The following is a guest post from Evan Tarver is a small business and investments writer for Fit Small Business. If you’d like to submit a guest post like this one about investing in your 401k retirement plan to Money Q&A, check out the site’s Guest Posting Guidelines.

A 401k lets you invest a portion of your paycheck into an investment account that can be accessed at retirement. Plan contributions are typically invested in a diversified portfolio that includes mutual funds, stocks, bonds, and other investment vehicles permitted by a 401k. 401ks are the most popular type of retirement plan because of their flexibility and tax advantages.

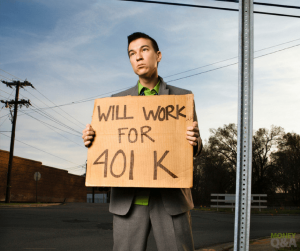

5 Reasons Why Investing in a 401k Is a No-Brainer

1. It Helps You Save for Retirement

A 401k is a great way to save for retirement because you can automatically invest a portion of your pre-or post-tax earnings directly from your paycheck. Since contributions are automatic, there’s no need to think about the contributions you should make each month. Also, you can’t access your funds without penalty until you’re 59.5 years old and you, therefore, won’t be tempted to spend your retirement money early.

Further, you decide how much you save for retirement as well as choose the investment vehicles based on your goals and risk tolerance. Typically, retirement contributions are invested into a diversified portfolio with a level of risk/return that helps you grow your principal investment. Upon retirement, you can withdraw this money and use it to finance your non-working years, taking advantage of 30 years or more of capital gains.

Finally, most employers will match a certain percentage of your 401k contributions, typically up to 5% of your paycheck. This serves as additional funds for your retirement. Make sure that you thoroughly understand the rules of your employer regarding matching contributions so you can maximize your 401k plan and have more money to use at retirement.

2. It Provides Tax Advantages

Another reason why most people choose to invest in a 401k plan for their retirement is the tax advantages it offers. There are two types of 401k plans, both offer different tax benefits. The first is a traditional 401k where contributions are made pre-tax. The second is a Roth 401k where contributions are made post-tax. Both are advantageous. Let’s now look at them in more detail.

a. Traditional 401k

With a traditional 401k, contributions are taken out of your paycheck before taxes are deducted. This means your taxable income is reduced by the amount you contribute, helping you save money on the front-end. You can normally save between 15% to 30%+ in taxes on your monthly contribution amount, depending on your tax rate.

However, when you withdraw your funds at retirement, your principal plus your gains are taxed at your income tax rate, which is typically lower than during your working years. For example, if you’re taxed at 25% when you make your initial contributions and then taxed at 15% upon retirement, your net tax savings will be 10%.

b. Roth 401k

A Roth 401k, on the other hand, lets you save money on the back-end rather than initially. With a Roth, you have to pay taxes on the contributions you make. However, you won’t have to pay any taxes when you pull out your money upon retirement. This gives your investment funds the potential to grow tax-free (because you already paid taxes).

3. You Can Use it to Buy Your First Home

When you buy your first home, you have the option to use a portion of your 401k funds to cover the down payment. Using your 401k funds to buy your first home is a good option if you’ve done your due diligence and deem it to be a good investment. You can either withdraw money from your 401k account or take a loan against it.

a. Withdraw Money From Your 401k Account

You can withdraw up to $10,000 from your 401k account without paying early withdrawal fees if you’re using it as a down payment for your first home. However, you’ll still have to pay taxes if it’s a traditional 401k. No tax will be charged with a Roth 401k because it’s post-tax and you’ve already paid the taxes upon contribution.

b. Take a Loan from Your 401k Plan

Instead of making a withdrawal from your 401k account, you can take a loan against it to buy a home. Generally, you can borrow up to $50,000 or 50% of your account value, whichever is lower.

It’s like borrowing money from yourself – you’re expected to repay the principal amount borrowed plus interest of typically 1% to 2% plus the prime rate. Also, you’ll have to pay off the loan within five years to avoid penalties.

4. You Can Use it for Emergencies

In case of emergencies that cause financial distress, you have the option to take a hardship withdrawal from your 401k account. Most major employers allow hardship withdrawals for employees who meet specific guidelines. Some cases allow you to take funds not exceeding the amount you need out of your 401k plan without paying the 10% early withdrawal penalty even if you are not yet 59.5 years old.

Hardship withdrawals may be allowed for emergency reasons which include paying off medical bills, becoming totally and permanently disabled, or more. Such withdrawals may be allowed without charging you with early withdrawal penalty. You can also take a hardship withdrawal for things like the prevention of eviction/foreclosure or for funeral and burial expenses. However, you will be charged a 10% early withdrawal penalty for these types of withdrawals.

5. You Can Use it to Buy a Business

Another good reason to invest in a 401k plan is that you can use a portion of your retirement funds to buy a business or franchise through a Rollover for Business Startups (ROBS). With a ROBS, you can use a minimum of $50,000 from your retirement account to finance your small business or franchise without needing to pay early withdrawal penalties or taxes.

A ROBS is not technically a withdrawal of funds nor a loan against your 401k account. This means that you don’t need to pay back the debt or be charged with interest. It is an allowable rollover that puts your retirement money into your own business as a form of investment. You can use ROBS to start a new business or franchise, purchase a business, or recapitalize your existing business.

The main reason why you should contribute a portion of your regular income to a 401k account is to build a nest egg for retirement. However, there are many other advantages that you can get from your 401k plan, including buying a home, starting a business, or paying for emergencies. For this reason, a 401k plan is something you should start investing in your 401k retirement plan today.

Evan Tarver is a small business and investments writer for Fit Small Business, fiction author, and screenwriter with experience in finance and technology. When he isn’t busy scheming his next business idea, you’ll find Evan holed up in a coffee shop working on the next great American fiction story.