I completely messed up investing in peer-to-peer loans through Lending Club because I was greedy. Jim Cramer is famous for saying that both bulls and bears can make money, but pigs get slaughtered.

What he means is that it is one thing to make money or make a living with your investments. But, to try and make a killing on them, you will often be crushed by those very same investments.

I’m ashamed that I got greedy with my Lending Club investments, tried to push the envelope, and got burnt. Keep reading to see what happened and what I’m doing now with the new loans I’m investing in through Lending Club.

Peer To Peer Loans And Lending Is Awesome

I don’t want you to get the wrong idea from this article. I love peer to peer lending, and I’m a huge fan of Lending Club.

I think that Lending Club is the best peer to peer loans lending club investment company on the market today. If you are not familiar with peer to peer lending, it is where you get to be the bank.

Peer to peer loans allows you to safely and securely lend money as an investor directly to a borrower as an investor. Lending Club simply provides a safe, secure platform for the money transfer.

The benefit for an investor who lends money to a borrower is that you receive a higher than average interest rate from other similar investments.

Since 2007, Lending Club has issued over 36,500 loans worth a total of over $382 million. While savings accounts and money market funds are earning less than 1% annual rate of return, Lending Club has averaged a 7.4% return for investors on their safest A rated loans alone. Borrowers receive great benefits from Lending Club by skipping the bank as well. They can receive a peer to peer lending loan with an interest rate as low as 6.78% APR.

Lending Club can also help borrowers qualify for a loan with lower credit scores and without collateral than a bank would typically finance (of course those interest rates are higher). For example, you can routinely find loans on Lending Club for borrowers who are looking to finance things such as their wedding, consolidate credit card bills, pay medical bills, or even start a new business.

How I Screwed Up My Lending Club Loans

When I started investing in peer to peer loans through Lending Club almost three years ago, I only wanted to invest in the riskiest of peer to peer loans. I wanted big rates of return on the riskiest borrowers. Lending Club’s E, F, and G rated loans have an average rate of return of 17.45%, 19.29%, and 20.72% respectively. But, as I stated earlier, I got greedy. And, I subsequently got slaughtered. I invested in the riskiest rate loans.

I loved to lend my money to people starting new business and not Lending Club’s bread and butter borrower who wants to consolidate debt at Lending Club’s current low borrowing rate than their credit cards were offering. Out of the 74 peer to peer loans that I invested in a whopping 12 went into default and were subsequently charged off.

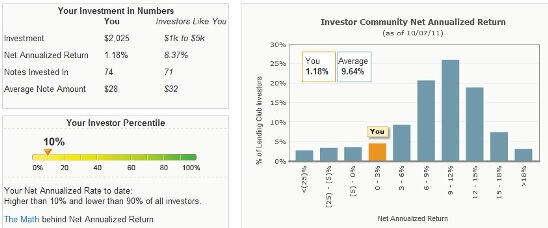

I lost my entire investment in those loans. Luckily, I was only investing $25 in each loan. So, I lost $300 of my investment. It completely wiped out most of my gains. I ended up earning only 1.16% annual rate of return for the past year.

My Lending Club Game Plan In The Future

One of the biggest takeaways that I want you to understand about peer to peer loans is that I haven’t given up on Lending Club or peer to peer lending. It wasn’t the system that went wrong. It was my greed to earn a consistent 20% annual rate of return. I wasn’t diversified. I only owned the riskiest E, F, and G rated loans.

Now, my plan for the future is to only invest in the safer A, B, and C rated loans. I plan on making my investments automatic and let Lending Club’s system pick the best loans for me. I’m done funding entrepreneurs’ dreams in this tough market. I’m going to stick to honest people with good credit scores who need to consolidate their debt.

Starting this month, I will keep you up-to-date monthly on my progress rebuilding my Lending Club portfolio into a safer and more consistent investment. My goal is to have an account balance that pays enough to fund new loans every month without making me having to add anymore principle to it, making it a truly passive investment.

Subscribe By Email

Like this article? Sign up for Money Q&A’s Email Newsletter, and we’ll send you a regular digest of our newest articles each week as well as exclusive giveaways, deals, and tips just for our email subscribers.

It is full of the answers to your most pressing money, investing, retirement, insurance, and other financial questions. And, it is all free! So, why wait? Click here to sign up now.

Interesting article. I am glad you are sticking with p2p lending and not blaming the investment vehicle for you below average returns. I think it is very important when investing in the higher risk loans to test your strategy with the historical loan pool. Lending Club now has over four years of history and investors can see what has and hasn’t worked in the past (via a tool like Lendstats.com). Of course, this doesn’t guarantee they will work in the future but it is certainly better than investing with your gut.

Good luck in bringing your returns back. I look forward to your next update.

Peter – Yes, I take full responsibility for my lower than average rate of return. I really love peer to peer lending and believe in it. It was definitely me and my error and not the system or investing platform. I had never heard of Lendstats.com before. I will have to check that out. Next week, I have an article scheduled here on Money Q&A where I dissect where my 12 defaulted loans went wrong. They share a lot of similar traits that make for great insight.

I agree with Peter. It takes insight to recognize that your greed prevented you from realizing even the average return for Lending Club. At least you didn’t earn any less than a savings account. Plus you learned a huge lesson in the process. I look forward to the next update following your new technique.

cashflowmantra – You make a great point about the savings account. So, I’m still doing okay. Now if it just weren’t for that pesky inflation thing my 1% return wouldn’t look so bad. Thanks!

Peter – Yes, I take full responsibility for my lower than average rate of return. I really love peer to peer lending and believe in it. It was definitely me and my error and not the system or investing platform. I had never heard of Lendstats.com before. I will have to check that out. Next week, I have an article scheduled here on Money Q&A where I dissect where my 12 defaulted loans went wrong. They share a lot of similar traits that make for great insight.

cashflowmantra – You make a great point about the savings account. So, I’m still doing okay. Now if it just weren’t for that pesky inflation thing my 1% return wouldn’t look so bad. Thanks!

I’m glad you’re sticking with it Hank, and happy to hear you were willing to invest in the higher risk loans, even if it was for greedy reasons haha. I know a lot of people who are discouraged from borrowing from places like Lending Club because they don’t think their loan will be funded. 12/74 isn’t too bad though, so I hope it proved to still be a great investment for you!

So let me understand Lending Club completely. If I invest some amount, is there any circumstance where I could OWE Lending Club money? Because I don’t mind paying FROM MY INTEREST for their work. But I don’t want to pay from my pocket…

Hope what I mean is coming through. Thanks!!

Jay – After you make your initial investment in Lending Club loans, you will not owe them any more money. You have the potential to lose 100% of your investment (just like with any investment), but you will never owe them money. In fact, you receive payments every month from the loans that you invest in as people start to pay them off which give you an income stream each month to reinvest. I hope this helps explain it more. If not, please email me again.

I think I understand. I don’t consider the money I am investing a “cost” – say I invest $200. I know within the investment itself I could lose that $200, but what I want to better understand is how much LC gets. Not that I mind paying! Just that I want to better understand the costs.

Am I correct in understanding that they only get money when I make money? Which is to say, if I get a return on my money, they get a [small] part of that return?

Actually, you can end up losing a few cents if your loan is repaid quickly, especially if it is the lower interest tiers. The interest paid may not exceed Lending Club fees, but we are talking about just a few cents here. And, of course, you would have all of your principal back to reinvest. For this reason, some lenders hesitate to lend to borrowers who state that they plan to pay back the loan early.

Great point, Mike. I’m comfortable taking on that risk though seeing a relatively small number of loans being repaid completely very quickly.

Thanks for sharing your experience. I have really been looking at getting into Lending Club and have also heard great things about it. Since savings accounts pay so little it makes sense to get into something like this where I could earn an average of 8%+.

I guess the key is to take it slow and spread my investments out.

Ben,

You are 100% right. I would also recommend only using Peer To Peer Lending with only a small percentage of your overall investmetn portfolio. Like any non-standard investment, you may only want to consider investing 5% to 10% of your total money in peer to peer lending.

This section “state and financial suitability” on the application is kind of… maybe exclusive…

“I have an annual gross income of at least $70,000 and a net worth (exclusive of home, home furnishings and automobile) of at least $70,000.

BOO.

Jay,

Lending Club makes its money in several ways. When a loan is issued, borrowers pay a one-time origination fee (for 36 or 60 month loans) that ranges from 2.00% to 5.00% of the loan amount. The service charge is one percent (1%) of each payment from the borrowers, which reduces the investors’ net annualized return by approximately 0.7%. This charge is automatically deducted from the proceeds that are deposited into your account.

The financial suitablity on the application is a requirement from the SEC to make sure that you understand the risks of investing in loans and is a formality. Hope that helps.

“The financial suitablity on the application is a requirement from the SEC to make sure that you understand the risks of investing in loans and is a formality.”

What I don’t understand is why the SEC (or Lending Club) thinks I have to gross $70k in order to understand the risks of investing in loans. It’s only a formality if you make over $70k, I suppose. If you make less, I’d call it a pretty big hitch.

Ouch Hank! You got creamed. I’m glad that you ended up on the plus side of the eqation at least. I am earning close to 10% and just did a review of how I am earning that much as well. I am extremely conservative and so far no defaults although one might go that way.

Good luck with the new strategy!

Sandy, You do point out the bright side like others here on this post. I did beat the savings account, money market, and CD rates even though 17% of all my loans defaulted. I’m going to mount a comeback, but like everything in finance, it is going to take time. Thanks for the comment!

This is really interesting. The only similar loans I’d heard of before were charities like kiva, where you loan to people without access to banks. Since it’s a charity, you don’t actually earn any interest back, you just have the opportunity to help many people with the same set of funds whenever you get paid back. This sounds like a fun way to invest, while being able to have much more information (and much more responsibility) than a lot of traditional investments. I’ll definitely be following your posts on this to see if I might be interested in it once I get out of school and get my financial feet under me.

Hank,

I think the only issue you had was that you decided to invest in business loans for small businesses. I purposely invest in HR loans and the like but I stay away from business loans.

I would say the title of his article is a bit misleading. You did not lose you shirt since you made money. Now, if you had a negative rate of return and lost a lot of money, then I think you could say you lost your shirt.

I like Prosper better for their higher interest rates they offer. I don’t even invest in LC due to their lower rates and because their loans are normally for a larger amount of money. I don’t have any data that says a $4,000 is more likely to be paid off over a $15,000 loan but I would think that would be true.

Good luck to you Hank. I would just stay away from business loans, unless you just want to lend to small businesses for your own personal reasons. As you can see small businesses tend to have a high failure rate, especially for start-ups.

Lost your shirt? Hardly. Any time someone is going after a high, risky, return, fails, but still breaks even, that’s called ‘winning.’ Especially in a year where the cash alternative was yielding less than 1%.

When I enter into an option trade and it goes wrong, it’s a 100% loss. You did well this year, Hank.

Thanks, Joe! I appreciate the comment and the kind words. You’re right….”losing my shirt” is a bit of a stretch. I like you putting it into perspective for us with option trading. Great point.

Ah you learned the most important lesson of p2p lending. Diversification.

I took this diversification theory one step further by investing in many different p2p platforms and many loans. Returns are slightly less but the level of comfort is far higher.

Peer to peer lending will continue to climb in popularity as the USA embraces alternative methods to earning interest.

Good luck in the future.

Trouble with the USA is regulation and the banks have too much power over the government so the last thing they want is P2P running wild and taking their business.

Remember, the bankers run the Federal Reserve!

One day perhaps the banks will get a reality check, but until then, not much happening.

Good luck.