Over the past three months, Money Q&A readers have bought several personal finance books through the blog’s Amazon affiliate links. I thought that it would be fun to look at these seven.

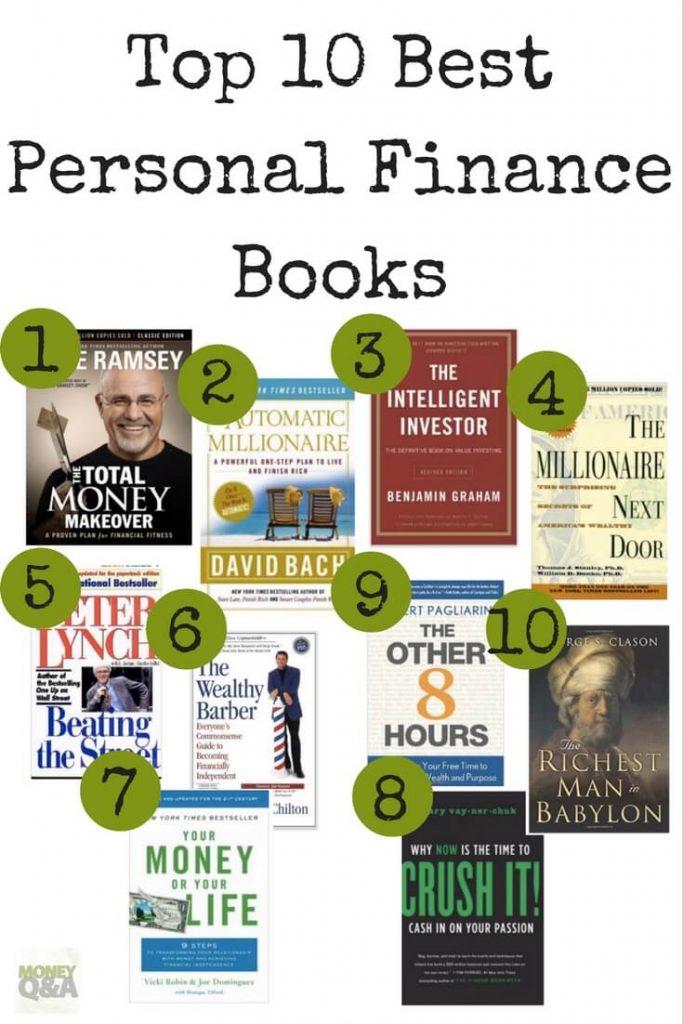

It’s no surprise that most readers are buying are part of my Top 10 Personal Finance Books list. The list shows the books that I think should be on everyone’s bookshelves and nightstands next to your bed. You can see the full list here.

These Top 10 Personal Finance Books are the ones that have meant the most in my life. They’re the ones that I have highlighted passages, dog-eared pages, and reread over and over. If you haven’t read them, I definitely think you should push them to the top of your list.

Finance Books that Money Q&A Readers Are Buying on Amazon

So, here are six books from the list that readers have bought on Amazon the past three months and one surprising book that someone ordered that’s really interesting. So, be sure to check out #7 at the bottom of this blog post.

And, don’t just stop there. I’m sure that I’ve missed quite a few great new books since I compiled my list almost ten years ago. In fact, I’m currently reading The Psychology of Money by Morgan Housel. I can’t put it down. It’s that good! It would definitely make the Top 10 list in my eyes. I’ve highlighted it at the bottom of the blog post, too as a bonus #8. Be sure to check it out.

So, have I missed some great money books? What are you reading right now that I should add to my personal finance book reading list?

Note – Some of the links in the blog post are Amazon affiliate links. I receive a small commission if you click on the link and then buy something from Amazon. And, as always, all opinions are my own.

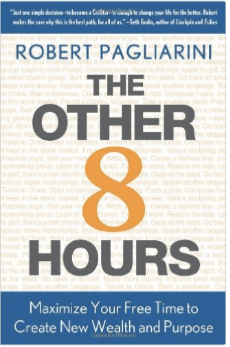

1. The Other 8 Hours: Maximize Your Free Time to Create New Wealth & Purpose by Robert Pagliarini

I love this book! Robert Pagliarini’s book, The Other 8 Hours, opened my eyes to a new way of thinking. A lot of authors have jumped on this way of thinking. My favorite, Garry Vaynerchuk, talks about it without using the term the other 8 hours. Check out my interview with Gary Vaynerchuk. And, if you’ve never seen one of Gary’s keynote addresses, I always recommend everyone check out his Web 2.0 Keynote.

The Other 8 Hours addresses the time left over after you have completed a full day’s work. This book will help you maximize your free time by identifying and utilizing your assets, including your education, skills, experience, connections, and networks. The author shares his own experiences and those of others who have discovered how to turn their extra hours into more money.

You will learn how to identify strategies for building passive income streams so that you can take control of your financial future without having to spend all day at the office or working overtime.

The Other 8 Hours provides a blueprint that will help you carve out more time in your day and find the inspiration to spend that free time in a more productive way.

2. The Richest Man in Babylon by George S. Clason

The Richest Man in Babylon is a book by the American author George S. Clason. The book is about financial planning and wealth building, based on the parables of a fictional character named “The Rich Man” who lived in the ancient city of Babylon. It was first published in 1926 as a series of pamphlets, then later sold as a book.

The Richest Man in Babylon has been translated into many languages. He is one of the most widely read books on personal finance and investment ever written, with more than 15 million copies sold over several decades.

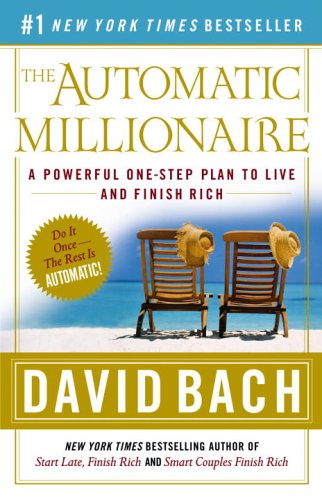

3. The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich by David Bach

The Automatic Millionaire: A Powerful One-Step Plan to Live and Finish Rich by David Bach is a book that will change your life. The best part of this book is it’s easy to read, understand, and apply the information in real life.

This book will teach you how to save money without feeling deprived or living like a miser. It provides step-by-step instructions on creating an automatic financial plan that works for anyone, regardless of income level or net worth. It also gives you examples based on real people who have used these strategies successfully.

The Automatic Millionaire teaches that if you are trying to become rich and gain financial independence, a budget is not the way! It would be best if you had an automatic plan that will work for your future to help you become a millionaire.

This book provides an easy-to-follow program for creating wealth based on proven methods of self-discipline and self-control. It explains how to set up an automatic savings system so you can become financially independent without having to sacrifice any of today’s pleasures. The Automatic Millionaire shows how anyone can develop the discipline needed.

The Automatic Millionaire is a one-step plan that will show you how to live and finish rich. The book is written by David Bach, a personal finance expert who has helped millions of people achieve financial success. Bach explains his unique approach in this easy-to-follow guide that includes phone numbers, websites, and apps so the reader can put the system into action from the comfort of their own home.

4. The Wealthy Barber, Updated 3rd Edition: Everyone’s Commonsense Guide to Becoming Financially Independent by David Chilton

The author lays out an easy-to-follow plan for taking control of your financial future with humor and great detail in The Wealthy Barber. The idea is to save little by little over time through a series of decisions you make in good faith because they are actually fun! You will learn how to take advantage of compound interest and some other basic principles like budgeting and managing debt. With a bit of help from his fictional barber Roy, this book shows us all just how much we can do on nothing more than an average salary with hard work, accountability, enthusiasm – with humor along the way.

The best part about this book is that you’re not just learning about finances but also getting entertained by an engaging story at the same time! With careful planning brought on through detailed explanations provided within its chapters, even those living off average salaries will have enough for retirement if they follow these simple steps.

The Wealthy Barber is one of the most successful self-help books ever written, with more than two million copies sold. Written with David Chilton’s trademark wit and humor, it has been featured on Oprah, CNN, CNBC, and many other television programs.

5. The Millionaire Next Door: The Surprising Secrets of America’s Wealthy by Dr. Thomas J. Stanley

The bestselling The Millionaire Next Door not only follows the lives of those who have accumulated wealth, but it also provides insight into what may be preventing others from achieving this goal. Some common traits that show up over and over among wealthy people are being frugal in nature (buying used cars), living modestly (giving no thought to driving expensive vehicles or wearing designer clothes), or working at a job they enjoy instead of one for which they need a high salary. In many cases, these rich individuals don’t live in Beverly Hills or New York City. They’re your next-door neighbors!

In fact, most millionaires live ordinary lives, just like you and me. They aren’t high-rollers or celebrity types. They’re people with solid occupations such as doctors, managers, small business owners. They live comfortable lifestyles and are typically homeowners living in average neighborhoods.

6. The Total Money Makeover: A Proven Plan for Financial Fitness by Dave Ramsey

The Total Money Makeover: A Proven Plan for Financial by Dave Ramsey is a great book that teaches you how to take back control over your finances with his seven baby steps. With this book, you’ll learn how to get out of debt, build an emergency fund, save for retirement and your children’s college education, pay off your mortgage, and then give to the charities that mean the most to you.

Be sure to check out my full guide on Dave Ramsey’s Total Money Makeover and his 7 Baby Steps.

Dave Ramsey’s Baby Steps

Baby Step 1 – $1,000 Emergency Fund

Baby Step 2 – Pay Off All Of Your Debt With A Debt Snowball

Baby Step 3 – Fully Fund Your Emergency Fund

Baby Step 4 – Save 15% of Your Income For Retirement

Baby Step 5 – Save For Your Children’s College Education

Baby Step 6 – Pay Off Your Mortgage Early

Baby Step 7 – Build Wealth And Give

7. Trump: Think Like a Billionaire: Everything You Need to Know About Success, Real Estate, and Life by Donald Trump

Donald J. Trump, the #1 New York Times bestselling author of The Art of the Deal and Think Big: Make It Happen in Business and Life and now former U.S. President, reveals his secrets to success in this classic book, Trump: Think Like a Billionaire, that will teach you how to use your brain to make money. In real estate, business, and in life, it’s not what you know but what you don’t know that hurts you. That’s why President Trump teaches readers how to out-think the competition.

BONUS – The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel

The Psychology of Money is a fun, engaging book that will teach you the timeless lessons on wealth, greed, and happiness. It’s not about how much you know about investing and saving for retirement. It’s about how you act with your money.

And behavior (any behavior…not just your money behavior) is hard to explain to someone, even people who are really smart. Learning and understanding money lessons are more than just about how smart you are or aren’t.

In this book, Morgan Housel takes the mystery out of financial decision-making by teaching you how to think like an investor or entrepreneur and how we think about money affects it all so much. You’ll see how your own distinctive view of the world around us influences all of your financial decisions. The book will also show you how to avoid common money mistakes rooted in our money beliefs and cognitive biases.

In The Psychology of Money, you will learn timeless lessons on making better financial decisions using stories from history and examples from today. You will learn about greed, happiness, self-control, loss aversion, social proof, ego traps, marketing tricks, and many other things that affect your financial future.