One of the most important lessons a parent can teach their child is proper financial management. This is something rarely taught in schools, yet a vast majority of parents do not adequately prepare their children and teenagers for independent financial management when they reach adulthood. Reasons for this may range from an unwillingness to discuss financial matters with their children to simply not realizing the importance of actively teaching kids the basics of budgeting, spending & saving, and other critical financial skills.

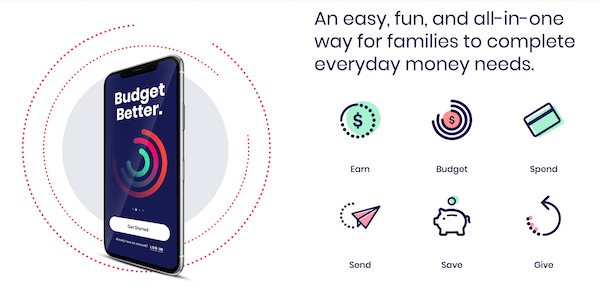

To help families overcome obstacles in financial literacy education and family money management, the digital wallet and money app Wallit is designed to help parents manage the family budget more effectively and teach their kids about financial management while they’re still young. This all-in-one wallet app has many features that would be tremendously useful for parents and kids alike, and it’s incredibly easy to navigate, regardless of your level of tech-savviness.

If you’ve been looking for new ways to teach your kids about modern financial management and simplify your family’s budget, here’s what you need to know about Wallit App before signing up.

Better Family Budgeting

At its core, Wallit is a comprehensive digital app for families in need of simpler budgeting options. It allows parents and kids/teens to stay up-to-date on shared financial records (e.g., allowances, kids’ savings, family savings goals, etc.) and send money to each other whenever needed.

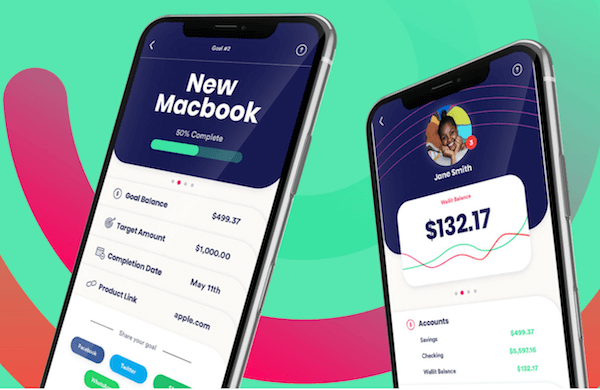

Gone are the days when parents needed a few $1 or $5 bills in their wallet each week to pay the kids’ allowances. With Wallit, you can set up a recurring allowance or send one-time payments to your kids for completing their chores. On the kids’ side of the app, Wallit lets them keep track of their income and expenses – great training for adulthood! – and create their own budgets to plan for short- and long-term financial goals.

How Does Wallit Work?

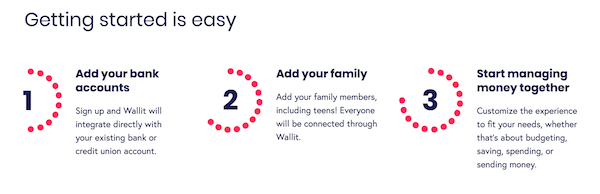

When you sign up for Wallit, the app asks for your legal name, email address, mailing address, and last 4 digits of your Social Security number (to confirm your identity). Once you establish an account, you can sync your checking and/or savings accounts with the app and directly share an account with your kid(s) to automate their allowances by setting up tasks with dollar figures attached. Alternatively, you can set up a weekly allowance amount that will be paid on a certain day or when they complete their tasks for the week.

If your kid/teen has their own bank or credit union account, you can link that with the app as well. Having their own account is incredibly useful for teaching them about the basics of earning money, setting budgets, planning for specific goals, saving money and controlling their expenses. When they earn money from you through the app, they can either transfer the funds to their bank account or spend the balance on a gift card through Wallit (many top retailers and brands are available).

If you’re worried about your kids getting access to money that isn’t theirs, then rest assured, Wallit has parental protections in place to prevent kids from spending money beyond what’s available in their Wallit balance. In other words, they will not be able to accrue debt or overdraft on their accounts.

No Bank Account? No Problem

If you want to use this digital wallet app with younger kids (13 years old or younger) or a kid who doesn’t have their own bank account yet, you can either set up an account for them to withdraw from in the app or they can have the option to purchase gift cards through Wallit in lieu of cash withdrawals.

Opening a joint bank account your kid(s) and helping them learn how to independently manage their own finances is one of the most valuable skills you can possibly teach them before adulthood. If they don’t have an account yet, then now might be the perfect time to create one so they can develop financial literacy, independence, and strong budgeting skills.

Should Our Family Get the Wallit App?

The full launch of Wallit is coming in October 2019, but in the meantime, you can download it through the Apple app store (it will be available in the Google Play store in fall). It’s already in use by thousands of families who want a more effective way to their kids about personal finance, and many more families will likely add Wallit to their family budgeting routine over the months to come.

All in all, it’s a great (and free) digital wallet app due to its easy-to-use nature, clear task/$ amount allowance feature, ability to send/save money, and variety of gift card options available within the app for kids to choose from if they don’t want to simply withdraw cash. For parents who want to simplify the allowance assignment, approval and payment processes, you won’t want to be without Wallit.