Qube Money (formerly ProActive Budget) is an online digital bank and budget app that digitizes the cash envelope system.

Have you wanted to try the cash-only budget method, but you’ve held back because of the impracticality of using only cash in this digital age? If so, then a new app called Qube Money Digital Envelope might be the solution you’ve been waiting for.

The way Qube Money works is fairly simple. You transfer funds into your Qube Money account whenever you get paid and determine how those funds should be allocated into different expense categories before you ever make a purchase.

When you use your Qube Money card at checkout, the amount you spend is deducted from your available balance in a given category, so you will always be aware of how much money is left for a given category of your budget at any point.

The Qube Money program is still relatively new, but it’s already making waves in the world of personal finance.

Qube Money Digital Envelope App Review

Control Spending Impulses

If you have a history of misusing your credit cards and racking up a significant amount of debt on non-essential purchases, then perhaps budgeting with a credit card wouldn’t work too well for you. There’s nothing wrong with this, of course. Plenty of people struggle to avoid spending money when there’s a seemingly endless credit limit readily available.

The great part about Qube Money is that it doesn’t let you overspend on purchases, which is a great feature for anyone who’s encountered problems with impulsive spending in the past. If you do not have enough funds allocated to a particular area of your budget, then your card will decline the purchase.

Get Out of Debt More Quickly

Even if you’re not much of an impulsive spender, you might still find yourself going in cycles when it comes to debt. You’ve probably fall into the pay off all of your cards, rack up new balances loop. To kick debt to the curb for good, the Qube Money system can help you rein in your spending by forcing you to live within your means with the help of innovative technologies.

In fact, the Qube Money approach is primarily designed to prevent users from overspending by declining purchases made with insufficient funds. This ultimately makes it easier to stay within your budget than if you had tried to manage your finances entirely on your own.

Once you’re able to allocate greater portions of your income towards debt repayments, you’ll be in a much better position to escape the cycle of debt and start focusing on new financial goals.

Teach Your Kids About Financial Management

For families with kids 12+ years of age, Qube Money’s Kid cards are perfect for teaching them more about responsible financial management practices. The Kid cards let you:

- Create custom categories on your Qube Money dashboard. So, $20 earned for babysitting can be allocated into different categories like savings and spending accounts.

- Share family categories. No need to reimburse your kids for buying grocery items or purchasing tickets for school events.

- Pay your kids’ allowances directly through the app.

- Teach your kids about the best ways to budget, save money, and plan for their financial futures.

How Much Does This Service Cost?

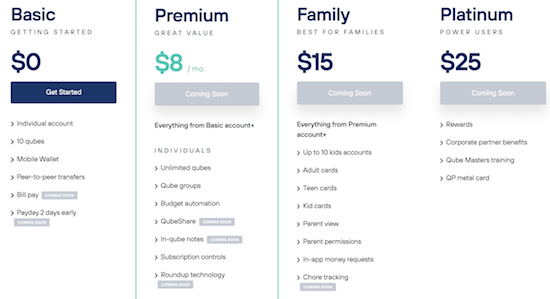

Qube Money is free for the basic account. There is a Premium level for $8 per month, a family plan for $15 per month, and a Platinum level for $25 per month. See details about pricing in the graphic below.

Should You Sign Up for Qube Money?

The Qube Money system is extremely safe to use because the card will decline any purchase that is not approved from your phone beforehand. You can even use it while shopping online, which makes it a much easier option than cash for anyone who occasionally shops for items on the Internet.

At its core, Qube Money is ideal for changing unwanted, impulsive spending behaviors by regulating your consumer habits and teaching you how to live within your means. It’s also a fantastic budgeting system for families thanks to the Kid cards.

So, don’t miss out on this low-cost opportunity to rein in your spending habits, get out of debt more quickly, and teach your kids valuable lessons about financial management, all from a nifty smartphone app!