Property investment is appealing to a lot of people for several reasons. Property is always needed, although the markets can rise and fall. There are different ways to invest in property, and some people view it as being a relatively easy way to make money through investing.

Investing in property can be a lucrative way to bring in an income, but it’s not something that you can jump into straight away. It requires careful thought to get it right, especially as it can involve a lot of money and large amounts of debt to get started. There are some crucial things to think about before investing in property.

What Type of Property to Invest In

There are different types of property that can prove to be good investments and different ways to invest too. Some of the key types of property are residential property, commercial property, and industrial property, as well as mixed-use property. Many people think of residential property first when they consider investing in real estate.

However, other types of property can be lucrative investments too. It’s also worth considering the different ways to invest in property. There’s the option of buying property to rent it out or to flip it, or there are possibilities such as investing in Real Estate Investment Trusts (REITs).

How to Determine the ROI of a Property

If you are investing in property, you need to know that it’s going to make you money. This means you need to be able to work out the return on investment, whether you’re going to be selling the property on or looking for tenants. When you’re investing in residential properties, you will need to look carefully at house or apartment sales to find properties that are priced correctly.

It’s not just the initial cost of the property that matters, but any ongoing costs that you might have too. Of course, you also need to consider how much you could potentially be earning, including the level of demand for the type of property.

How to Manage Your Property

When renting a property out, you need to think about whether you are suited to being a landlord. It can be a time-consuming task, and it’s not right for everyone. If you don’t think that it’s for you, you can hire a property management firm to carry out essential tasks for you. This can include things such as finding tenants, collecting rent, and taking care of maintenance requests.

The Risks Involved

It’s always necessary to be aware of the risks involved when investing. When it comes to property, you should be familiar with the general risks of property investment, as well as understand the specific risks for different types of property and the investment opportunities that you consider.

Diversifying your income stream can be a useful way to help mitigate the risks. If you have a diverse investment portfolio, your investments are less likely to be affected all at once by any downturns.

Before you decide to invest in property, you should educate yourself on whether it’s right for you and how to get it right.

Investing in Real Estate with Streitwise

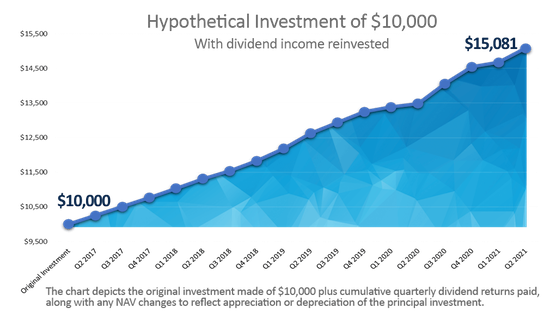

Streitwise is an excellent opportunity for investors to create passive income streams with commercial real estate investments. Their dividends are disbursed to shareholders on a quarterly basis (typically averaging 8-9% on an annual basis).

Streitwise also offers a dividend reinvestment program to significantly accumulate more wealth for investors who opt-in. DRIPs are beneficial for investors who prefer to maximize their long-term returns instead of using dividends as a source of passive income, so it’s up to you to decide what you want to do with your Streitwise dividends.

Anyone who has as little as $5,000 available to invest and a desire to diversify their portfolio beyond stocks and bonds should consider investing in commercial real estate with Streitwise.

Finding Rental Property Through Roofsock

RoofStock is the #1 marketplace for buying and selling single-family rental homes right from the comfort of your living room without having to visit rental properties across the country. Roofstock has listings in over 40 markets across the United States.

Roofstock helps investors buy and sell rental properties in many different neighborhoods across the United States all online. Roofstock was designed to make the whole process of investing in rental properties much easier. They give prospective investors all the information they need in one convenient location online so they can expedite the investment decision process. They’ve done all of the hard work for you by finding and vetting all of the rental real estate properties and only recommend the best ones with the potential for a great rate of return.

And their industry-leading guarantee allows investors to buy remotely with total confidence. Their certified properties are inspected and come with a 30-Day, Money-Back Guarantee, so you can invest remotely from a distance with confidence.

Owning and leasing out your own rental properties can be a stressful experience for some, but with Roofstock’s extensive property / neighborhood / tenant information, low costs, and incredible customer support, make the process so much easier to buy and sell rental property through Roofstock.