The following is a guest post from Chris. Chris started a digital marketing business that focuses on freelance writing, content marketing, and SEO while working full-time and playing dad to two kids. You can check out his blog – Money Mozart, to read more.

There are several ways to make money in real estate, such as owning property and selling them at a profit or earning rental income. You can also buy real estate shares if you prefer through peer-to-peer investing fintech websites like Streitwise, Fundrise, PeerStreet, Roofstock, and others. However, an often overlooked method of making money in real estate is through property tax liens.

In the simplest terms, you can earn money through property tax liens when homeowners fail to pay their taxes and are forced to foreclose on their properties or be evicted from their homes. It may seem like a backward way of making money, but it works.

This kind of investing can be very profitable but also very risky. If you’re considering investing in property tax liens, there are some things you need to know before taking the plunge. This article will discuss how to invest in property liens, as well as the risks and benefits.

Property Tax Liens: An Overview

When a homeowner fails to pay property taxes, the appropriate county or city can place a lien on the property. Liens are legal claims against them for the delinquent amount associated with it. As a result of the lien, the homeowner is unable to sell or refinance the property until the lien is lifted and all taxes are paid.

When the lien on the property is issued, the municipality creates a tax lien certificate reflecting the property’s owed amount. It also includes any interest, as well as penalties that may also be associated with the property. The documents are taken to auction, and the highest bidding investor wins the lien.

Property tax lien auctions and sales are only legal in some states in the United States. Each state has its cap for the maximum interest that the new lien owner can earn in interest. It’s best to research the laws and regulations in your particular country or city to make sure you’re following the rules to earn the best ROI on your investment.

How to Invest in Property Tax Liens

Property tax liens are bought just like actual properties at auctions. These can be in-person or at an online auction, depending on each property’s situation. There are two ways to bid on the property: You can either bid to make the interest rate for the property go down or bid up on a premium you plan to pay for it. The lien gives the lien to the investor who can either accept the lowest interest rate or pay the best premium.

If purchasing a tax lien piques your interest, you should begin by choosing what kind of property for which you’d like to purchase a lien (residential, commercial, undeveloped land, etc.). Then, you can contact your city representatives to figure out the details of the next auction, such as which property liens are next to sell and any specific rules for the sale. From there, you purchase the lien and move on with the investment process.

Knowing the process of investing in property tax liens can be complicated. Here’s a more detailed, step-by-step process for investing in property tax liens:

- You can begin by contacting your local city representatives or registrar’s office. You will need to ask for the list of tax liens in your area and information about the auctions. This should come at little to no cost to you.

- Next, you’ll choose which properties you would like to obtain the lien for. Make sure you confirm the rate of interest that you’ll be paid for paying the delinquent tax amount. Then, purchase your lien with cash.

- Get the certificate for the tax lien and make sure to get a receipt. Store records of the sale in a location such as a safe or vault. Either wait for the lien to expire or for the home or property owner to pay off the lien plus interest. Go back to the tax recorder’s office to collect your interest payments.

- Monitor the property owner’s activity regarding payments. If the owner does not pay the lien in the allotted time frame, you may seize the property and begin evicting the current tenant or property owner. Once the loans are as good as unpaid, and you can take the property, you may do so.

- Repair or improve the home you have obtained in seizure or auction, then sell it for profit. You may also rent it for profit.

What to Expect From Investing in Property Tax Liens

The primary way that investors turn a profit from property tax liens is through interest paid by the property owner. Although rates can be (and often are) bid down at auction, they are still quite high. For instance, as of May 2019, the average interest rate for a property tax lien in Illinois was 36%. So the process itself can return a lot of money, which is, of course, beneficial to you as an investor.

However, investing in property tax liens isn’t as simple as purchasing the certificate and collecting the money. You must fulfill certain obligations as an owner of the tax lien certificate, depending on your location. For example, you usually have to notify the property owner that you’ve purchased the tax lien certificate. It would help if you also informed them when the redemption period is about to end.

You must also understand that properties may be in a state of disorder. Angry homeowners will often gut down their properties as they’re evicted, so you should expect to spend extra money on repairs and improvements so you can make your new property ready to re-sell or rent.

To make educated decisions for investing in property tax liens, you also need to do your research on properties you’re interested in. Sometimes, the property’s current value can be less than the amount listed on the lien, making it a dangerous prospect. You should divide the face amount of the tax lien by the property’s market value; if this value is above 0.04 or 4%, stay away from that property.

The Risks of Property Tax Liens

Investing in property tax liens is not easy. Auctions can get quite competitive, and it’s not uncommon to find yourself purchasing liens at terms you’re not comfortable with. Interest rates can get bid down to the point that buying the lien isn’t profitable. As said before, sometimes, the property’s current value can be less expensive than the lease. Most importantly, the return on a property tax lien is a fixed return, making it potentially less profitable. That guarantees continued returns over time.

One of the most significant issues with property tax liens is that the property itself may have several problems that require you to remodel or repair to get up to code. You often cannot see the property’s condition before purchasing the lien, so you may not know what you’re getting into.

However, you can always look into the surrounding circumstances of the neighborhood to get an idea of what the property’s condition may be. According to Ruth Lyons, of InvestorJunkie, it’s “not enough to go by general property value estimates in the media,” and you should actually “get your real estate license and join a local broker to have access to both listing prices and especially closed sale prices.”

The Benefits of Property Tax Liens

There are several advantages to buying tax lien properties. For one, you’re not buying the property itself, nor are you dealing with the property owner. If the property is redeemed, you could earn a lot of money in interest. If your interest is in the property itself, you could potentially secure it for well under market value.

You don’t necessarily need tens of thousands of dollars to invest – some liens will sell for a couple of hundred dollars. Market turns such as recession can also work in your favor, potentially forcing homeowners to walk away from their property altogether.

Regardless of the pros and cons, you must have a crucial understanding of the physical property’s condition you’re purchasing as well. You should at least know the following:

- Condition of the area around the property

- Hazardous materials or dumpsites near the property

- Environmental problems with or around the property

- Other foreclosures in the area

The physical property’s condition is extremely important for investing in the property because it reflects on the property’s value and can have a significant effect on how much ROI you earn. Knowing these conditions can help you know about properties before investing and potentially gaining or losing money in them.

Tips and Tricks for Investing in Property Tax Liens

Investing in property tax liens can be difficult, especially if you’re new to it or you’re not sure what you’re doing. Here are some tips and tricks that you can use to help you along the way.

Consider Private Loans or Credit Cards

There’s no need to worry if you don’t have enough capital to pay for a property tax lien. Since many of them can be purchased for no more than a couple hundred dollars, you can apply for a loan to purchase one. I actually recommend OppsLoan for this, which Hank did a wonderful review on.

This will allow you to pay back the full amount quickly. You can start earning money on your property tax lien as soon as interest payments are paid or when the property is seized, so the credit card can be paid back easily. Credit cards usually are a risk, but with property tax liens, it’s much less of a risk than it typically could be in other investments.

Consider the Drawbacks

The benefits are plentiful, but you need to keep a sober mind. The two most obvious drawbacks are a general lack of liquidity once you make the investment and that the returns are fixed. This isn’t too beneficial for a portfolio based on continued returns.

Profits are not always something an investor can bank on; the homeowner may be unable to pay their delinquent fees, and the investor could lose out on their interest payments. They may also have to expand their investment if there happens to be more than one lien on that property.

Remember to Keep ROI In Mind

You should identify your goals financially before deciding to purchase a tax lien certificate. This allows you to figure out if the return on investment (or ROI) will be right for you. Tax liens can be profitable depending on many factors, including the US state in which you’re located.

The price can also vary depending on the amount, which can cut into profits. Just remember to research your area and what your potential ROI can be before you get started investing.

Know that Homeowners May Pay Off Their Debts

Keeping a realistic mindset is necessary when investing in property tax liens. It would help if you remembered that although you may end up with a property and a lot of money in interest, there is the potential for the homeowner to pay off their delinquencies.

In this case, you will only earn money in interest, and you will not end up with a property. It can still be a profitable opportunity for you and your portfolio but remember not to go into property tax lien investing with your sights set exclusively on getting a new property for below-market value.

Diversify Your Portfolio

Property tax liens can take time and money. This makes it a problematic primary investment strategy for investors. There are several benefits to a property tax lien, but you need to remember to diversify your portfolio. Since these liens are usually only fixed income, consider pursuing several investment options and creating a diverse portfolio. In this way, you can spread out your risk and guarantee several cash flows simultaneously.

Invest in Rental Properties Online with Roofstock

RoofStock is the #1 marketplace for buying and selling single-family rental homes right from the comfort of your living room without having to visit rental properties across the country. Roofstock has listings in over 40 markets across the United States.

Roofstock helps investors buy and sell rental properties in many different neighborhoods across the United States, all online. Roofstock was designed to make the whole process of investing in rental properties much easier. They give prospective investors all the information they need in one convenient location online to expedite the investment decision process. They’ve done all of the hard work for you by finding and vetting all of the rental real estate properties and only recommend the best ones with the potential for a great rate of return.

And their industry-leading guarantee allows investors to buy remotely with total confidence. Their certified properties are inspected and come with a 30-Day, Money-Back Guarantee so that you can invest remotely from a distance with confidence.

Owning and leasing out your own rental properties can be a stressful experience for some. Still, Roofstock’s extensive property / neighborhood / tenant information, low costs, and incredible customer support make the process so much easier to buy and sell rental property through Roofstock.

Invest in REITs with Streitwise

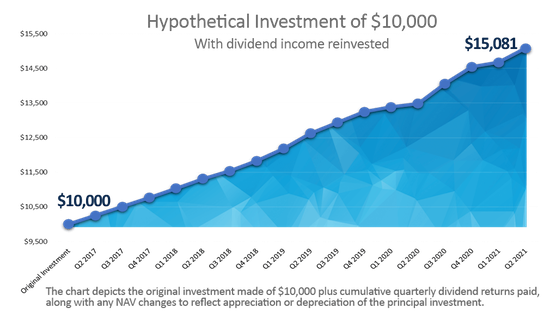

Streitwise is an excellent opportunity for investors to create passive income streams with commercial real estate investments. Their dividends are disbursed to shareholders on a quarterly basis (typically averaging 8-9% annually).

Streitwise also offers a dividend reinvestment program to significantly accumulate more wealth for investors who opt-in. DRIPs are beneficial for investors who prefer to maximize their long-term returns instead of using dividends as a source of passive income, so it’s up to you to decide what you want to do with your Streitwise dividends.

Anyone with as little as $5,000 available to invest and a desire to diversify their portfolio beyond stocks and bonds should consider investing in commercial real estate with Streitwise.

Property tax lien investing can be an excellent way to see a decent ROI, but there are heavy competition and a degree of risk. Before considering property tax liens, do your research; Find out the guidelines in your location and attend an auction to feel out how they go.

All you need to remember is to do your homework. When you see an opportunity, take it, but only when you’re ready to make such a significant investment.