh Review – Fast, Easy, Fun, and Cheap Meals

What is Hello Fresh?

You’ve probably seen the Hello Fresh commercials on television. They seem to be everywhere lately. Hello Fresh is one of the many meal subscription services that delivers prepackage and proportioned ingredients right to you doorstep each month.

The Hello Fresh meals typically come in portions for two people. They have just the right amount of ingredients to make the recipe. And, the recipes are simple. They’re easy and fun to make. Each meal comes with its own recipe card to help you prepare the meal.

You get to pick which meals you to order through their smartphone app or website. They typically give you eight to ten different meals to choose from on the list. And, meals aren’t repeated throughout the year.

You can download the recipe to recreate them again later if you want. That’s what my wife and I have done for our favorites. There are several recipes prepared by celebrity chefs like Jamie Oliver too.

If you’re not in the mood or are going to be out of town, you can delay or skip as many shipments as you want as well. It’s really easy to make changes through the Hello Fresh smartphone app or website.

Why I Love Hello Fresh

Hello Fresh sends all of the meals pre-proportioned. In the box with your main ingredients, they send small jars of any ingredients, spices, and condiments that you may need from the recipe.

The directions are easy to follow. And, they come in a nice recipe card that you can keep in order to make the recipe again. They’re super simple to follow.

Another great thing about Hello Fresh is that their recipes use interesting and ingredients that you may not normally cook with. One of our favorite meals has been mahi mahi with Israeli couscous. If it were not for Hello Fresh, I would have never tried Israeli couscous. Now we’re cooking with it

The meals are healthy. Each meal is a healthy dinner with protein, vegetables, and a starch. It’s two perfectly balanced portions for two people.

There are also vegetarian options and larger meal sizes for families if you want to choose those options.

In my upcoming book, “

In my upcoming book, “