The following is a guest post by Lars Kroijer, who used to run a hedge fund in London and wrote the book, “Investing Demystified: How to Invest Without Speculation and Sleepless Nights“. If you’d like to guest post on Money Q&A, check out the site’s guest posting guidelines.

With President Donald Trump making headlines on an hourly basis and our social media accounts going crazy with comments on his presidency, we are left asking ourselves: Should we perhaps change our investment strategy as a result?

In short, the answer is yes but perhaps not how you think.

In earlier blogs, I have outlined how I consider it highly unlikely for the vast majority of investors that they can beat the markets themselves through active stock selection, market timing, or via picking the one out of ten actively investment funds that may do so over a ten-year period.

And, for your equity exposure, you should pick as broad and cheap an index tracking exposure as you can get your hands on, namely a world equity index tracker. Just because Donald Trump is now President of the United States, that is no less true. You most likely couldn’t beat the markets before November and still can’t.

Editor’s Note – You may also like to see five things you can learn about personal finance from President Trump!

What you perhaps can expect is to make 4-5% above inflation. This is based on over 200 years of history of equity returns in many states of the world. And, you can expect that return to range from lottery type winnings to desperate failures – can also reasonably expect to be compensated in higher risk periods with commensurate higher expected returns, but there are no guarantees obviously.

Editor’s Note – I think you can squeeze out a 10% return on your investments. Be sure to check out how.

So, even in a President Trump world, we haven’t found a crystal ball. So, what can we do?

In my view, there are two main things we main things we should focus on.

- Evaluate if the risk of the markets has changed enough that we should re-evaluate the risk levels of our portfolio.

- We should consider if the sudden change in the political landscape has changed our overall economic life enough that our risk profile should change as a result.

Market Risk

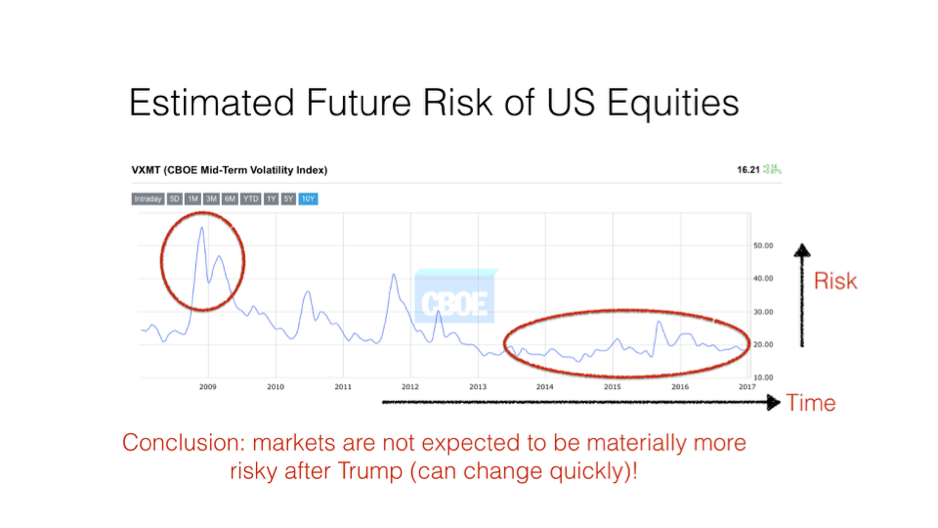

Below is a graph of the expected future risk of the US stock market. Without being too technical, it measures the expected standard deviation six months into the future. Since the index value is based on the implied volatility of equity options, it is a market price.

If you think you know the future volatility of the market better than this chart, you can get rich trading it (many try!). There are many issues with this kind of chart, including that the value itself is very volatile. So, the risk changes a lot.

The volatility doesn’t capture “fat tails”, the fact that unlikely events happen far more than predicted by the normal distribution assumption of the standard deviation. And, that it is only six months into the future. That all said, the chart gives a good idea of future expected risk. You can also find it on cboe.com.