Disclaimer – You should not consider this as professional stock market and stock picking advice. Every investor should do their own research before investing. If you don’t feel comfortable investing in the stock market, you should seek out the help and advice of a certified professional.

The following is a guest post by Dan Charles is a professional trader/investor, Portfolio manager, and trading software developer. To learn more about him check out https://www.simpletrades.net/. If you’d like to guest post on Money Q&A, check out our guest posting guidelines.

As a professional stock trader, it is important to be able to recognize the various trends on a daily basis and then formulate a plan to benefit. In this article, I will be breaking down where I see the Nasdaq, S&P 500, Crude Oil, Gold, US dollar, and Bitcoin going next week and try to offer up a plan for each.

One thing to keep in mind is that the markets change very quickly, so my views below may be changed as early as the Monday market close. I may love a stock on a Tuesday and hate it by Wednesday so this is why one needs to do their due diligence when buying any type of instrument like the ones we will discuss below.

In the picture above we have a daily chart on the Nasdaq (NQ) futures. The Nasdaq is a heavy Technology and Biotechnology index that holds stocks like Google (GOOGL) Facebook (FB) and Amazon (AMZN) to name a few.

This week leading up to the US election and lack of a stimulus being passed we are seeing the Nasdaq be extremely bearish. Price today is holding support at 11000 which means buyers are trying to keep it from breaking below 11000, which could bring on a further decline and possibly testing those prices on the left which were made September 24th at a low of 10660.

I see more volatility going into election week and I see the market being bearish in the coming days in the stock market but it is possible to see a short-term rebound Monday.

The S&P 500 is the picture above and this is a daily chart as well. The S&P 500 is the most important index to track because it holds 500 stocks and gives a general idea of market sentiment over the Dow Jones which is only tracking 30 companies.

The S&P is in the same situation as the Nasdaq is, showing a lot of volatility and bearishness going into the election week.

The S&P is also holding higher lows from the low on Sept 24th which signals a possibly rebound early next week. However, with the volatility and the US election happening, I do see additionally selling coming.

Crude Oil (CL) is in the Picture above in the stock market and it is on the daily chart as well. It is important to view other time frames, but I always start with the daily chart as a guide. Crude Oil prices truly tumbled off this week as well and broke through the $37 a barrel price which was an important support price. Right now Oil is holding support at $35 but it is looking more bearish as of this week.

It is possible Oil prices have a rebound on Monday because whenever prices are falling this quickly and especially at this degree, it is common to have possibly a short-lived rebound.

In the picture above we are looking at a daily chart on Gold (GC).

Gold prices were very choppy (going sideways) for several weeks until Wednesday when prices broke strongly below $1900 an ounce. Just like in some of the charts before you can see the price is pulling up today and holding the lows from September 24th which are around $1850.

Gold is a safety currency which means in times of worry and panic there is often an increase in the buying of Gold in the stock market. That for sure lines up with the election next week.

For me to be a bull on Gold I will need it to be over 1900 to gain my confidence.

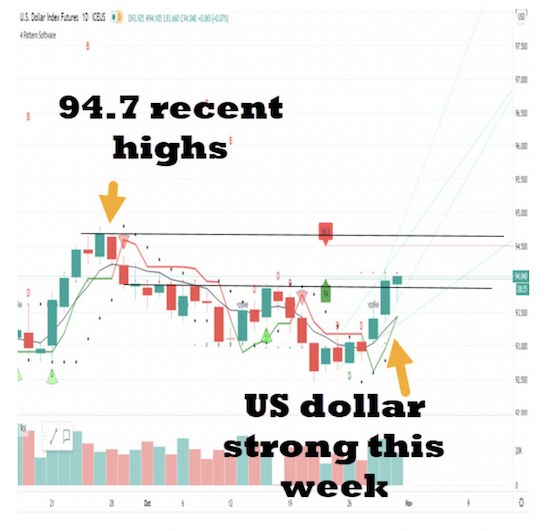

The picture above is a daily chart of the US dollar futures (DX).

As you can see the US dollar is gaining strengh this week and I see more upside on here going into next week and further. I think it has a chance to reach the most recent highs of 94.7.

The US dollar has been very weak the previous months of May, June, July, and August but it seems to have reached a bottom in September and the month of October it only looks stronger for the months to come.

In the picture above is a daily chart of Bitcoin (BTCUSD). As you can see with all the uncertainty going on in the world, the Cryptocurrencies have been an attractive place to invest in the stock market and Bitcoin is looking very strong right now and seems likely to break 14000 very soon.

Despite the fact I am bullish on Bitcoin and do see it testing and breaking 14000, I also see that bitcoin should have a pullback very soon. Pullbacks are when a stock, currency, or commodity is in a strong uptrend and it starts to slow down. In an uptrend it is normal to have one to three red days (pullback) so things can cool down and we then analyze it further to see if the uptrend continues or if prices start to change to a downtrend.

About the author:

Dan Charles is a professional trader/investor, Portfolio manager, and trading software developer for over 20 years. He is strictly a chart reader believing that reading the chart is far superior to fundamentals because the charts never lie. To learn more about him check out https: https://www.simpletrades.net/