When you’re starting out as an entrepreneur, one of the first things you must do is form a limited liability company (LLC) or corporation to legally and financially protect yourself in ways that regular sole proprietorships don’t have access to. It isn’t the easiest process to tackle by yourself, especially if you’re a first-time business owner or you’re branching out into a new type of corporation classification.

To help entrepreneurs launch new businesses and current sole proprietors establish an LLC or corporation, MyCorporation is a great resource for getting started. Founded in 1998, MyCorporation specializes in helping entrepreneurs form businesses, register trademarks and copyrights, and efficiently file other documents online.

To date, MyCorporation has helped more than one million businesses form and grow throughout the U.S. and they’re well-known for providing exceptional customer service to small business owners and real estate investors seeking to incorporate their businesses in dependable and cost-efficient ways.

If you need expert-level guidance with forming your next business or you simply want outside expertise to facilitate other document filing processes – such as trademarks or copyrights – then MyCorporation might be a good fit for your situation.

MyCorporation Services

MyCorporation offers multiple business formation and documentation services, including:

- Business Formation (DBA, LLC, S-corp, C-corp, B-corp, nonprofit, etc.)

- Business Licenses

- Employer Identification Numbers

- Registered Agent Services

- LLC Operating Agreements

- S Corporation Election

- Logo and Website Design

- Business Checks

- Business Name Searches

- Business Compliance Checks

- …and many more!

Even if you’re perfectly capable of forming your new business on your own, there are plenty of business services offered by MyCorporation that could save you time and money.

How to Start a Business

As a sole proprietor, there’s not much paperwork involved to establish your business entity (though you should still establish a “doing business as” or DBA with your county clerk’s office). You don’t even need a business name or employer identification number – your legal name and Social Security number are your business name and EIN. The upside of sole proprietorships is that you get 100% of the profits; the downside is that you’re 100% responsible for debts and losses as well.

A major benefit to establishing an LLC instead of maintaining your sole proprietorship status is that you are only on the hook for the amount you’ve invested into your LLC. In other words, you’re not personally responsible for debts and losses incurred by your business. Yes, it costs more money to establish an LLC, but it could be worth the upfront investment to mitigate potential legal and financial risks later on.

LLC or Corporation?

A Limited Liability Corporation (LLC) is primarily concerned with the structure of a business, while its corporation classification (S-corp, C-corp, etc.) is primarily concerned with how a business is taxed. Specifically, an S-corporation designation (“passed through” entity) means the corporation itself doesn’t pay income taxes (the business owner and any partners do on their own personal income taxes) and there can be no more than 100 shareholders (all of whom must be U.S. citizens or legal residents).

Meanwhile, a C-corporation designation is taxed as a separate entity; the business is subject to its own taxes while the business owner and/or partners are also taxed on their income received through the corporation. C-corporations are always recognized at state and federal levels, while S-corporations may not be recognized in certain states.

If you’re on the fence about which corporation designation you should choose for your company, MyCorporation can help you work through the pros and cons of every available option and help you choose the best classification for your business. MyCorporation also offers assistance with Benefit Corporation and Nonprofit Corporation designations.

Get Help with Running Your Business

In addition to helping entrepreneurs establish their businesses, MyCorporation is also useful for running your business as well. MyCorporation offers many one-time filing services (dissolution, withdrawal, reinstatement, amendments, MyIncGuard Service, Certificates of Good Standing, etc.) and ongoing business management services.

Ongoing business management services include things like annual reports, 501(c)(3) filings, corporate resolutions, stock certificates, business insurance, etc. and business products to ensure you’re able to focus on running your business instead of getting bogged down in paperwork and technical/legal matters that would otherwise require a great deal of time and energy on your part.

Trademarks and Copyrights

Want to file a trademark to protect your business name and/or logo? Need assistance with claiming ownership and legally protecting your original works? MyCorporation also specializes in helping entrepreneurs and creative folks protect their business entities and intellectual property with trademark and copyright registration services.

How Much Does MyCorporation Cost?

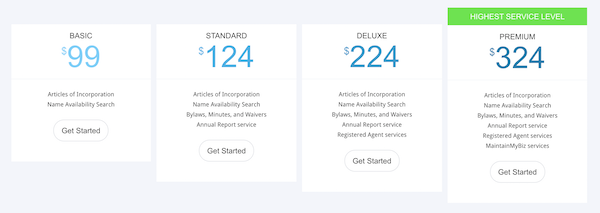

Corporation and LLC formation packages offered by MyCorporation start at $99 for a basic package and go up to $324 for the premium package, which includes articles of incorporation, name availability search, annual report services, registered agent services, MaintainMyBiz services, and more.

Filing trademarks with MyCorporation starts at $199 while filing for a copyright will cost you around $99. Other services range in price depending on where your business is located, the type of service and amount of time/effort involved in delivering the service.

Should I Use MyCorporation?

MyCorporation is an excellent resource for business owners and novice entrepreneurs alike. Whether you need assistance with business formation and licenses, trademark/copyright registration, or other business management services, MyCorporation is one of the oldest and highest-rated online business document filing services available to business owners today.