Fortunately, free personal finance apps like Trim have been developed specifically for the purpose of saving you money with as little effort as possible. Even if you think you’ve done everything in your power to cut your expenses to a bare minimum, Trim can find new ways for you to save that you might not have considered yet.

Review of Ask Trim App

Discover Hidden Savings Opportunities

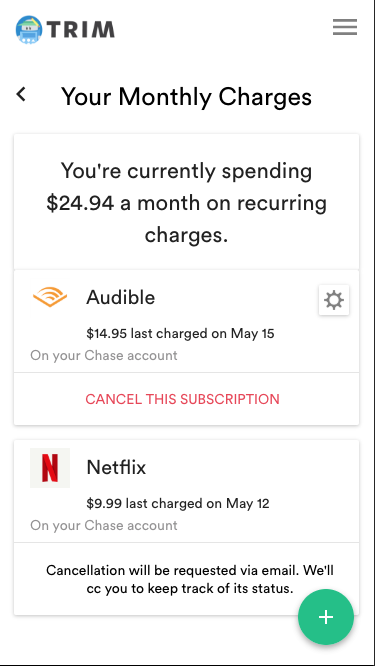

You may not even realize you’ve been paying $5 per month for a digital subscription that you never use, so Trim can help you save money by alerting you to ongoing subscriptions that have been quietly siphoning money from your bank account each month.

Subscription Canceling

- Trim recognizes recurring charges to make sure you don’t have any unwanted or forgotten subscriptions.

- Cancel subscriptions you no longer want with a 1-single click for FREE!

- Trim has saved our user over $1.4M in canceled subscription in 2018!

If you decide you no longer want a certain subscription, Trim will get it canceled it for you. It really doesn’t get easier than this! Trim has also begun offering more advanced services such as cable bill negotiations (for Comcast, Time Warner, and Charter), and the company plans on adding more negotiating services for things like Internet bills and even student loans in the future.

Trim will negotiate your cable, internet and/or phone bill with ANY provider, lowering your bill up to 30%. You can directly connect your Comcast, Time Warner (Spectrum), and AT&T accounts using your existing login credentials. For all other service providers, you can easily upload or email a bill for Trim to negotiate.

Bill Negotiation

- Trim will negotiate your cable, internet and/or phone bill with ANY provider, lowering your bill up to 30%.

- Trim continues to monitor your bills and will negotiate whenever we see an opportunity to save you money.

- When Trim successfully saves you money, we charge 33% of annual savings. We only ever charge you if we save you money.

When Trim successfully saves you money, they charge 25% of annual savings. Trim only ever charge you if we save you money. Trim continues to monitor your bills and will negotiate whenever we see an opportunity to save you money.

Trim Can Monitor Your Spending Habits

Trim keeps tabs on your transactions so you can quickly and easily understand where your money goes. You get a breakdown of your spend by category and find out how much you spent on any merchant this month by texting “Spend [merchant_name]” instead of sifting through your transaction history.

These are pretty nifty features that can help you continue to track your spending. I also like how Trim sends me a text message when it recognizes a large purchase has been made on one of my accounts. It’s a great safety check. Trim also recognizes recurring charges to make sure you don’t have any unwanted or forgotten subscriptions.

Automated Emergency Fund Saving

With Ask Trim’s Automated Emergency Fund Saving, you can now get help building and tracking your savings towards a specific goal like building your emergency fund with just three super easy steps! Select a goal and a target amount. Not sure how much to save? Trim will help you figure it out!

Set up automatic, weekly transfers and earn a 1.5% bonus on your balance to build towards your savings goal. Then, sit back and watch your money grow! Trim will provide updates and encouragement on your progress.

Automate Your Savings Goals

Trim’s usefulness doesn’t go away once you’re free of unwanted subscriptions. With this app, you can save more money on car insurance and find better rates on credit cards, which allows you to automate your savings long-term because you’ll be paying less interest indefinitely. Whenever there is a transaction posted to your account(s), Trim can notify you via text or you can ask Trim to report back to you how much you spent with a certain merchant within the last month or so.

Simple Savings

- Trim will help you determine how much money you should put away and track your progress on meeting the goal.

- You can set it and forget it with automated weekly transfers from your checking account and watch your money grow with a 1.5% bonus.

- Typical users are on track to build $2K of savings per year!

This nifty app helps you save money and time by automatically searching for potential savings and keeping you on top of the income/outflow of your budget by scanning your accounts for transactions (instead of you having to do this manually).

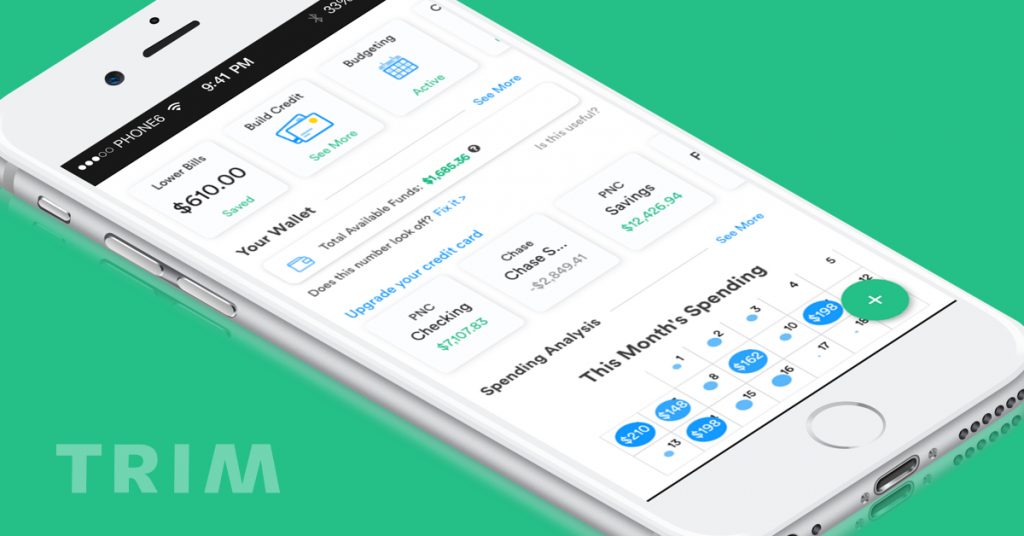

See Your Full Financial Picture

Having Trim lets you understand your full personal finance picture. You can connect all of your financial accounts to view and track your total available funds. Your Trim dashboard shows the total balance of all your connected accounts—your checking and savings account.

It’s an easy way to quickly keep tabs on your overall financial health. Trim can also set you personalized recommendations. Do you have the right credit card? Trim will recommend cards that get you the best rewards for your credit score. Could you be earning more from your savings?

Trim Debt Payoff

Trim can now help get rid of any debt you may have. You can get started here: go.asktrim.com/debt

Their new dedicated coaching and payoff program will analyze how to get you out of debt and then make sure you succeed. They can also negotiate your credit card APR with your bank as a first step.

Debt Payoff

- Get a custom payoff plan, help to lower your APR and access to expert advice from financial coaches. The program is just $10 a month and comes with a 90-day money back guarantee.

- New Year Special: Trim is offering a $10 sign-up bonus to start paying off your debt. After you sign up, just send the code “TRIMDEBT” to your new Debt Payoff coach to get $10.

- We save our users $1230 on average by negotiating their credit card APRs.

So far they’ve been successful 75% of the time in getting a lower APR, which saves the average user more than $300 per year.

It costs $10/mo, and if Trim doesn’t save you enough to make this a positive investment, they will give you a refund any time in the first 90 days.

Trim Debt Payoff is a high-touch coaching service and payoff plan for credit card debt. They immediately save most customers hundreds of dollars by negotiating their credit card interest rates (APRs). Then, they automatically calculate a long-term plan to pay off their debt.

How does the Trim Debt Payoff Program work?

Here I’ll break down the three main parts of Trim’s Debt Payoff Program. Not all of them are required for each person, but in total, they create an effective pathway out of debt.

- Payoff Plan & Debt Calculator.

As a first step, Trim’s AI sets up a personalized payoff plan, based on the credit card balance and APR information from the accounts that you link. - APR Negotiation.

Then, Trim will set up a call to negotiate the interest rate (APR) on your existing credit cards. This is NOT negotiating the principal amount, and it won’t have any impact on your credit score. Hopefully, this step WILL save you hundreds of dollars in interest charges going forward. For many banks, Trim can remember to call and negotiate the APR every 3-6 months. - Personal Coaching.

Starting on Day 1, and extending until you’re finally done with debt, Trim’s Financial Coaches can help guide you and answer any questions you might have. Many users report that the power of having an expert alongside them is a huge motivational boost to getting out of debt.

Trim’s Security

Doing anything online with your financial records can make some folks nervous, but fortunately for Trim users, the platform offers top-of-the-line security options with 256-bit SSL encryption, two-factor authentication, and no sensitive financial information stored on Trim’s servers. This equates to bank-level security for your private information, allowing you to enjoy peace of mind and Trim’s savings without sacrificing one for the other.

Should You Get Trim?

The app’s offerings may seem simple but the recurring expenses Trim is able to find might surprise you. Sometimes, you might be paying for a monthly subscription without even realizing it, but that $2-8 adds up to quite a bit of wasted money over time if you don’t cancel the unwanted subscription as soon as possible.

Even if you assumed there was nowhere else left to cut in your budget, Trim is a safe way to double-check whether you’ve overlooked an ongoing payment without canceling it. Trim can also help you negotiate lower prices on your monthly bills (perfect for anyone who doesn’t have a couple hours free to wait on the phone with your cable company’s representatives).

So, don’t miss out on this great opportunity to get a head start on your savings with Trim. The app is free and the security is extremely tight, so there are minimal risks involved and a high potential for long-term rewards!