The following is a guest post from Ben, publisher of the blog – Saved by the Cents. If you’d like to submit a guest post to Money Q&A, be sure to check out our guest posting guidelines.

You may be reading the title and thinking that I completely disagree with Dave Ramsey’s Baby Steps to achieve financial freedom. It’s actually quite the opposite. I have a lot of respect for Dave Ramsey. I also believe that what he’s done has been quite instrumental in my life and many people I have come in contact with.

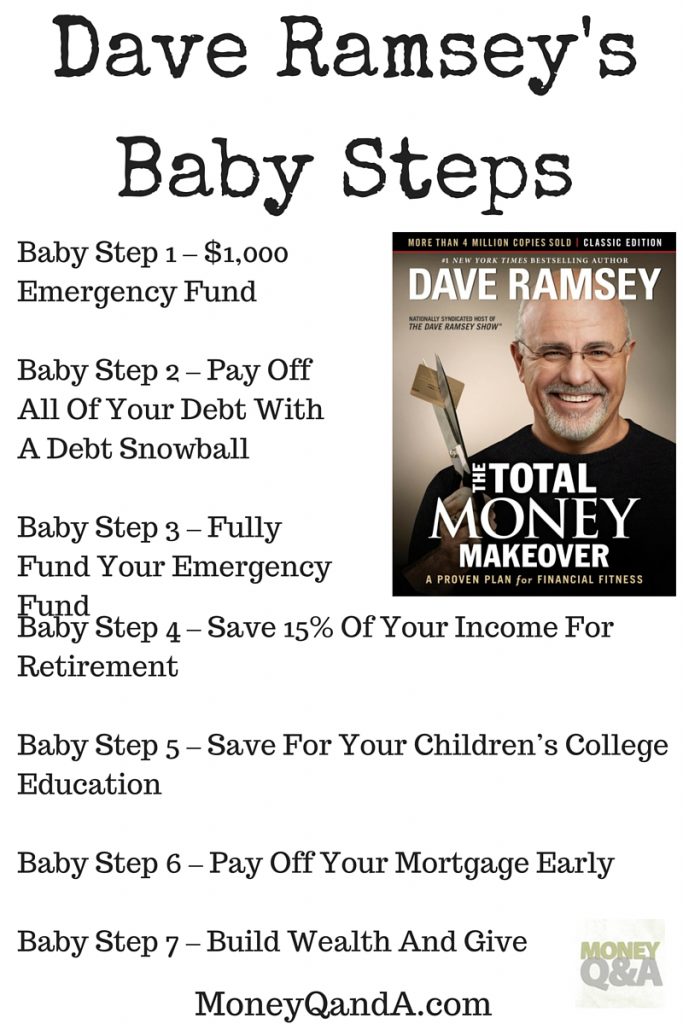

If you aren’t familiar with Dave Ramsey’s Baby Steps, you may want to take a look at the different steps:

- Baby Step #1: Create a $1000 Emergency Fund

- Baby Step #2: Payoff Your Debt with Debt Snowball

- Baby Step #3: Fully Fund Your Emergency Fund (3-6 months)

- Baby Step #4: Invest 15% of Your Income Into Retirement

- Baby Step #5: Save For College

- Baby Step #6: Payoff Your Mortgage Early

- Baby Step #7: Build Wealth and Give

I have spent an inordinate amount of time studying Dave Ramsey and the baby steps. As such, I found there were 4 changes I would make in 2020.

New Baby Step #1: Create an Emergency Fund of 50% of One Month of Gross Income

Baby Step #1 (Create a $1000 Emergency Fund) has been around as long as I can remember. There’s no question in my mind that an emergency fund is crucial to financial success.

Why would I update that Baby Step? Here’s why I would update this step:

- There’s inflation, so $1,000 doesn’t have the purchasing power that it once did, meaning that you may have to add money back to your credit card if your refrigerator breaks and you have to replace it.

- Generally, you may have higher expenses if you have higher income, so having an emergency fund based on a percentage of income is more reasonable.

What I would do instead? This one is tricky. I’d recommend a percentage of your income. I’d like to tack on “up to a certain amount”, but I think that complicates things. What would that certain amount be? I would suggest: “Create an Emergency Fund of 50% Your Gross Income”.

On a side note, I know it’s not mentioned in any Baby Step, but I do believe that creating an effective budget is extremely important. I would probably actually have that as Baby Step #1 and potentially have 8 Steps.

New Baby Step #2: Payoff Your Debt with Debt Avalanche (or Debt Savvy)

Baby Step #2 is focused to use a debt payoff method that is stated to provide the psychological benefit of paying your smallest debts off first via the Debt Snowball Method.

Let’s start with the basics.

- The Snowball Debt Payoff Method focuses on putting your extra monthly payment to your smallest debts to snowball into your higher debt amounts. The Snowball method ignores interest rates.

- The Avalanche Debt Payoff method focuses on putting your extra monthly payment to your highest interest rates. The Avalanche method ignores debt amounts.

- The Savvy Method: This is a newer method that combines both the snowball and avalanche method. If you have smaller debts, you would prioritize those first then move to avalanche for the interest savings.

You may be wondering whether to prioritize the highest interest rate or the lowest amount first.

If you are gazelle intense (Dave’s term for your intensity to get out of debt), you may lose thousands of dollars in interest payments by doing the snowball method. So, why would you do this debt payoff method? What I would do here is to find the best debt payoff app that matches your preferences and focus on either the Avalanche or the Savvy method. I’d add Savvy in parentheses as it’s a lesser-known method.

New Baby Step #6: Invest Your Money Where It Yields the Highest Return

Baby Step #6 is about “Payoff Your Mortgage Early”. While I think you should pay off your mortgage early, I question whether it is always the best thing for you to do. For example, if you are getting a great return on your investment, should you always pay off your mortgage early? I would argue that each fiscal investment decision should be compared against alternative decisions.

For example, let’s say you owe $100,000 on your mortgage at a set rate of 3.5% fixed. Let’s say you receive an inheritance of $50,000. Dave Ramsey would state that you may use that money to pay off your mortgage if you are in Baby Step 6.

However, let’s also say that it’s possible to get a long term (almost guaranteed return) rate of 9.5%. My reasoning is that you should put most of your money in the asset that returns 8.8% and continuing to pay the minimum on your house payment because you will yield a higher return on that investment.

New Baby Step #7: Build Wealth

Now you may be wondering why I would remove “…and Give” from Baby Step 7 as there’s a huge benefit from giving through gifts that keep on giving or through your alma mater.

So, why would I change this? Because I believe that you shouldn’t rob yourself of the joy of giving until Baby Step 7. I believe that learning to steward your money and giving at the same time can be a great learning lesson.

It can also encourage you to get out of debt faster because of the joy that you receive from giving away your money. I know it’s odd, but I will say that it has always been better in my life to give than to receive.

About the Author

Ben is a personal finance writer with a background in consulting, high-tech, and fintech startups. He enjoys covering topics such as budgeting, debt freedom techniques, and fintech. He also writes at his own blog, Saved By The Cents. In his free time, Ben enjoys spending time with his three young daughters and exploring new hikes.